Axios Capital

May 19, 2019

Situational awareness: Australia, shockingly, doesn't have a new prime minister. Scott Morrison surprised everybody by winning re-election in this week's general election, keeping the right-wing coalition in power. Former PM Tony Abbott, on the other hand, will be absent from parliament for the first time in 25 years. He lost his Sydney seat to Olympic skier and environmentalist Zali Steggall by a 16-point margin.

1 big thing: Unbundling real estate

Illustration: Rebecca Zisser/Axios

There's a lot of risk in real estate. Just owning it, of course, is the main risk. It can work out well for people lucky enough to be able to put a small down payment on a house before it soars in value.

- Real estate can also cause a global financial crisis, should millions of Americans find themselves underwater on their mortgages.

Driving the news: Wall Street is increasingly looking for ways to take on these risks. Companies like Point will buy an equity stake in your home, while Zillow and Opendoor will take on the risk of finding a buyer, giving you an up-front cash payment for your house, no staging or repainting necessary. Often, the houses they buy end up getting rented out by giant Wall Street landlords, rather than being sold to individuals.

- Redfin is trying out a similar approach for buyers, moving toward a future where house hunters can buy entirely online.

- The entrenched system of 6% brokerage commissions is being taken to court, with Redfin's CEO describing the existing MLS cartel as a dinosaur about to be hit by an asteroid.

What we’re seeing: WeWork was designed to be asset-light, renting out office space and then subleasing it to smaller tenants. Now, seeing demand for real estate risk, it has created a sister company, ARK, to buy up the buildings it's renting in. Investors get to choose exactly which risk they're interested in.

- The government is also in the business of reallocating real estate risk to revitalize depressed urban areas. University of Georgia law professor Mehrsa Baradaran has proposed a "Homestead Act for the 21st Century" that would give abandoned properties to local residents without needing to create financier-friendly Opportunity Zones.

The big picture: De-risking homeownership has always made sense. That's why the government created Fannie Mae and Freddie Mac. If Silicon Valley financiers lose money by taking on these risks, well, they can afford to. And if they can find a way to efficiently renovate homes at scale, that could save more than money, it could save marriages.

2. Just how dangerous are leveraged loans?

Illustration: Rebecca Zisser/Axios

Investing in unbundled risk can be extremely dangerous. Alan Greenspan was never more wrong than when he defended the deregulation of derivatives in 1999:

"These new financial instruments are an increasingly important vehicle for unbundling risks. These instruments enhance the ability to differentiate risk and allocate it to those investors most able and willing to take it."

The catch: In theory, Greenspan was right. In practice, however, derivatives weren't being used to allocate risk to people who wanted it. Instead, they were used to hide risk, to make risky loans look like ultra-safe securities with triple-A credit ratings, and to sell them to unsuspecting investors who had no idea what they were buying.

Driving the news: The Federal Reserve and others, including Janet Yellen, have been worrying a lot about the rise in leveraged lending. High-risk, junk-rated loans to deeply indebted corporate borrowers now total well over $1 trillion, and already lawsuits have started flying after loans have gone bad. But unlike Greenspan's derivatives, leveraged loans are well-understood and held by institutions that understand their risks.

- Nobody's kidding themselves that these loans are safe. Defaults are priced in, with credit spreads already above their 20-year average, per the Fed.

- The biggest loan investors are banks and insurance companies, and the risk is dispersed enough that even significant financial losses on these loans would not cause a broader systemic risk. Elsewhere, CLOs comprise a very small part of most investors' asset allocation.

- $1 trillion is a lot of money, but it's small in comparison to the combined capitalizations of the Big Tech stocks. Investors in Facebook, Apple, Amazon, Netflix and Alphabet lost a total of $650 billion in the fourth quarter of 2018, with no systemic spillovers.

What to watch: So long as the music keeps playing, the banks will keep on dancing. When one loan comes due, it will be refinanced with another, or interest will be paid in kind. When the music stops, defaults will spike. The big question is what then happens to the borrowers, their vendors and their employees.

