China moves to contain property defaults

Add Axios as your preferred source to

see more of our stories on Google.

With defaults stacking up in China’s property sector, Beijing has stepped in more forcefully to contain the damage.

Catch up fast: The Chinese government is loosening the flow of credit. It recently cut reserve requirements for banks and has asked the banks to provide more loans to property developers. To encourage M&A, it declared that loans backing such deals won’t be subject to the “three red lines” test that effectively froze lending to property developers.

- The government has also asked banks to speed up the mortgage approval process for consumers that want to buy properties from cash-starved developers.

Why it matters: Ever since China Evergrande, the largest and most distressed developer of the bunch, started hinting at default this past fall, the biggest question for markets was how much of the sector will be engulfed in the crisis.

- “I don’t think the policymakers want to see more and more Evergrandes coming out … The government is trying to break the vicious cycle by starting to ease [policy], and stabilize the sector,” Tracy Chen, fixed income portfolio manager at Brandywine Global Investment Management, tells Axios.

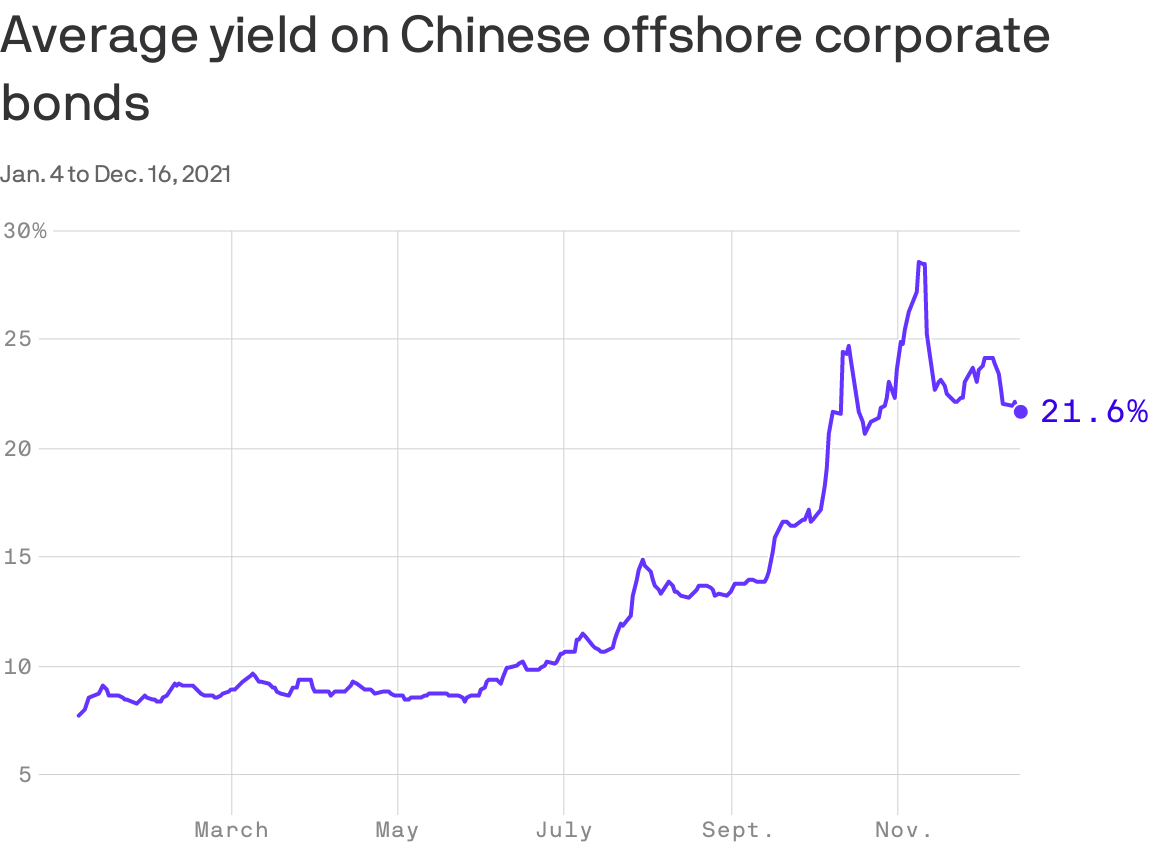

State of play: High-yield-rated developers are still locked out of the offshore bond market by virtue of sky-high yields. But the freefall in bond prices appears to be over — yields have stopped climbing and have begun to move the other way, ICE BofA index data show.

The big picture: Policy support or not, the sector is still a minefield for investors. Reports of hidden off-balance sheet debts, as well as corporate governance concerns stoked by inter-company deals, have investors primed for more surprises, Chen says.

The bottom line: The property sector accounts for about a quarter of economic activity in China, while housing is about 70% of individual wealth held by the Chinese. It's "too important for policy-makers not to ensure its well-being," Chen adds