Axios Capital

October 01, 2020

Thanks very much for subscribing to Axios Capital; do please forward this on to your friends and tell them to subscribe here.

- In this week's newsletter: How the public changes its mind; how buyout firms learned to love equity; the darker side of the cheerleading industry; a record fine for JPMorgan; Palantir becomes a public company; art becomes commoditized; and much more. All in 1,763 words, a 7-minute read.

1 big thing: When the world changes its mind

Illustration: Aïda Amer/Axios

Our febrile world is not normal.

- The precautions that we're taking against the spread of COVD-19; the way in which the president of the U.S. delights in violating political norms; the fires, hurricanes and other signs that catastrophic global warming has arrived; the virulent spread of the QAnon conspiracy theory — all of these things, and many more, represent a stunning break with the world as we knew it.

Why it matters: Society is made up of what Santa Fe Institute president David Krakauer calls "collective public ledgers." Many of those institutions have "tipping points" — the rate of surface change can seem slow, even as deeper underlying dynamics set the stage for a sharp or violent change in public opinion.

What they're saying: "You can think about bodies of belief like a huge public ledger," says Krakauer. Every individual inscribes their opinions into the ledger, and most of the time the ledger itself moves much more slowly than private opinions do.

- Depending on where you set certain initial assumptions, ledgers can be largely static, they can evolve slowly, they can flip back and forth in a predictably volatile manner — or they can flip suddenly, like a phase change from liquid to gas.

Between the lines: It's easy to think of public opinion about wearing masks, for instance, as a top-down function reflecting the differing messages sent by various public figures. That's easy to believe in the U.S., where attitudes to mask-wearing align strongly with political beliefs. But it has a harder time explaining why, say, only 58% of people in Italy regularly wear a mask, compared to 93% in Spain.

The big picture: Krakauer has spent his career studying complexity, which is a defining feature of the pandemic — and of the whole world, at the moment.

- The virus is a great example of a stochastic disease, as Zeynep Tufekci explains in The Atlantic. "Randomness plays a much larger role," she writes, "and predictions are hard, if not impossible, to make."

- The QAnon conspiracy theory is similarly complex and unpredictable, morphing from its far-right roots to infect wellness influencers and left-wingers like Piers Corbyn, the brother of former UK Labour Party leader Jeremy Corbyn.

The bottom line: After the "black swan" and "25 standard deviation events" of the financial crisis, followed by the victories for Brexit and Trump in 2016, and now a global pandemic, society has started to expect the unexpected and embrace the irrational.

- People now rationally expect that unlikely fat-tail events will happen multiple times per year. That expectation in turn makes it much more likely that they will rewrite the ledger of societal institutions.

2. How equity became more attractive than debt

Illustration: Annelise Capossela/Axios

The prime example of something highly improbable that became conventional wisdom: The idea that both interest rates and inflation will remain near zero for well over a decade.

Why it matters: As Axios' Dan Primack writes, private equity firms (the polite rebranding of "leveraged buyouts") have historically bought companies and loaded them up with debt.

- Now, they're starting SPACs, filled with fresh equity capital, with the intent of taking companies public. "The acquisition part is the same," says Dan, "but the transaction financing is inverted."

The big picture: Normally, debt is cheaper than equity, because it is tax-advantaged. In 2005, for instance, the effective tax rate on equity financing was 36%, while the effective tax rate on debt financing was negative 6.4%.

- What's changed is that interest rates have become so low that tax-deductible debt service expenses aren't big enough to generate much of a tax savings. Simultaneously, stock prices are so high that raising equity capital has never been cheaper.

The bottom line: SPACs are less work for private equity companies: Rather than own and operate a company, they will often just take a board seat. But they will still see enormous upside if the deal works out.

- SPACs also come with less accountability. There are no deep-pocketed limited partners asking awkward questions, just public shareholders who can come and go as they please.

3. Bain Capital's cheerleading investment gets ugly

Illustration: Aïda Amer/Axios

When Bain Capital bought Varsity Brands in 2018, it snapped up the entire U.S. cheerleading industry, writes Axios' Courtenay Brown.

Why it matters: Varsity Brands owns nearly all aspects of the cheer ecosystem. It even pays its own regulators — the people who are accused of shirking their duty of protecting young cheerleaders from sexual predators.

Driving the news: Investigations by USA Today last month revealed the regulators’ lax policies for preventing child abuse.

- The industry’s governing bodies — which were founded by Varsity Brands and whose directors are paid by Varsity — are named in a suit against Jerry Harris, a celebrity cheerleader and a star of the hit Netflix show "Cheer."

- In a statement, a Varsity Brands spokesperson said they "believe strongly that cheerleading has become safer and stronger" because Varsity founded the two oversight commissions.

- Harris was arrested on child pornography charges last month. The mother of two alleged victims told USA Today she reported the misconduct to one of the industry's regulator, to no avail.

