At G20, oil kingpins try to fix a new fiasco

Add Axios as your preferred source to

see more of our stories on Google.

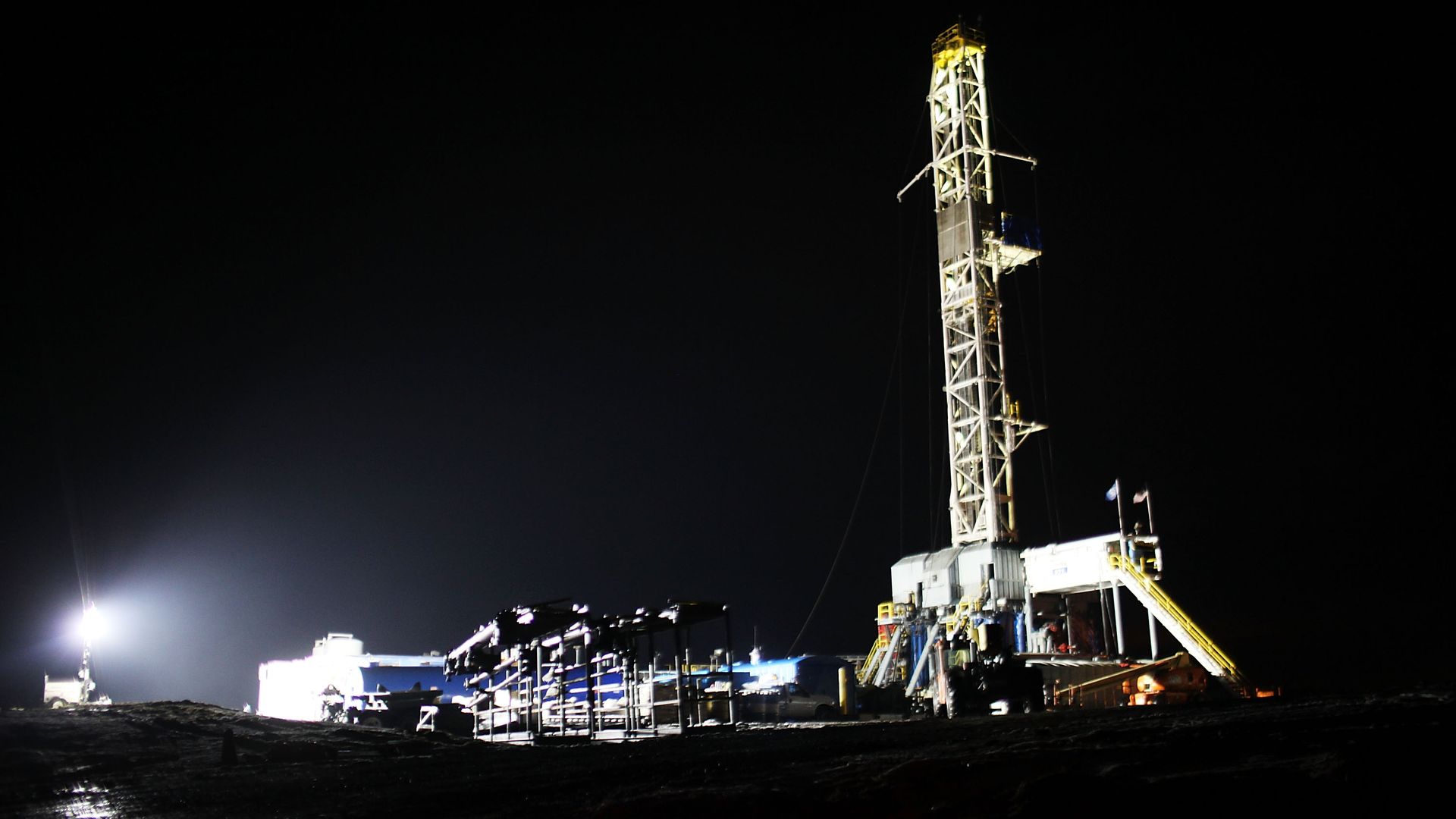

Springville, Pa. Photo: Spencer Platt/Getty

Yet again, energy experts have gotten the oil market wrong: Less than two months ago, Brent crude was about $86 a barrel, and the talk was a certain return to ultra-profitable $100 oil. Today, Brent closed at $58.68, down 31% from the peak, after the industry's worst two months in a decade.

