Axios Capital

January 23, 2020

Happy Lunar New Year to all my readers, especially my fellow rats.

In this week's chart-filled edition of Axios Edge: Davos, bankruptcy finance, college admissions, rhodium, a NY Times endorsement, and more on the Lunar New Year. Plus a few surprises. All in just 1,633 words, which should take you about 6 minutes to read.

1 big thing: Public Davos, private Davos

Photo Illustration: Sarah Grillo/Axios. Photos via Getty Images: Fabrice Coffrini/AFP and Harold Clements/Express

Call it the hypocrisy gap. Davos has always struggled with the difference between the conference's rhetoric and its reality. This year, as climate change and talk of "stakeholder capitalism" increasingly dominate the public agenda, the gap between why delegates go and why they say they go is wider than ever.

Why it matters: Davos, once a quiet Alpine talking shop, has become a global media frenzy. Governments, corporations, and the World Economic Forum itself (slogan: "Committed to Improving the State of the World") increasingly see Davos as an opportunity to send the message that they care deeply about {insert cause here}. But that's not what keeps the plutocrats returning year after year.

The value of Davos, the reason why companies spend astonishing sums of money to attend, has nothing to do with improving the state of the world, and indeed has precious little to do with the official WEF program.

- Heads of state, finance ministers and plutocrats attend Davos for a very simple reason: It's the one time each year when they're all in the same place at the same time. If your job involves talking face-to-face with CEOs from around the world, one week in Davos can save you months' worth of private-jet flights.

Davos delegates are even happy to embrace Donald Trump — the unilateralist who, according to former adviser Steve Bannon, "couldn’t say ‘postwar rules-based international order'" even if you threatened to shoot him. (That's from the new Trump book by Carol Leonnig and Philip Rucker of the Washington Post.)

- Trump is opposed to almost everything that Davos ostensibly stands for, but his presidency has been good for the markets and for billionaires' net worth.

- A capital-friendly neoliberal consensus still reigns in Davos, where wealth taxes are anathema and the phrase "doing good" is invariably preceded by the phrase "doing well by."

Davos is home to the world's most exclusive caste system, where even billionaires suffer from crippling FOMO and angle desperately for coveted invites. (The Google party is the perennial hot ticket.)

- The implicit message: You can never have too much of the two things that get you status at Davos, which are money and power.

The bottom line: Davos delegates have to be judged by their deeds, not by their words. Talk is cheap; white badges with blue dots are expensive. And shareholders demand a financial return on the cost of attendance.

Bonus: A tale of 2 delegates

Photo: World Economic Forum/Manuel Lopez

The image is indelible. Greta Thunberg, maybe 5 feet tall, wearing animal-free boots and a well-worn hoodie, stands on a box to reach the WEF microphones to address the assembled suits. The words "Climate Apocalypse" are clearly visible behind her.

- The message: The Swedish teenager took a train to Davos and was effective in speaking truth to power.

- The reality: Thunberg was part of a panel discussion in the small Sanada room, which seats maybe 150 people. U.S. Treasury Secretary Steven Mnuchin subsequently dismissed Thunberg by saying that "after she goes and studies economics in college she can come back and explain that to us.”

Trump, by contrast, was given the cavernous Congress Hall and gave a characteristically immodest speech in front of thousands of delegates.

- He was then congratulated by WEF chief Klaus Schwab:

"Mr. President, thank you for your speech, and congratulations for what you have achieved — for your economy, and also for your society. ... All your politics certainly are aiming to create better inclusiveness for the American people. ... I want to thank you personally for injecting optimism into our discussions. We have many problems in the world, but, as you said, we need dreams.— Klaus Schwab, to Donald Trump

The bottom line: Thunberg's presence at Davos was great for the conference's optics. But Trump (and his daughter) effortlessly topped the conference hierarchy.

2. The last inefficient market

Illustration: Eniola Odetunde/Axios

There's no such thing as a free lunch — unless you find yourself in bankruptcy court, looking for companies to lend money to. That business — known as debtor-in-possession financing, or DIP loans — stubbornly refuses to succumb to the efficient market theorem.

