Dec 16, 2021 - Economy

Private equity giant TPG files for an IPO

Add Axios as your preferred source to

see more of our stories on Google.

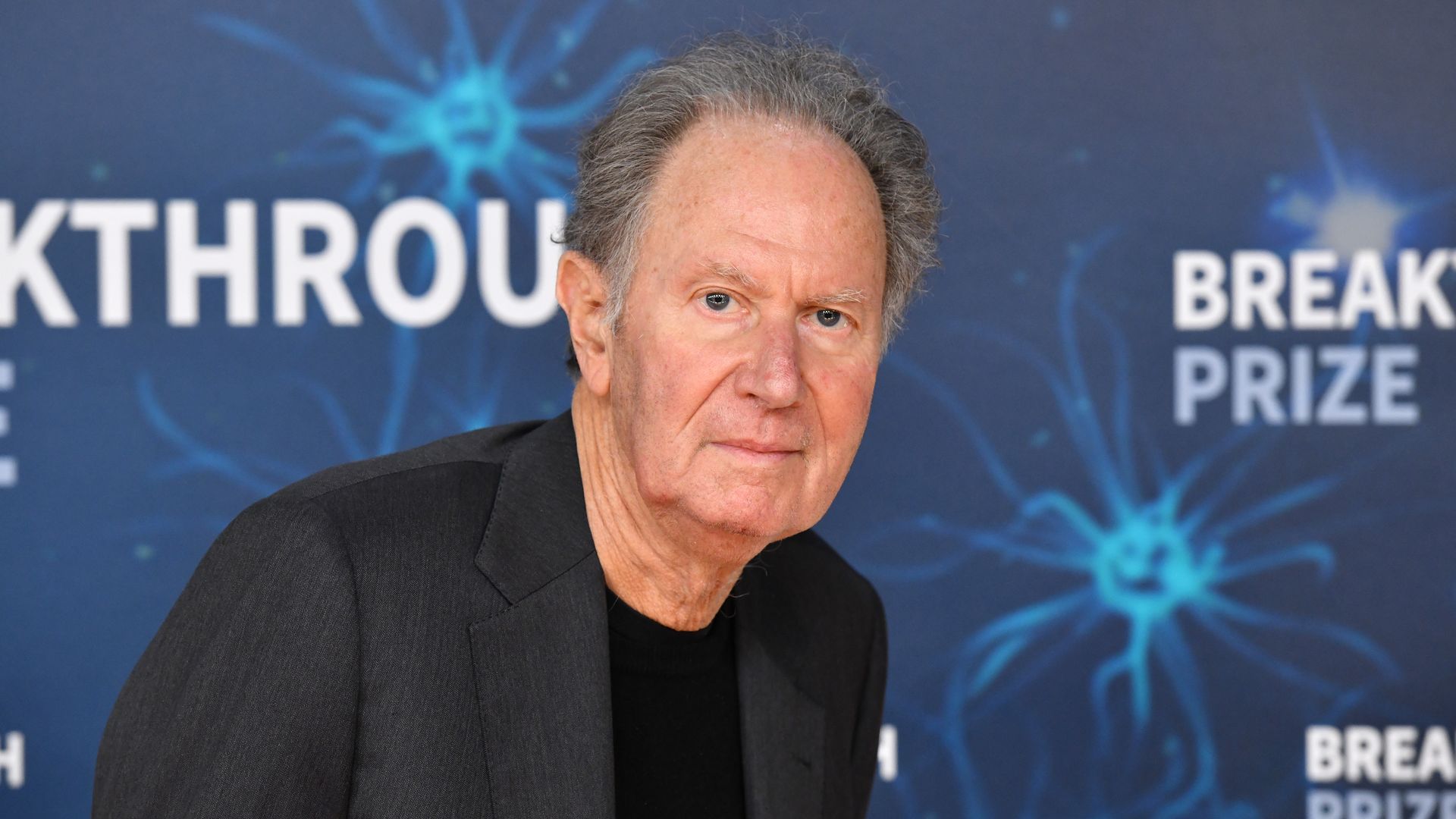

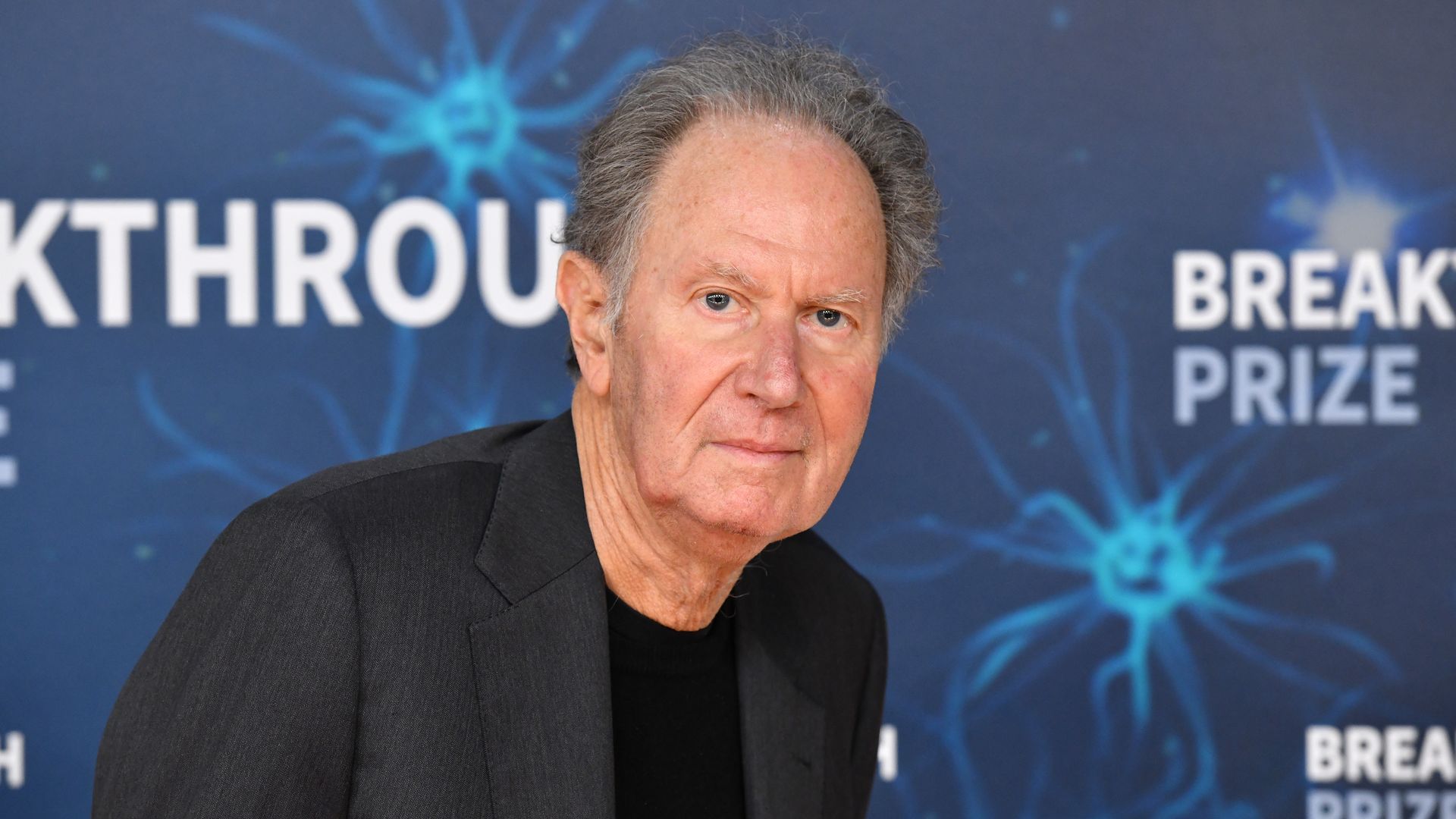

TPG co-founder David Bonderman. Photo by Ian Tuttle/Getty Images for Breakthrough Prize.

Add Axios as your preferred source to

see more of our stories on Google.

TPG co-founder David Bonderman. Photo by Ian Tuttle/Getty Images for Breakthrough Prize.