Charles Schwab earnings point to trouble for zero-fee brokerages

Add Axios as your preferred source to

see more of our stories on Google.

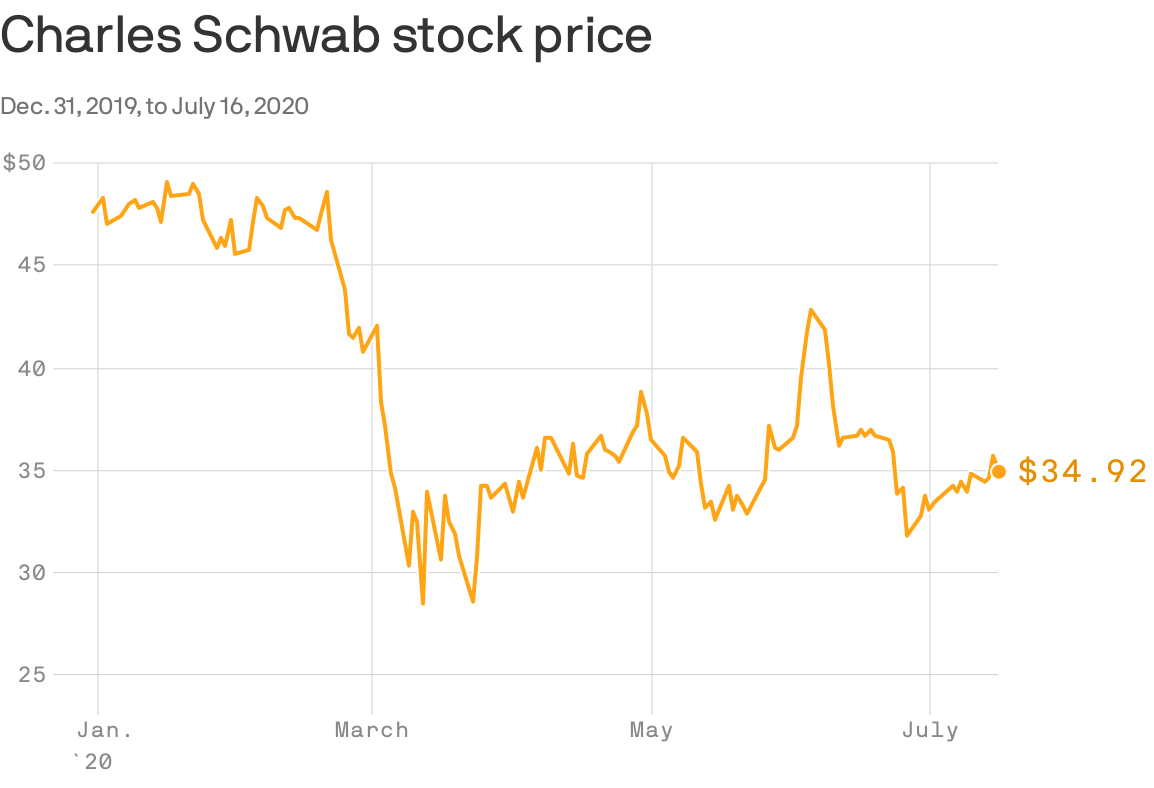

Brokerage firm Charles Schwab's earnings report Thursday sent the company's stock down more than 2%, but the numbers in the report also called into question the sustainability of the zero-fee model it has pioneered.

What's happening: Schwab now manages a record $4.11 trillion in client assets from 14.1 million accounts, having added 1.62 million new clients during the quarter, but still managed to see weak revenue and net income numbers.

- Net income for the first half of 2020 fell 23% to $1.46 billion, down from $1.9 billion a year earlier.

- Revenue dropped 9% to $2.45 billion from $2.62 billion in the first quarter and $2.68 billion in Q2 2019, according to CNBC.

Flashback: In an effort to take on upstarts like Robinhood, Schwab slashed its trading commissions to zero in October, forcing then-rivals E-Trade, Interactive Brokers and TD Ameritrade to follow suit in a matter of weeks.

What they're saying: "As the impact of the Fed’s dramatic monetary easing during March extended across the yield curve, the further compression in asset returns outweighed growth in client cash sweep balances from both ongoing asset gathering and the USAA acquisition," Schwab CFO Peter Crawford said.

Yes, but: The Fed has said it expects to keep interest rates low through at least 2022 and many asset managers expect rock-bottom interest rates and anemic inflation even after that.

- Schwab also acquired USAA’s brokerage portfolio for $1.8 billion in May and is undergoing Department of Justice antitrust review for its purchase of TD Ameritrade.

What to watch: If Charles Schwab is making less money after increasing its assets under management to $4.11 trillion and adding 1.6 million clients, how can any online brokerage increase profits under the zero-fee model?