Welcome to Marijuana 2.0

Add Axios as your preferred source to

see more of our stories on Google.

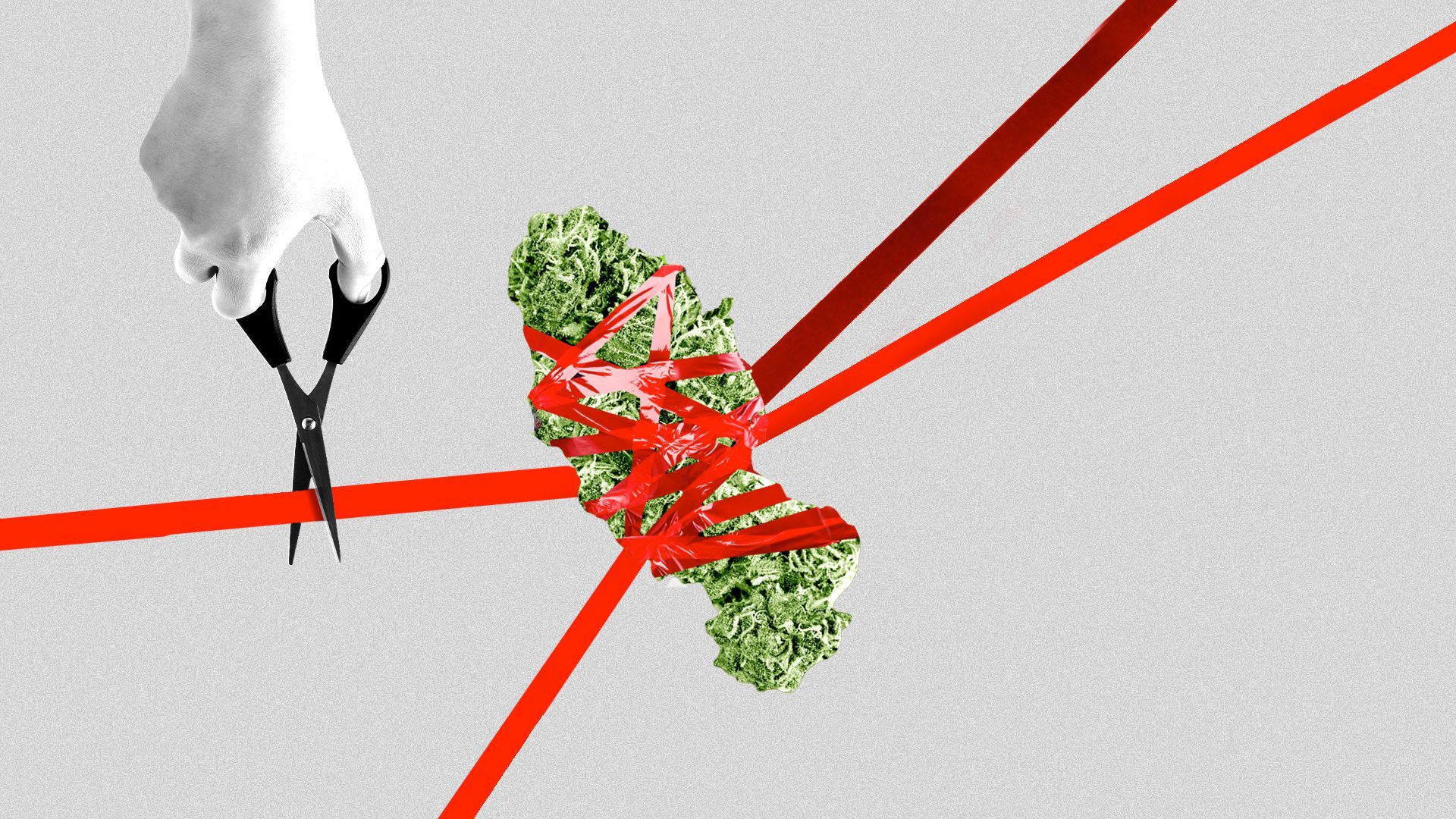

Illustration: Aïda Amer/Axios

The cannabis industry is poised to undergo another major change as Colorado's House Bill 1090 takes effect next month, providing investment opportunities for publicly traded companies, venture capitalists and private equity firms, which were previously barred.

Why it matters: The law will push cannabis into a new phase of development and foster considerable consolidation in the industry, creating new businesses and driving out others.

- Wall Street, venture capital funds and private equity firms will now have the opportunity to enter a fast-growing industry and provide the funds to scale at a new level.

- "We are moving to a national, even international economy in marijuana," Jim Burack, director of the Colorado Department of Revenue's Marijuana Enforcement Division, tells Axios.

The big picture: Colorado is opening up right as investors have begun to sour on publicly traded pot stocks, which have seen their once massive valuations cut in half over the course of the year.

- "There was too much exuberance and froth in the markets," Emily Paxhia, managing director at cannabis investment firm Poseidon Asset Management, tells Axios.

- "Anyone who was prudent about valuing the market saw this coming from 10 miles away. Now there will be a shift to operational efficiency in many of these businesses. That's a healthy innovation for any market."

Between the lines: While Canadian companies like Aurora Cannabis and Canopy Growth have drawn massive valuations, investors have been eager to find a way into the U.S. market, which has a much larger and richer consumer base.

- Investors will now have access to a U.S.-based mature marijuana market that includes businesses ranging from restaurants and property development to advertising and wellness.

Yes, but: The industry's growth prospects remain restricted by the fact that it is federally illegal, making many traditional avenues for growth impossible.

Still, Colorado's deregulation of the industry and the potential for access to banking services through the SAFE Banking Act, which recently passed the House of Representatives, could be game changers.

- The new law "opens up funding opportunities that we have really not had available to us before," Nancy Whiteman, CEO of edibles company Wana Brands, tells Axios.

- "Having more and more cannabis companies that are operating in multiple states and some of them with very large, deep pockets, it's changing a lot about how the industry operates."