Warnings appear in household finances

Add Axios as your preferred source to

see more of our stories on Google.

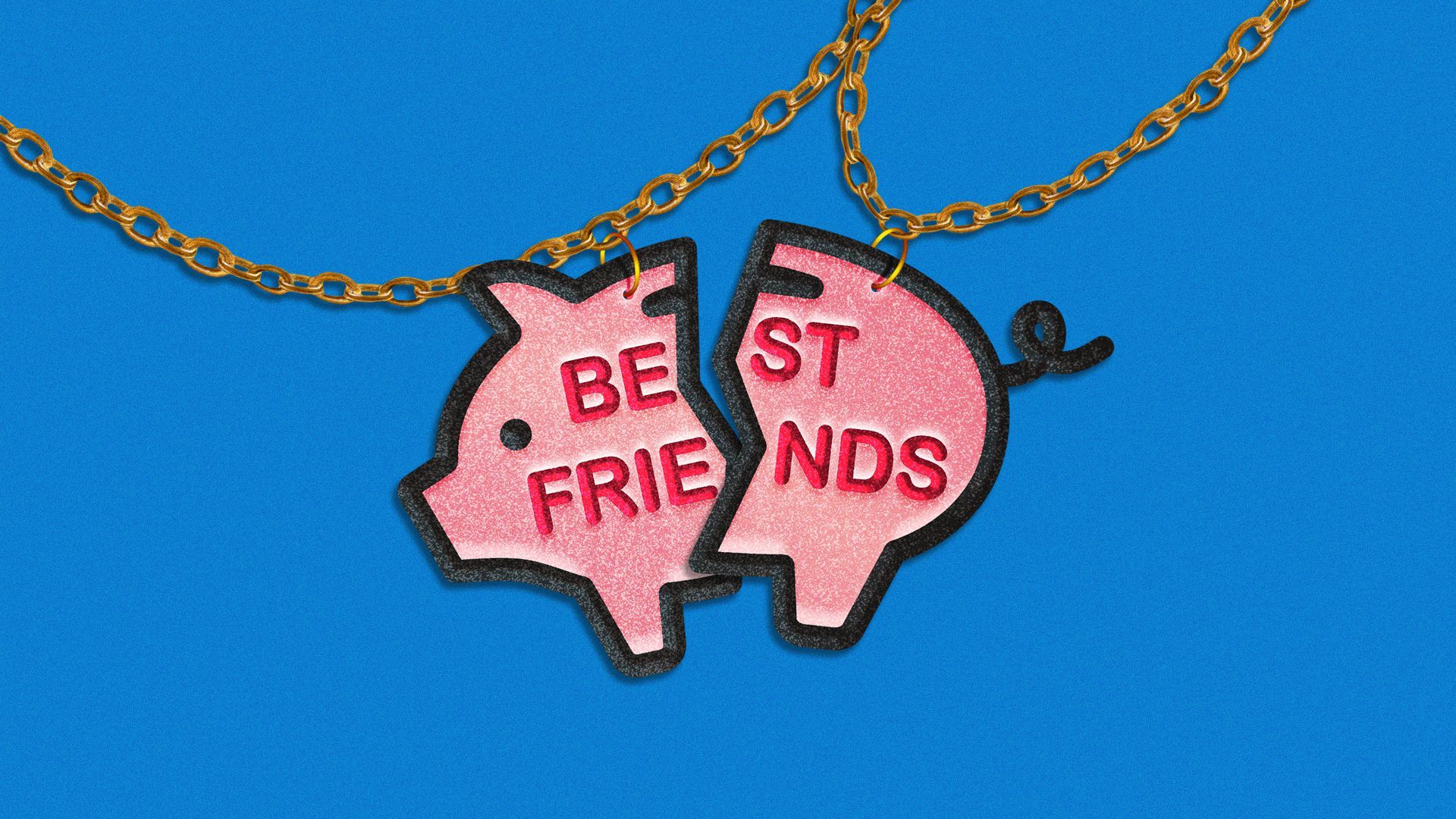

Illustration: Maura Losch/Axios

New data gathered from America's households raises some red flags as to just how well people are dealing with inflation.

Why it matters: Positive corporate earnings reports and robust consumer spending have prompted many to conclude that, despite skyrocketing inflation, the American consumer is doing just fine.

- Yes, but: A recent survey by the Census Bureau raises questions as to how sustainable that spending is — and just how vulnerable many Americans may be as their pandemic savings and other sources of cash run out.

State of play: The Household Pulse Survey, covering March 30 to April 11, is based on 63,769 responses.

- The findings show a 32% increase in those saying they were relying on credit cards and loans to meet their spending needs.

- By contrast, the amount of people who could cover their spending from regular income sources — "like those received before the pandemic" — grew at a much slower rate, up 5% from last year, according to the data.

Meanwhile: More than 1 in 10 adults reported tapping loans from friends or family to meet spending needs, a 34% increase from a year ago.

- This trend has disproportionately affected Black Americans, Bloomberg noted today, with 1 in 6 now relying on friends and family compared to 1 in 9 last year.

Quick take: Some of that borrowing is effectively just Millennials (age 26-41) taking IOUs from Boomers (age 58-76). Nothing to see there.

- But the year-over-year increase points to a collision between inflation and a generation weighed down by larger student loans and the long-term effects of suffering through a poor job market for a significant portion of their careers.

- The Bloomberg report noted that although Millennials lead almost as many households as Boomers, they hold about one-eighth the wealth.

The bottom line: U.S. consumers' ability to shrug off inflation has a shelf life — and we may be nearing the end of it.