Oil's biggest kingpins are now at the G20 summit in Buenos Aires, where they will try to set things right. But if they can't — for reasons including pressure from President Trump and their own divisiveness — look for a renewed bloodbath in oil, with danger for the world's petro-states and numerous other industries.

What's going on: In oil and gas, the last decade has been an almost farcical series of bad calls — starting in 2008 with an oil price spike to $147 a barrel and a consensus that the era of low prices was over because of a fossil fuel shortage.

- Instead, shale oil and gas came along and, by 2014, the U.S. was suddenly awash in both.

- That was depicted as incredibly good news for the U.S., a platform for the U.S. to enter an industrial renaissance.

- Instead (another bad call) prices went into a tail spin, finally crashing below $27 a barrel. The carnage included dozens of oil company bankruptcies, a mini-recession for several industries, and hundreds of thousands of job cuts.

"Analysts always tend to extrapolate current trends and miss turning points."— John Kemp, senior energy analyst at Reuters, to Axios

In the latest chapter of this bad run of forecasting, analysts and traders watched as oil prices marched back over $80 a barrel in the last week of September, and most determined that that was the new normal. Except, as traders crowed at a big industry conference in Singapore that month, $100-a-barrel oil would be back soon, breaching a threshold that, during the rough patch, no one thought would ever be crossed again.

Instead, we have an eight-week-long crash of prices:

- In a report today, the U.S. Energy Information Agency said that, for the fourth straight month, U.S. oil drillers have produced record volumes, reaching almost 11.4 million barrels a day, almost 2 million higher than a year earlier.

- The August and September year-on-year additions are the largest in almost a century.

- Astonishing fact: For the first time since 1948, U.S. net oil imports will drop to zero next year before stabilizing at about 320,000 barrels a day, analysts say.

As usual, analysts cite a dozen reasons why they could not possibly have averted being blindsided, even though that's what the oil game is all about — avoiding being blindsided.

What they missed:

- That Trump would grant a slew of sanctions waivers to buyers of Iranian oil, rather than forcing much of it off the market immediately, said Amy Jaffe of the Council on Foreign Relations. Nor that Saudi — itself expecting Iran to be exporting relatively little — would pump a record 11.1 million barrels of oil a day.

- That shale drillers would continue their deluge — a whopping 5 million added barrels of oil including this year and next.

- That the global economy would slow: Barclays gives a 20% to 25% chance of a U.S. recession by the end of next year, and 25% to 40% in 2020, says Michael Cohen, head of energy markets research.

What's next: OPEC is to meet next week in Vienna to discuss a production cut. But the real game is in Buenos Aires, where the most powerful men in oil — Russia's Vladimir Putin, Saudi Arabian Crown Prince Mohammad bin Salman, and, because of the power of his tweets, Trump — at the G20 summit.

Saudi for one needs $73-a-barrel oil to finance the national budget, according to the IMF. Putin, with a break-even of $40, will go along with a cut because he is seeking Saudi investment in Russia, said Scott Modell, head of Geopolitical Risk at Rapidan Energy.

- In a meeting today, an OPEC advisory committee suggested a 1.3-million-barrel-a-day cut. That is precisely the 2019 oil surplus projected by the International Energy Agency, but it may be more — in a recent note to clients, for instance, Helima Croft at RBC, forecast a 1.4 million-barrel-a-day surplus next year with no cuts.

The worst off in a sustained low-price era, Modell said: Venezuela and Nigeria.