Axios Capital

June 02, 2019

Many thanks to everybody who replied last week with feedback about the optimal length of this newsletter. You are all fabulous and wonderful people, and your opinions have been heard.

This week's installment is 1,680 words, and there’s a lot in here: trade wars, the inverted yield curve, rare earths, the retailpocalypse, the geopolitics of car mergers, the eleemosynary predilections of MacKenzie Bezos, and more.

- After you've read this, I hope you'll find time to watch Axios' Jonathan Swan ask Jared Kushner what he sees in the murderous crown prince of Saudi Arabia. The premiere of the second season of "Axios on HBO" airs at 6 pm ET tonight.

1 big thing: Trump's war on trade

Illustration: Aïda Amer/Axios

GoPro will move some production from China to Mexico to avoid Trump tariffs.— Silicon Valley Business Journal headline, May 14

The U.S. is in the middle of a full-blown trade war with China, our largest source of imports. There's broad bipartisan consensus that even if the Trump administration's tactics are misguided, China achieved its dominant trade position unscrupulously, being selective as to which international trade norms it would accept. Some broader context:

- America's largest backup source of imports is Mexico, a member in good standing of NAFTA since inception. A natural part of any U.S. trade war with China would normally consist in encouraging American companies to source their products within the North American free trade area, rather than shipping them across the Pacific.

- The White House is in a hurry to ratify USMCA, the successor agreement to NAFTA. The proposed treaty has support from Mexico, which also wants to see it signed quickly.

- In six months, the U.S. could find itself fighting another big trade battle, this time with the EU and Japan.

- In just over a month, the U.S. plans to end India's preferential trade privileges.

The bottom line: This is the worst possible time to start a trade war with Mexico, our most natural ally in any economic confrontation with China. And yet now we seem to be entering an entirely voluntary and preventable two-front war.

- Any tariffs on Mexico will face legal challenges and might never even happen in the first place: Trump is nothing if not mercurial on such matters.

Why it matters: To get embroiled in one major trade war might be considered a misfortune; to find oneself in two of them looks like carelessness. Trump can't end global trade. But by making it much less predictable, he can cripple a key driver of American — and global — economic vitality.

Go deeper: How Trump's Mexican tariffs would impact goods in America

Bonus: America's scary yield curve

Risk-free bond yields aren't supposed to look like this. The interest rate on the 10-year Treasury bond is now 0.22 percentage points lower than the rate on 3-month Treasury bills. The rate on 3-year bonds is 0.25 points lower still. While the so-called yield curve inversion — perennially seen as a harbinger of bad times — doesn't mean that recession is imminent, it does mean that the markets have given up hope of healthy growth over the next few years.

Go deeper: The bond market is giving ominous warnings about the global economy

2. The biggest tax hike in 30 years

Illustration: Lazaro Gamio/Axios

If Trump's 5% tariff on Mexican goods takes effect later this month, the president's trade policies would constitute a bigger tax hike than Bill Clinton’s in 1993, writes Axios' Courtenay Brown.

By the numbers:

- Tariffs already in place will increase revenues by $69 billion, the Tax Foundation estimates — or about 0.32% of GDP. Add in the threatened 5% tax on Mexican imports, and that rises to about 0.40% of GDP.

- That’s more than Clinton’s tax bill in 1993, which brought in revenues of about 0.36% of GDP after the first year, and just shy of George H.W. Bush’s increase in 1990, which amounted to 0.41% of GDP after year 1.

What to watch: If Trump follows through on his threats — 25% on all Chinese and Mexican imports — those revenues would amount to 1.45% of GDP. You’d have to go back to the 1968 tax hike for a bigger revenue measure, per data compiled by the Treasury Department.

3. China's rare earths saber-rattling

Illustration: Sarah Grillo/Axios

"Don't say we didn't warn you." With these words, China has signaled that its next step in the trade war might be to cut off America's access to rare earth minerals — a key component in everything from cellphones to missile systems.

Where it stands: China exports about 80% of the rare earths imported by the U.S., and a boycott could cripple much of American high-tech manufacturing.

- China doesn't dominate this industry because it has unusually large deposits of rare earths; it doesn't. (As every story about rare earths has to mention, they're actually very common.) Rather, China simply has a greater willingness than most other countries to do the filthy job of mining these minerals — a job that generally involves hundreds of nasty acid baths, a lot of pollution and even quite a bit of radioactive waste.

Flashback: In 1991, Lawrence Summers, then the World Bank's chief economist, signed his name to a notorious "pollution memo" that was leaked to the environmental community. The memo made perfect economic sense, even if it was politically rash.

