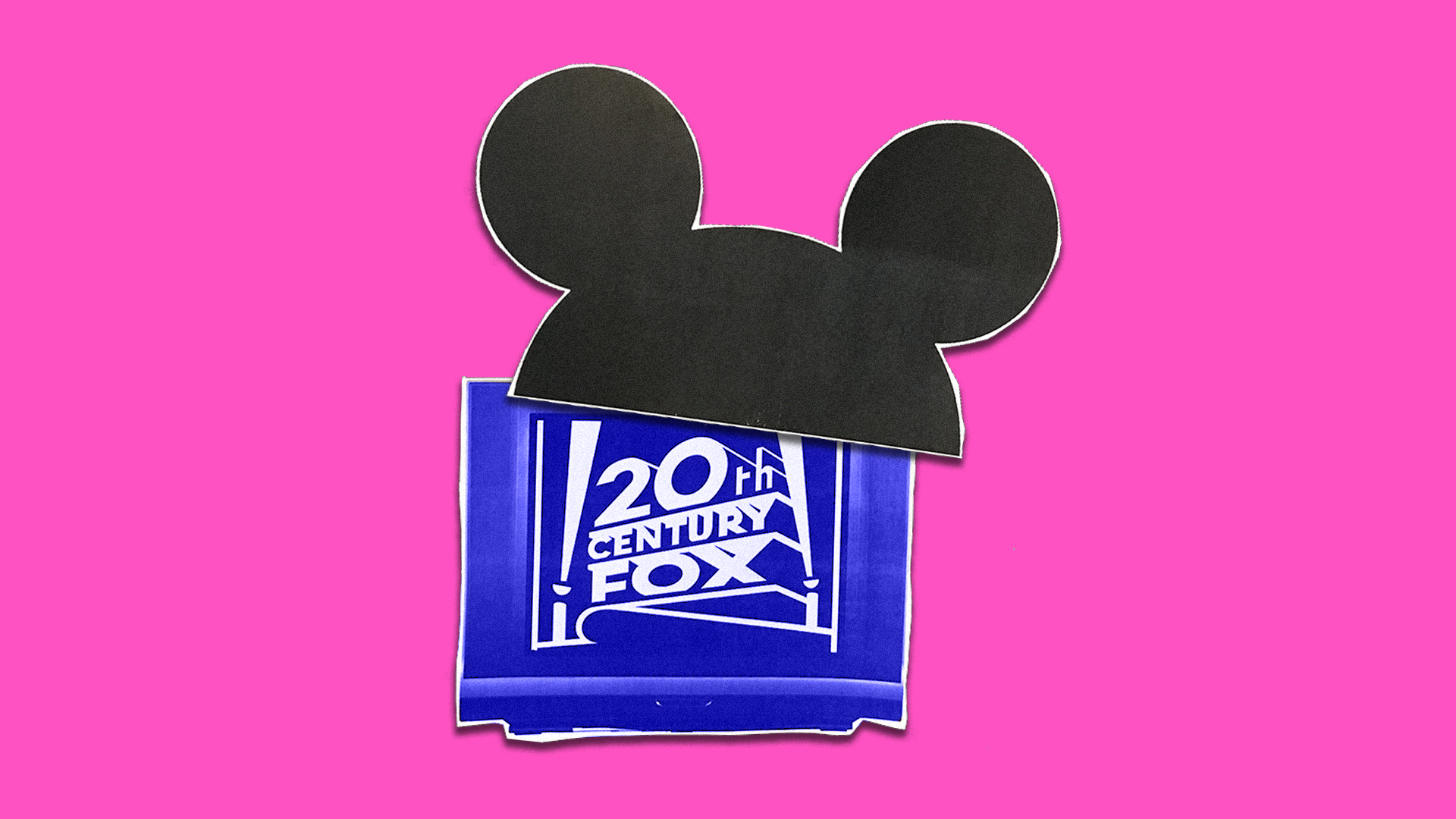

Disney to acquire most Fox assets for $52.4 billion in historic deal

Add Axios as your preferred source to

see more of our stories on Google.

Rebecca Zisser

Walt Disney Company announced Thursday that it has agreed to acquire the entertainment assets of 21st Century Fox, including Fox's movie studio and entertainment television networks, as well as Fox's international TV assets. Bob Iger will remain CEO and Chairman of Walt Disney through 2021, instead of 2019, as previously announced. Fox says it will created a "New Fox" brand that consists of highly-rated news, sports and broadcast businesses.

Why it matters: The deal would give Disney the scale to take on Netflix, but first it will need to convince regulators that it doesn't pose the same sort of monopoly risk as AT&T's proposed purchase of Time Warner.

- The transaction would include 21st Century Fox’s film and television studios, like 20th Century Fox and its rights to popular movies like X-Men and Avatar, its cable entertainment networks, like Nat Geo TV and FX, and international TV businesses, like its 39% in UK-based Sky News and Star TV in India.

- Disney also gets Fox's 30% stake in Hulu. Added to its existing 30% stake, Disney becomes the controlling stakeowner in the streaming property.

- The price tag is well below earlier reports, which started out at $60 billion. Reuters last night reported "more than $75 billion."

The timing of the annoucement is strange, given that The Department of Justice recently sued to block a merger between AT&T and Time Warner, with no final decision expected until the end of April at the earliest. There had been some speculation — including from AT&T CEO Randall Stephenson — that the DOJ's action would put Disney's talks with 21st Century Fox on ice. Big mergers are disruptive to a business, and even more so when regulatory approval is in doubt.

- Disney would be required to pay Fox a $2.5 billion breakup fee in the event of government opposition. That either means Disney is quite confident in regulatory approval, or means that Fox is wary.

- In 2015, average breakup fees were 3.2% of a deal's total value (per a Houlihan Lokey study). This one would be nearly 4.8%. AT&T only agreed to a $500 million breakup fee with Time Warner, even though the deal value is $85 billion.

The move could change the way Fox and Disney manage their existing sports and news outlets, like ABC News, ESPN, Fox Sports 1 and Fox Newc Channel. 21st Century Fox has been beefing up its sports distribution partnerships globally, with a mega-cricket deal in India and soccer rights in Latin America. But this deal would give Disney access for nearly two dozen regional sports networks (RSN's). Recode reports that Disney would have access to them should it want to market the sale of its sports platform to win future national deals. There already has been some criticism, however, of Disney effectively doubling down on a live sports strategy that has been flagging via ESPN.

For Disney, access to Fox's international assets is huge: Acquiring Fox's current 39% stake in Sky News gives Disney access to 23 million homes across the EU. Fox anticipates winning majority stake before the deal closes officially, which would give Disney even more leverage in that market. It would also give Disney access to Sky's streaming service, and Fox's Indian market assets, like Star TV. Netflix grew its international audience by $4.45 million subscribers last quarter.

Noticeably missing from the joint press release and 21st Century Fox's press release is information on the fate of Fox executive James Murdoch, who was rumored to be given a spot within Disney's empire to give the Murdochs some managerial control over the new venture. Bob Iger said on Good Morning America that Murdoch would help with the transition and that he would be discussing whether a role would exist for Murdoch or not at the new company.

Many legacy media players have been consolidating to be able to compete with tech giants, like Google Facebook and Netflix. Disocvery Communications acquired Scripps Inc. for $14 billion this summer.