- U.S. bankruptcy law is designed to keep bankrupt companies operating as going concerns. The ownership might change, and the shareholders generally get wiped out, but it's possible for employees and vendors to emerge from the process in an improved condition. As we saw with Toys "R" Us, however, that doesn't always happen.

The bottom line: If the leveraged loan market starts collapsing under its own weight, the broader consequences will likely be small. On the other hand, if the loan market fails as a result of a broader economic contraction, highly indebted companies will be at much higher risk of shutting down entirely once they default.

3. How student debt causes lower incomes

Illustration: Aïda Amer/Axios

A bonus philosophical question: If those same leveraged companies didn't have to service so much debt, might they be more successful? It's a question that's hard to answer empirically, but a new paper looking at student loans suggests that debt does come with more than just interest costs.

- Three researchers, all of them business school professors, managed to persuade Equifax to give them detailed financial data on thousands of borrowers who had student loans from National Collegiate. When the company couldn't prove that it had chain of title, the borrowers' debts were discharged.

By the numbers: Does a significant student debt burden force you to earn more money, just so that you can repay your loans? Or does it just keep you stuck in a suboptimal job, when you might be able to earn more elsewhere? The answer seems to be the latter. The researchers report: "After the discharge, the borrowers' geographical mobility increases ... ultimately their income increases by more than $4,000 over a three year period, which is equivalent to about two months' average salary."

4. Britain fractures

Illustration: Sarah Grillo/Axios

Brexit continues to swing back and forth between tragedy and farce. The U.K. goes to the polls on Thursday to elect 72 new members of the European Parliament. That's despite the fact that the governing Conservative Party, the opposition Labour Party, and the topping-the-polls Brexit Party all believe that the country shouldn't elect any MEPs at all.

- The official position of all three parties is that the people have spoken, that they want to leave the EU, and that it's the job of Britain's politicians to deliver Brexit. That fact notwithstanding, Brexit looks no closer to being delivered: Prime Minister Theresa May is going to put her deal to Parliament for a fourth time in early June, where it is certain to be soundly rejected.

- Negotiations between the Conservatives and Labour aimed at reaching a mutually acceptable Brexit compromise have also failed, with the leaders of each party accusing each other, correctly, of being unable to deliver their respective parties' votes. Brexit has fractured Britain's politics, a state of affairs that will probably continue for as long as the United Kingdom continues to exist. That might not be long, if Scotland is allowed another independence vote.

- Boris Johnson, a man who once said, with good reason, that "my chances of being PM are about as good as the chances of finding Elvis on Mars, or my being reincarnated as an olive," is the favorite to replace May as prime minister. May has said she'll step down after the June vote, but hasn't laid out any specific timetable.

The bottom line: As Reuters pithily put it, "Nearly three years after the United Kingdom voted 52% to 48% in a referendum to leave the EU, it remains unclear how, when or even if it will leave the European club."