Driving the news: This year's annual meeting of the American Economic Association saw the presentation of a compelling new 57-page paper from Espen Eckbo, Kai Li, and Wei Wang. The verdict: DIP loans never default — but carry enormous interest rates nevertheless.

What they did: The researchers gathered data on 393 DIP loans over a 13-year period from 2002 to 2014. The loans were worth more than $120 billion in total. (I'm indebted to the indispensable Petition newsletter for finding this paper.)

- On average, the loans paid 6 percentage points more than Libor. That's about 2.5 percentage points more interest than junk-bond issuers pay to borrow money.

- Lenders also charged an average of 0.9% in upfront and annual fees.

What they found: Junk bond issuers default; DIP loans don't. (As the authors write, DIP loans not only have super-priority, they're also fully collateralized against the assets of the company.) The fees and interest charged are pure profit; they don't reflect any credit risk inherent to the loan.

- Winners: DIP lenders are found not only among previous lenders but also when new lenders come in from hedge funds or private equity.

- Losers: Junior creditors of the bankrupt company usually object to the terms of the DIP loan, since the excess profits are ultimately coming out of their pockets. But they're almost always overruled by the bankruptcy judge.

The bottom line: The paper's authors conclude: "The spread and fee premiums add $4.2 billion to the borrowing costs for the Chapter 11 firms. This evidence shows that DIP lenders—super-priority lenders of last resort — engage in a form of rent extraction not seen elsewhere in the US credit markets."

3. Coming up: China’s Lunar New Year

Illustration: Eniola Odetunde/Axios

The Year of the Rat begins on Saturday, writes Axios' Courtenay Brown.

Why it matters: China’s New Year is the country’s biggest holiday, and it's accompanied by spending on travel, food and high-end gifts during the week-long celebrations.

- It’s peak time for businesses, particularly luxury retailers like LVMH, whose investors fear that Lunar New Year shopping — normally extravagant — will be muted this year.

- This year's festivities will be different than in recent years. Public Lunar New Year events in four cities, including Beijing, have been canceled because of coronavirus outbreak fears.

No major airline announced flight cancellations to China in response to the virus. There’s anecdotal evidence, though, that some people are shifting Lunar New Year travel plans because of the outbreak.

- Wuhan is quarantined. Residents are banned from departing from the airport there, which sees hundreds of flights to Beijing and other Chinese cities every week.

- Tour companies are offering refunds for arrangements made in the city, according to the New York Times.

- The Chinese government estimated that residents would make 3 billion trips to celebrate the New Year, slightly more than last year. Those projections came before news of the virus spreading.

Aside from Hong Kong’s own coronavirus concerns, officials there nixed a long-running parade for fear that it would attract pro-government protestors.

Celebratory pork will also be in short supply. It’s among the top consumed food items in the week-long celebrations, but African swine fever ravished China’s pig herds. That’s pushed pork prices to astronomical levels in China.

The bottom line: The Lunar New Year is a barometer for the health of the Chinese economy. Last year, sluggish spending prompted concern about a consumer-led slowdown. This year might not be much better.

4. How Johns Hopkins transformed its freshman class

In 2014, with almost no fanfare, Johns Hopkins president Ronald Daniels ended the admissions advantage given to "legacies" — the children of alumni.

- The result: Legacy admissions have accounted for less than 4% of the incoming undergraduate class in each of the past three years. That's down from 12.5% in 2009, when Daniels became president.

"Because legacy students at these schools are more likely to be wealthy and white than non-legacy students, the very existence of legacy preferences limits access for high-achieving low- and middle-income students, and also for African American, Latino, and Native American students."— Ronald Daniels, writing in The Atlantic

Johns Hopkins moved to need-blind admissions in 2018, after receiving a $1.8 billion gift from Mike Bloomberg. The university has also eliminated all student loans from its financial aid packages and has replaced them with grants.

- The result: 19.1% of the 2019 incoming freshmen are eligible for Pell grants. That's more than double the 9% in 2009.