Between the lines: The overseers say they maintain lists of sexual predators who have been suspended or banned from the industry.

- USA Today found 180 cheer-adjacent people who have been charged with sexual misconduct with minors who weren't banned from the industry (or on the lists) — just by googling and sifting through public records.

- Even after USA Today's findings, the individuals weren't banned.

The big picture: Allegations about this lack of oversight in cheerleading aren't new.

- An investigation by the Houston Press raised the issue back in 2015 — three years before Bain Capital bought Varsity Brands for a reported $2.5 billion.

What they're saying: Varsity Brands "seems to be oriented around maintaining market power, not stopping sexual predators from working in cheerleading," Matt Stoller wrote in his monopolies newsletter Big last week.

For the record: Bain, which claims to target "lasting impact through responsible business," referred Axios to the Varsity spokesperson, who issued a statement saying that they were "heartbroken and appalled to learn of the disturbing misconduct." The company says it is "committed to providing the safest environment possible."

4. Spoofing doesn't pay

Illustration: Sarah Grillo/Axios

Traders always aspire to "best execution" — if they're buying or selling a certain asset in the market, they want to get the best possible price. The problem is that high frequency traders (HFTs) make that extremely difficult.

Why it matters: One time-honored (yet illegal) tool for trying to outwit the HFTs is "spoofing." That's where a trader enters a series of fake orders that she has no intention of filling, to fool the HFTs about the supply and demand in the market.

Driving the news: JPMorgan has been fined $920 million for spoofing in commodity markets and Treasury bonds.

- The CFTC, the lead agency levying the fine, calculated a curiously specific $172,034,790 as the amount that JPMorgan made from the spoofing, along with an equally specific "$311,737,008 in market losses." No indication was made of how those sums were arrived at.

- The fine includes "restitution" of $205,992,102, to go into a "JPM Victim Compensation Settlement Fund." It's unclear who will ultimately receive that money, but it is certain to be sophisticated institutional investors who traded willingly at a given price.

Reality check: Spoofing might sometimes feel like a victimless crime, but it does deter institutions from trading, and therefore reduces liquidity and price discovery.

The bottom line: This fine is deliberately large to deter any other institutions from trying something similar. But so long as the HFT sharks are infesting the market waters, the big institutions are still going to be hesitant to swim freely.

5. 15 years of Palantir's share price

Palantir's Series A funding round — the first time that a value was really placed on the company — came in 2005, with a $2 million investment from In-Q-Tel, the CIA's investment arm, at 10 cents per share.

By the numbers:

- In-Q-Tel then led the $10.5 million series B in November 2006, at 6 cents per share, and also took part in the $37 million Series C at 58 cents per share, in February 2008.

- By November 2016, Palantir was raising money from institutional investors at $11.38 per share

Between the lines: Investors then started buying shares from shareholders, rather than from the company itself, at significantly lower prices — as low as $4.17 per share in August 2020.

- Palantir finally became a public company yesterday, and for one minute, at 1:50pm, it briefly touched $11.38 per share. But then it fell back to close at $9.50 per share.

The bottom line: We don't know how much of a stake the CIA still holds in Palantir. But if it hasn't sold any of the shares it bought, In-Q-Tel could be sitting on a holding worth more than $1 billion.

