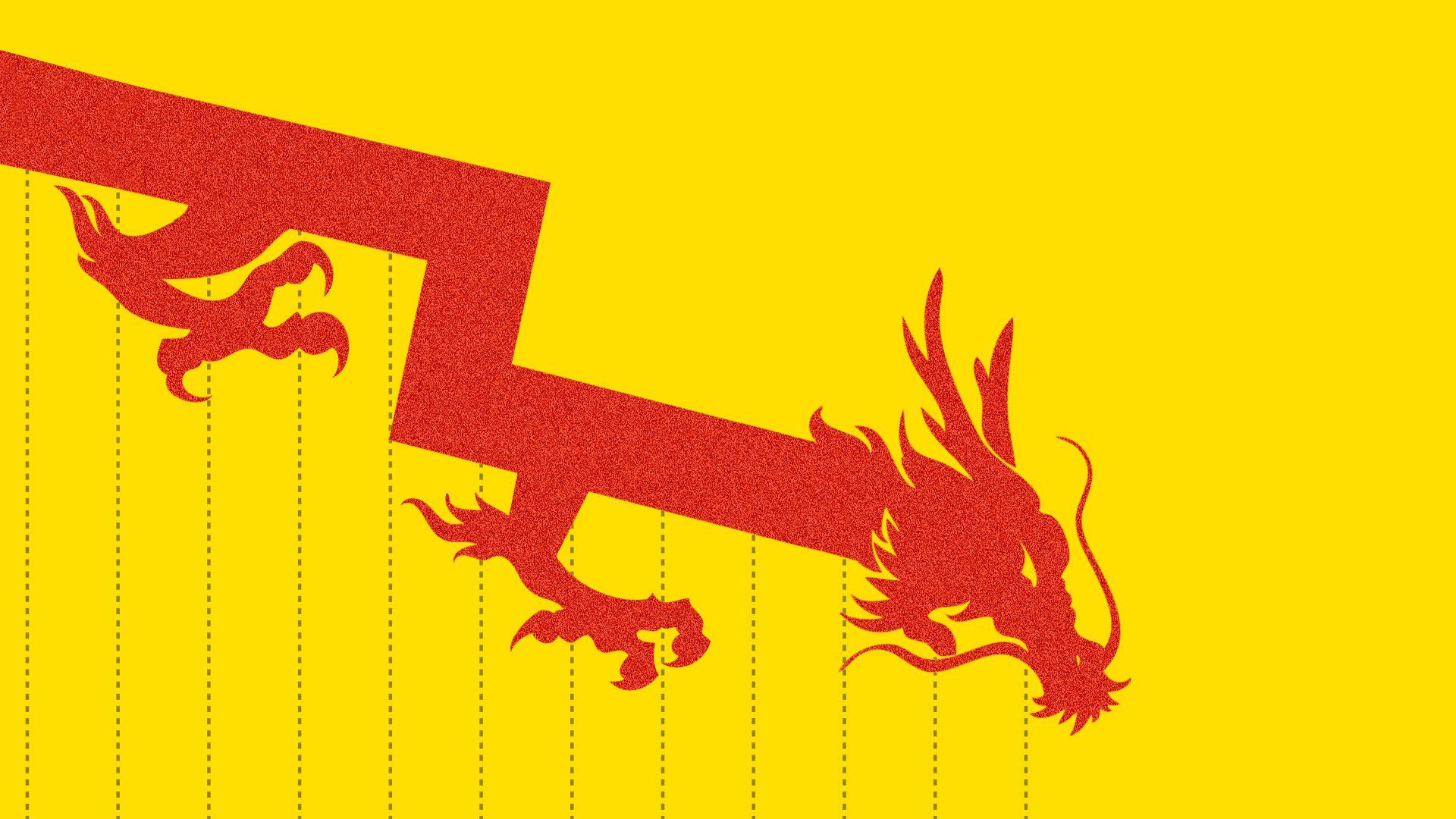

China's unclear economic outlook

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Rebecca Zisser/Axios

China's year-end economic data dump presented an ambiguous picture of the world's second-largest economy that analysts chose to paint in various ways by cherry picking data points.

The big picture: When taken as a whole, the data reflects an economy that could be slowing or could be slowly turning from one driven by high-flying export growth to one sustained by a consumer-focused, service sector that Chinese government officials have declared they want.

What they're saying: Some have been ringing the alarm of an economic slowdown in China, pointing to historically weak readings.

- China's economy expanded 6.6% in 2018 — the slowest annual pace the country has seen since 1990.

- In the fourth quarter, GDP growth came in at 6.4% year-over-year, the slowest since 2009.

China's government has long been accused of padding the numbers on economic data, and some expect that weak readings like these are proof that the country's real economy is actually growing much more slowly.

Yes, but: Also included in the data dump are a collection of strong data releases that don't fit the falling dragon motif.

- China's industrial output rose 5.7% year-over-year in December, more than the 5.3% economists were expecting.

- Fixed asset investment rose 5.9% year-over-year, nearly matching economists' predictions of 6%.

- Retail sales data rose 8.2% in December, up from November's 8.1% gain.

- Production in high-tech industries, strategic emerging industries and equipment manufacturing expanded 11.7%, 8.9% and 8.1%, respectively.

What to watch: For U.S. businesses, a clearer picture of what's happening could come this week when companies with significant revenue from China — including Starbucks, Wynn Resorts and Ford — report quarterly results.

Go deeper: Other companies are feeling the heat in China's slowing market