5. Spot the wine tariff

In October, the U.S. imposed a 25% tariff on most French wine. In November, French wine exports to the U.S. plunged by 56%, from $130 million to $57 million. That's by far the biggest monthly fall in French wine imports ever.

- Olive oil experienced something similar. After a 25% tariff on Spanish olive oil was imposed in October, total American olive oil sales fell by 8%, per Nielsen.

6. The colossus of rhodium

The price of rhodium has jumped by more than 50% in just the first three weeks of January, writes Dion Rabouin of the Axios Markets newsletter.

What's happening: Rhodium is mined in such small quantities, mainly in South Africa, that a modest uptick in demand by carmakers (which use it in their catalytic converters) can result in huge price swings. According to The Economist, German chemicals giant BASF anticipates that demand for rhodium could rise by 40% this year in China alone.

Sign up for the Axios Markets newsletter here. The Edge subscription page is here.

7. Insider trading the New York Times

The New York Times turned its Democratic endorsement into a multimedia extravaganza this week, culminating in a full episode of "The Weekly," its TV show. But betting-market activity would have tipped off viewers as to who was likely to win the Gray Lady's nod.

- By the numbers: Bettors wanting to win $1 in the event of an Amy Klobuchar endorsement would have had to pay just 3 cents at the beginning of the day on Sunday. But the price soared as the endorsement neared, closing at 68 cents on unprecedentedly high volume.

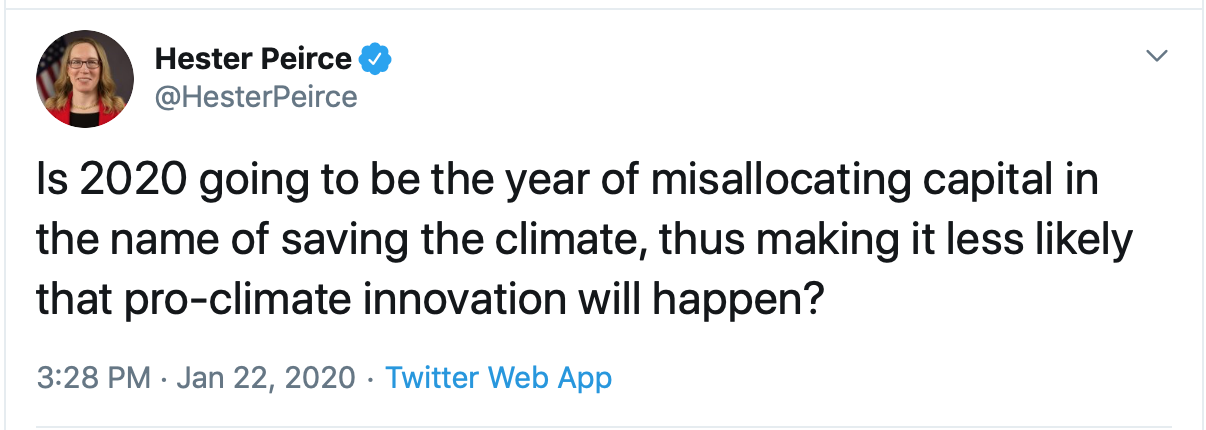

8. SEC tweet of the week

SEC commissioner Hester Peirce worries that if financial markets allocate capital in the name of saving the planet, they will allocate capital away from the companies that could save the planet through innovation. Maybe we should just trust in Adam Smith's invisible hand to solve the climate crisis for us.

9. Building of the week: Geisel Library

Photo: Education Images/Citizens of the Planet/Universal Images Group via Getty Images

The centerpiece of UC San Diego, William Pereira's Geisel Library is turning 50 this year.

- The library was renamed in 1995 in honor of Audrey and Theodor Geisel. (Theodor is better known as Dr. Seuss — Seuss was his middle name.)

- The 38,000 square feet of windows help the massive concrete building almost disappear into the sky in its upper stories.

- Built at a cost of $4.4 million, the much-loved library has become emblematic of the entire university. A stylized form of the building serves as the university's logo.

Sign up for Axios Capital

Learn about all the ways that money drives the world