- "Health impairing pollution should be done in the country with the lowest cost, which will be the country with the lowest wages," Summers wrote. "The demand for a clean environment for aesthetic and health reasons is likely to have very high income elasticity."

- Summers wasn't entirely serious. But the memo does a good job of explaining how China ended up mining most of the world's rare earths.

By the numbers: The Rare Earths Monthly Metals Index, a price gauge created in 2012 at a level of 100, stood at just 19 in May — surprisingly low after almost a year of worries that China could cut off supplies. If American businesses have been warned, they haven't shown any signs of stockpiling the precious supplies they need.

Go deeper: Why rare earth minerals matter in the U.S.-China trade war

4. Dispatches from the retailpocalypse

Where it stands: Abercrombie & Fitch stock plunged 25% on Wednesday. JCPenney stock is trading at $0.80 per share, down from a high of $80 in early 2007. And Dressbarn is closing down entirely.

Now comes the trade war. Hallmark doesn't expect to be able to exempt greeting cards from the next tranche of Chinese tariffs, according to an internal memo seen by Axios' Dan Primack.

- Hallmark imports around $500 million worth of products from China each year, including plush toys and Christmas ornaments. That puts the potential tariff impact at more than $100 million, at least some of which the company expects to pass on to consumers.

"Hallmark and our suppliers cannot absorb the full impact of the increased cost," says the May 15 memo. "Despite all supply chain creativity, it will not solve the whole problem."

Why it matters: The trade war is already hurting retailers, if only in terms of the amount of time that company executives are being forced to spend on contingency planning. Worse is yet to come.

5. M&A goes sovereign

Illustration: Sarah Grillo/Axios

Car companies aren’t just big business, they’re national champions. When it comes to mega mergers, sovereign governments are succeeding where industrial titans like Carlos Ghosn and Sergio Marchionne failed.

- Fiat Chrysler is proposing a 50-50 merger with France's Renault, creating the world's third-largest automaker, behind Volkswagen and Toyota.

- Political considerations were obvious in the merger proposal, which signaled zero layoffs despite the fact that many plants in Europe aren't running at full capacity. (Without that layoff commitment, the French government would never have gone along.)

The trend: The U.S. government sold Chrysler to Fiat. The Japanese government removed Carlos Ghosn as chairman of Nissan and effectively toppled him as CEO of Renault, too. The Italian and French governments have encouraged the proposed merger between FCA and Renault. And the Chinese government, which brokered the takeover of Volvo, is now dictating an electric future.

The bottom line: There are undeniable economic imperatives driving the consolidation of the auto industry — but the hands on the wheel don’t belong to shareholders.