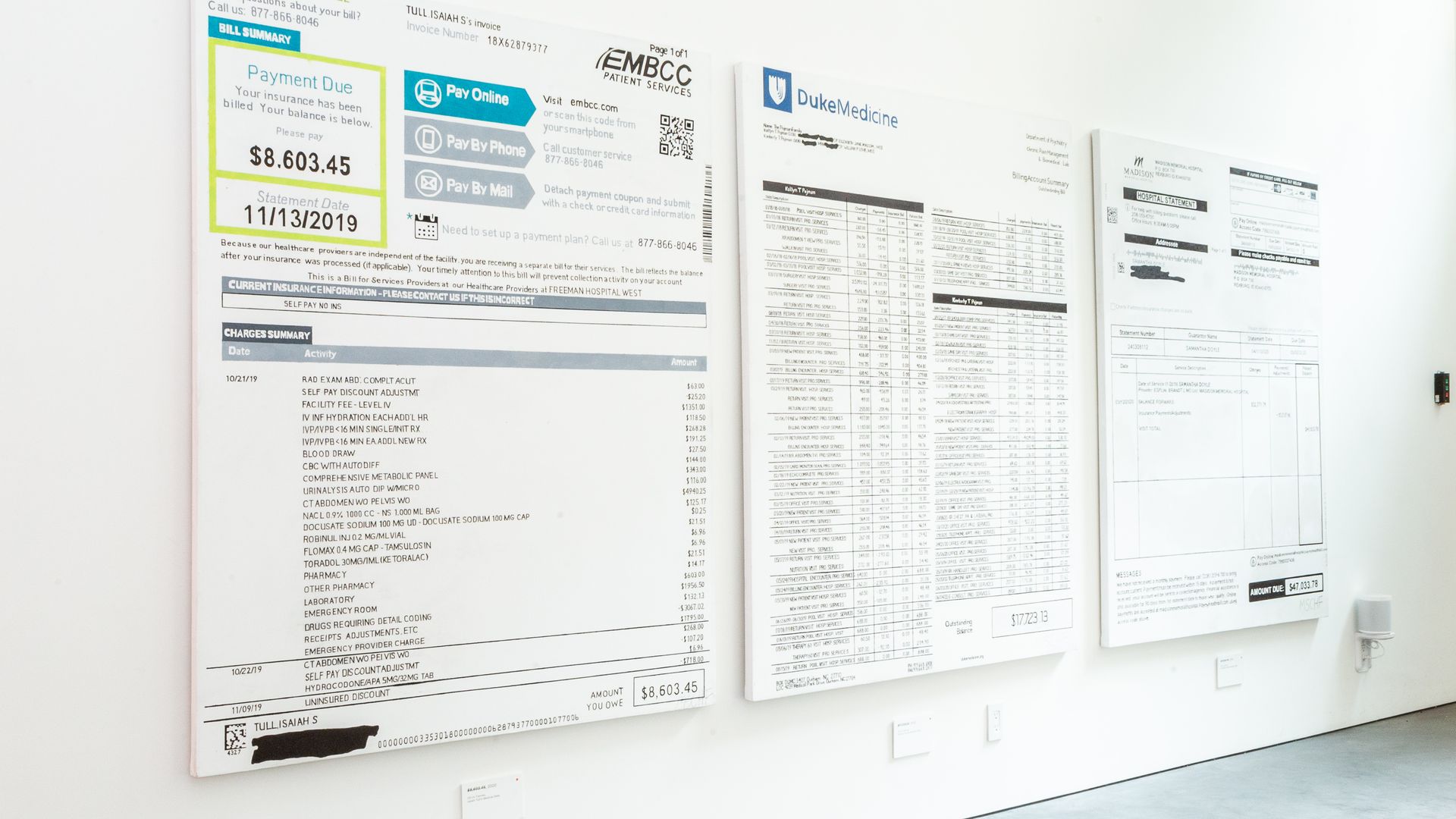

6. The art of debt

Photo: MSCHF

MSCHF's latest piece of conceptual art is a curious cocktail: One part J.S.G. Boggs, one part Occupy Debt, and one part hype beast. Add to a VC-funded cocktail shaker (or a Lower East Side art gallery) and stir gently with a few cubes of self-loathing irony.

Why it matters: The central conceit is relatively simple. MSCHF made paintings of three medical bills, called the triptych "3 Medical Bills," and sold it for the amount on the bills — which was then used to pay off the underlying debt.

- Where things get interesting is that the buyer, Otis, is immediately turning around and reselling the work by securitizing it into 3,750 shares at $20 each.

What they're saying: "This drop is admittedly quite different (and more speculative) than some of the other drops on the Otis platform," Otis founder and CEO Michael Karnjanaprakorn tells Axios.

- In other words: When Otis securitizes a set of four pairs of Travis Scott sneakers for $55,000, it has some idea what the secondary-market value of those sneakers might be. But MSCHF art has much less of a secondary market, and this work has no real comparables.

- What's more, the elegance of the original work — with the price being equal to the face value, and the money going to pay off the debt — is lost if and when Otis sells it at a profit. That sale will pay off no debt, and the price will have no conceptual resonance.

The bottom line: The securitization of art by its nature turns an object of contemplation into an object of speculation; any artistic value becomes irrelevant except insofar as it affects the price.

- By choosing a pure speculator to be the the purchaser of this work, MSCHF is giving it a very 2020 twist.

7. Coming up: The September jobs report

Illustration: Lazaro Gamio/Axios

The September jobs report is out tomorrow, writes Axios' Courtenay Brown.

- The unemployment rate is expected to fall 0.2 percentage points to 8.2%, with some 850,000 new jobs being added.

Of note: This is the last jobs report before the U.S. presidential election. The only other major economic release will be the third-quarter GDP figures.

8. Building of the week: The Crayola House

Margaret McCurry built what is now known as the Crayola House between 2001 and 2005.

- Situated in Oostburg, Wisconsin, on the shore of Lake Michigan, it's a bright and cheerful postmodern summer cottage with five bedrooms — all with views of the lake — and four baths.

- The kitchen takes pride of place at the corner prow.

The house is now for sale at the bargain price of $1.175 million.

- I urge you to click through either to the listing or to James Tarmy's story about the house, if only to check out the stunning front entrance.

Editor's note: The seventh item has been corrected to state that the unemployment rate is expected to fall 0.2 percentage points (not 2).

Sign up for Axios Capital

Learn about all the ways that money drives the world