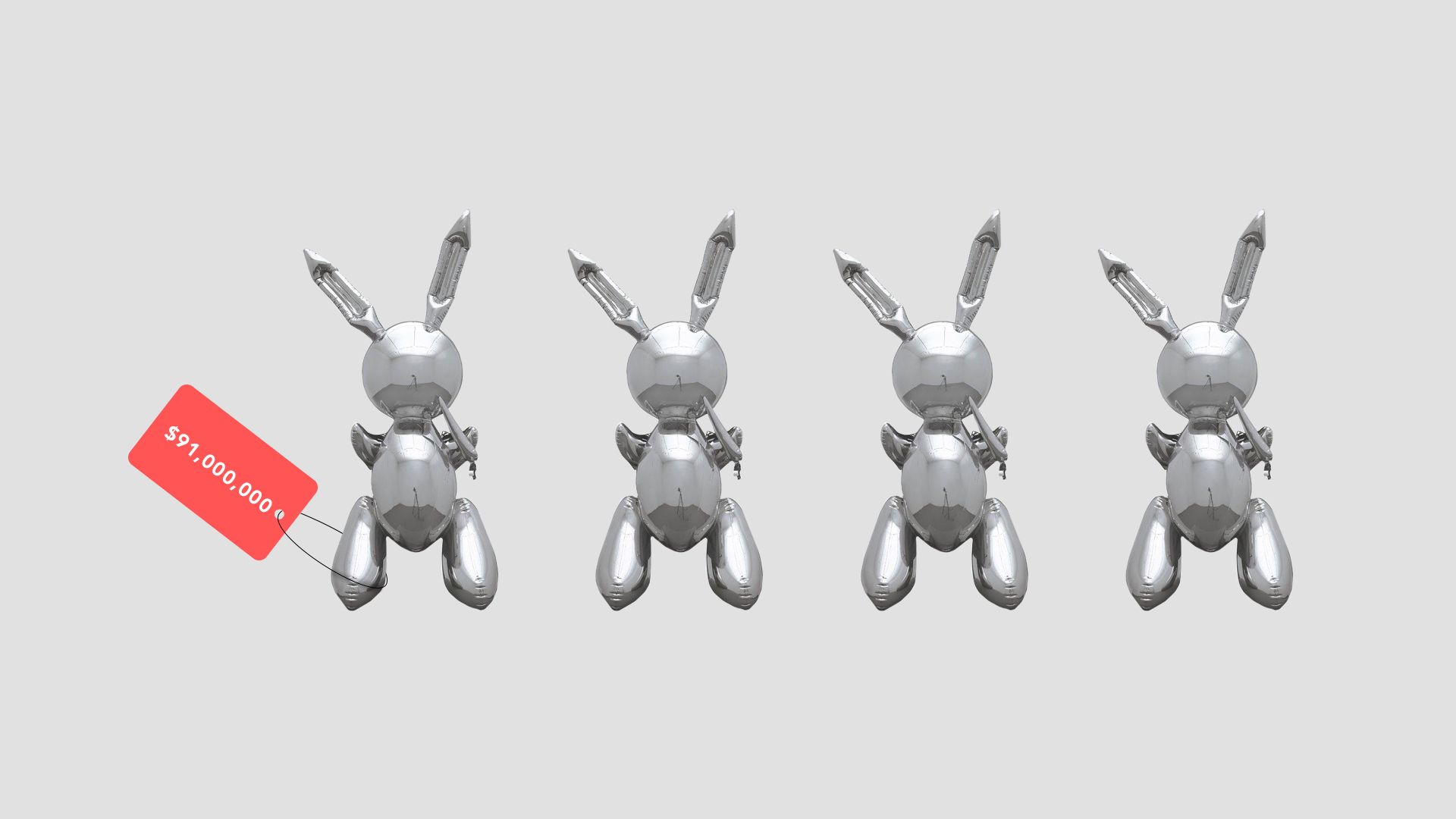

5. Rabbit rabbit rabbit rabbit

Illustration: Rebecca Zisser/Axios

"Rabbit," an iconic sculpture by Jeff Koons, this week became the most expensive artwork by a living artist ever sold at auction, fetching $91,075,000.

- It's one of an edition of 4, which, according to classical economics, should make it less valuable. In the art world, however, as we saw with a $101 million Giacometti sculpture in 2014, being one of an edition can make an artwork more valuable, not less. (One of the other big sales of this week, a $111 million Monet, is similarly part of a celebrated series.)

- The most valuable artwork by a living artist is unknowable, but it's almost certainly not "Rabbit." It's hard to imagine a major Jasper Johns flag painting, for example, fetching less than $100 million today. Alternatively, do you consider Thomas Heatherwick's "Vessel" to be an artwork? That reportedly cost $200 million.