Go deeper: The geopolitics of the auto industry

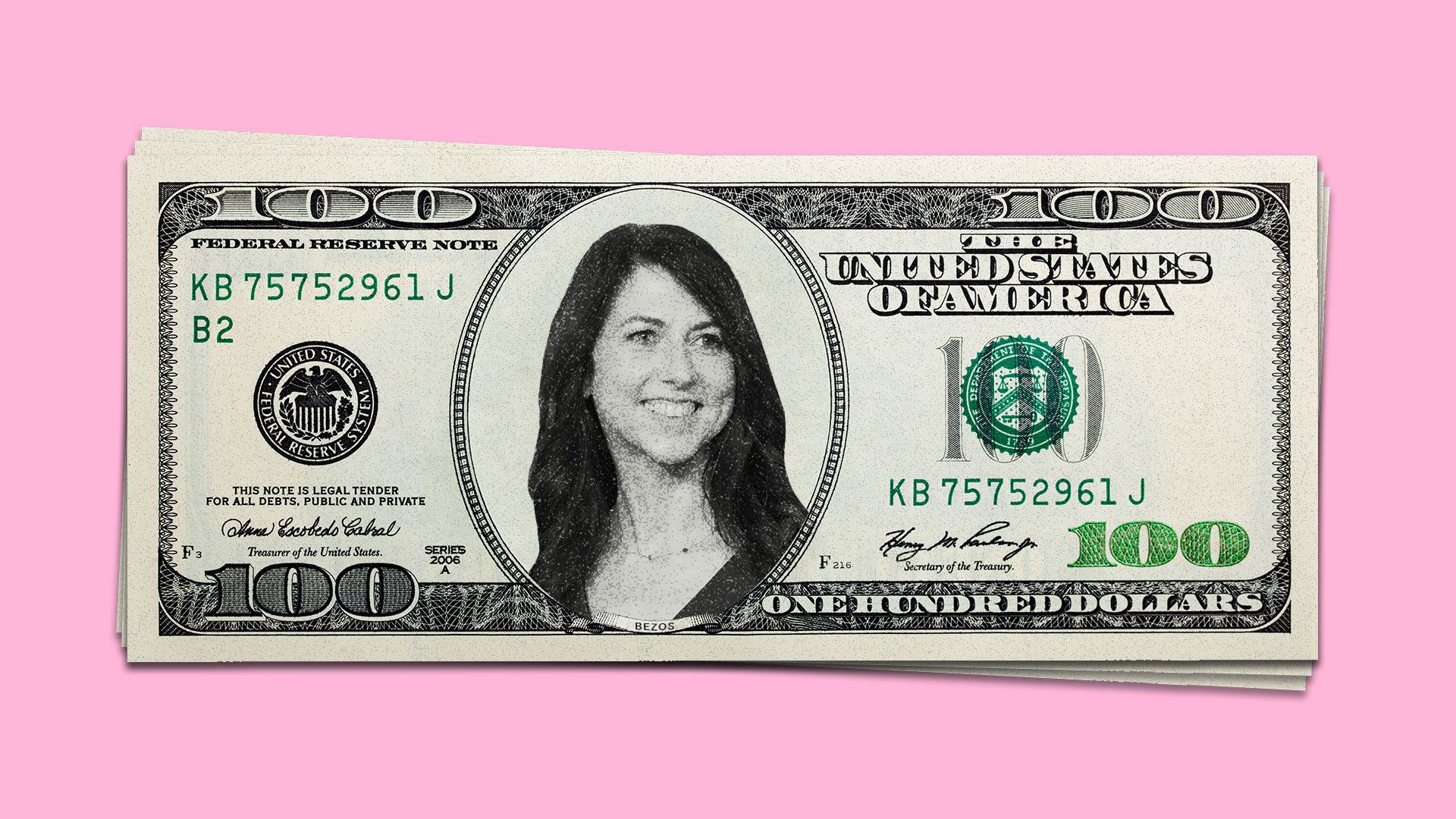

6. The urgent charity of MacKenzie Bezos

Illustration: Aïda Amer/Axios

19 billionaires signed the Giving Pledge this week, but just one of them — MacKenzie Bezos — looks likely to give away more money than the rest of them combined.

- Bezos is a novelist, and her Giving Pledge letter quotes a writer, Annie Dillard, as a key inspiration. “Do not hoard what seems good," writes Dillard. "The impulse to save something good for a better place later is the signal to spend it now. … Anything you do not give freely and abundantly becomes lost to you. You open your safe and find ashes.”

- Bezos's conclusion: "I won’t wait. And I will keep at it until the safe is empty."

Why it matters: The amount of money pledged to charity but not spent grows every year. Bezos understands that it makes sense to front-load her donations, since today is more urgent than tomorrow.

7. The week ahead: Trump meets the Queen

Illustration: Rebecca Zisser/Axios

President Trump will kick off a trip to Europe tomorrow, where he will meet with the U.K.'s Queen Elizabeth and outgoing Prime Minister Theresa May, writes Courtenay.

- Friday is May’s last day as head of the Conservative Party, though she’ll remain prime minister until the party elects a new leader.

The U.S. jobs report will be released Friday. Economists estimate the economy added 190,000 jobs in May, while the unemployment rate is expected to tick up to 3.7%.

Beyond Meat and Zoom — two of the best performing IPOs so far this year — will both release quarterly results on Thursday for the first time since going public.

8. Building of the week: Felix Chevrolet

Felix Chevrolet, at Jefferson and Figueroa, will always be the purest distillation of Los Angeles.

- The showroom was built in 1946 by Godfrey Bailey and featured state-of-the-art technology, including full-height canted windows under a curvilinear canopy. It was (and is) particularly effective when lit at night.

- Founded in 1921 by Winston Felix, the eponymous Chevrolet dealership moved into the showroom in 1958, bringing its iconic neon sign with it. Felix was a friend of Felix the Cat's creator, Pat Sullivan; their cross-marketing deal turned out to be spectacularly successful for both of them.

- The sign is neon no longer: It switched to LEDs in 2012.

Elsewhere: How Qualcomm shook down the cellphone industry for almost 20 years. New Zealand's "wellbeing budget" prioritizes mental health over economic growth. WeWork's CEO will consider declining investments on moral grounds, after raising $4.4 billion from Saudi Arabia. Lunch with Warren Buffett sells for $4,567,888. What Intuit knows about you.

Editor's note: The lead sentence in the 8th piece was corrected to delete the reference to Chevrolet becoming part of a Franco-Italian international conglomerate.

Sign up for Axios Capital

Learn about all the ways that money drives the world