SEC seeks to cut LBRY fine by 99%

Add Axios as your preferred source to

see more of our stories on Google.

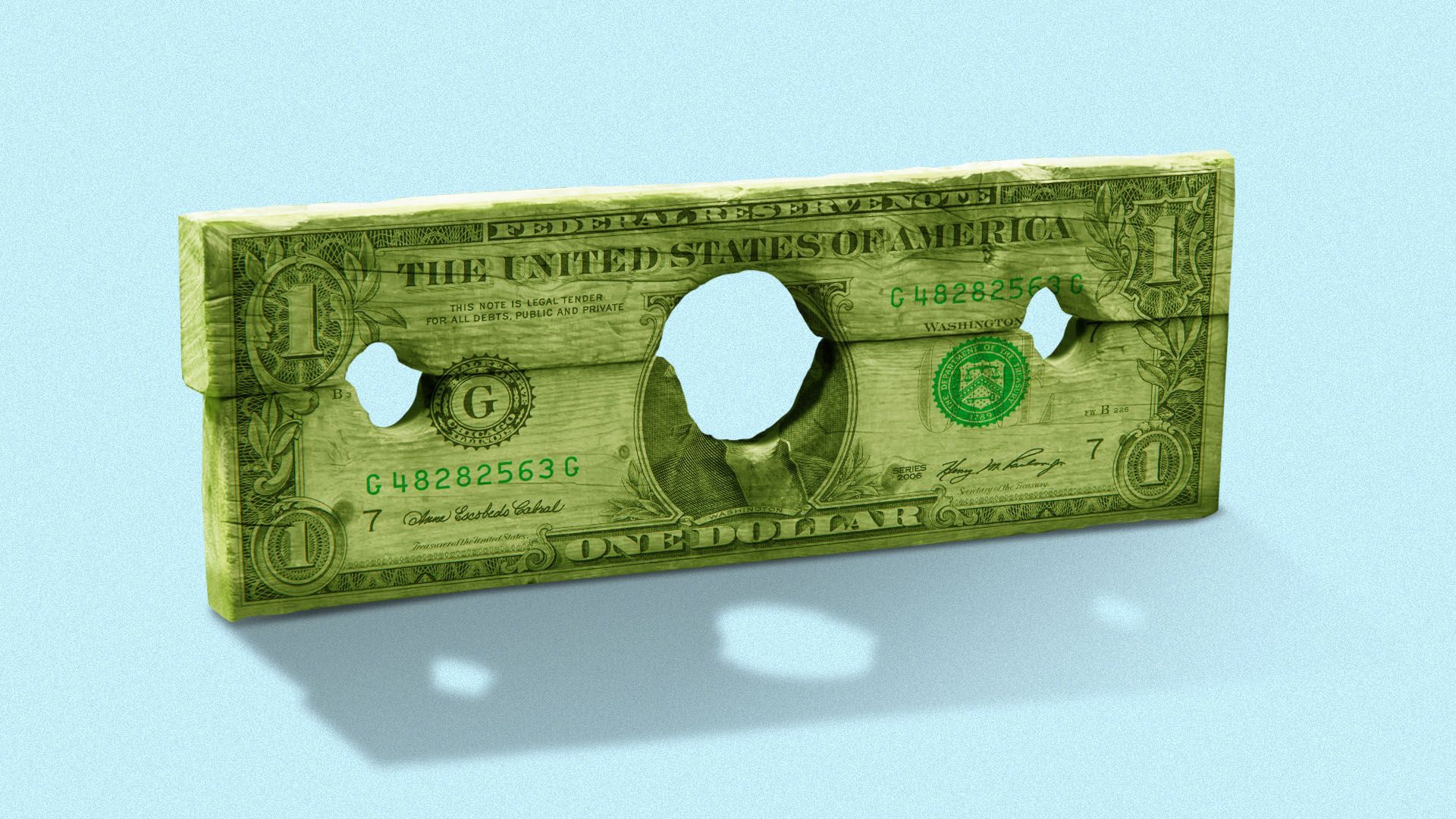

Illustration: Sarah Grillo/Axios

A top U.S. regulator is amending its previous complaint against LBRY, cutting the fine imposed against the crypto firm by more than 99% — but don't call it a "win" for the sector.

Details: The Securities and Exchange Commission cited "ability to pay" and LBRY's inevitable shuttering in lowering the fine, though the company argued in court that the original $22 million was comparatively larger than others' also caught in the regulators' crosshairs over similar offenses.

- The SEC wants to reduce the fine to roughly $111,000, a court document filed Friday shows.

Context: New Hampshire-based LBRY is a content-sharing blockchain that endeavors to be a decentralized database that can't be controlled by a single entity.

- The SEC charged it with conducting an unregistered securities offering in selling its native LBC tokens to investors, including those in the U.S., in March 2021.

- LBRY CEO Jeremy Kauffman has taken a Ripple-like posture against the complaint, maintaining that LBC tokens were not securities.

The intrigue: The SEC also wants the court to stop the company from offering LBC until all of the tokens are destroyed and the firm shutters.

What they're saying: "The time before LBRY dissolves may prove to be the time of greatest risk of further violation — a cash-strapped defendant who knows that it will cease to exist as a legal entity may have a sense of impunity and be more likely to violate the securities laws during that time," the SEC said.

- LBRY did not respond to Axios' emailed query for a statement.