- The hammer price on the Koons, $80 million, is exactly the same as was bid for a David Hockney painting in November. But Christie's has increased its buyer's premium in the interim, so the final price was $762,500 greater than the amount paid for the Hockney.

- The seller was the estate of publishing magnate Si Newhouse. Newhouse had promised his "Rabbit" to MoMA — but promises, evidently, can be broken.

- The buyer, technically, was Robert Mnuchin, the father of Treasury Secretary Steven Mnuchin. But Mnuchin père is an art dealer; he was merely bidding on behalf of an as-yet unknown client.

Go deeper: Artsy's Nate Freeman has the full history of who has owned each of the four Rabbits; the list includes Charles Saatchi.

6. Marketing pitch of the week

Illustration: Aïda Amer/Axios

You Can Get What You Need, When You Have an Annuity.

The Rolling Stones continue to prove that age is just a number, and that living longer is really about continuing to do the things you love. ... For Stones fans and millions of other Americans, the answer could be an annuity.— The Alliance for Lifetime Income announces that it's sponsoring the new Rolling Stones tour

Sales of fixed-indexed annuities totaled $19.5 billion in the last quarter of 2018. That's up 40% from a year earlier, when financial advisers were operating under a fiduciary rule saying that they had to give advice that was in the best interest of their clients. (That rule was effectively iced last year by a federal appeals court.) Annuities are generally extremely lucrative for the people selling them, which perhaps explains why annuities firms can afford to be the sole sponsor of the new Rolling Stones tour.

7. The week ahead: The world's biggest elections

Illustration: Rebecca Zisser/Axios

After 6 weeks of voting, we will find out on Thursday who will lead the world’s largest democracy for the next 5 years, writes Axios' Courtenay Brown.

- Indian Prime Minister Narendra Modi is up against Rahul Gandhi — the leader of the secular, center-left Indian National Congress. Modi is expected to win with fewer parliamentary seats, “requiring coalition support to form the next government,” according to Alyssa Ayres of the Council on Foreign Relations, writing for Axios Expert Voices.

The 2nd biggest democratic exercise in the world (after India) starts on Thursday, as up to 400 million people vote to elect over 750 lawmakers to the EU parliament.

- A strong showing for anti-establishment and euroskeptic parties — including Nigel Farage’s Brexit Party — is expected when results are out 3 days later, reports Reuters.

Boeing is expected to submit a software fix and details on additional pilot training for the grounded 737 MAX jets to the FAA this week — a first step to getting the fleet back in the air after two deadly crashes in the past year.

8. Building of the week: The National Gallery's East Building

Photo: View Pictures/UIG via Getty Images

"Washington is finally going to have a good 20th century building. I will go further: Washington is finally going to have a great 20th century building." Thus begins Ada Louise Huxtable's rapturous reception in 1971 of I.M. Pei's East Building for the National Gallery of Art.

- The commission was a tough one. Opposite the main National Gallery building, which Huxtable aptly describes as "John Russell Pope's last magnificent fling of frozen mega classicism," it sits on an awkward trapezoidal plot — a piece of land that Pei called "perhaps the most sensitive site in the United States."

- Pei's solution was not just successful in its own right; it marked the point at which Washington finally embraced Modernism.

As befits a great New Yorker, Pei was an immigrant, born in Guangzhou, China, in 1917. He was 24 when Pope's building was opened by Franklin Delano Roosevelt. At the time Pei was studying architecture under Walter Gropius at Harvard. He won the East Building commission at the age of 51 and kept on going, designing Doha's Museum of Islamic Art at the age of 90. He died on Thursday, aged 102.

Elsewhere: How Uber drivers artificially create airport surge pricing. How reckless loans devastated a generation of taxi drivers. Why your bicycle is more expensive. Quora is worth $2 billion. The number of female CEOs in the Fortune 500 has hit a record high: 33. A false rumor on WhatsApp started a bank run. The etymology of the dead cat bounce.

Sign up for Axios Capital

Learn about all the ways that money drives the world