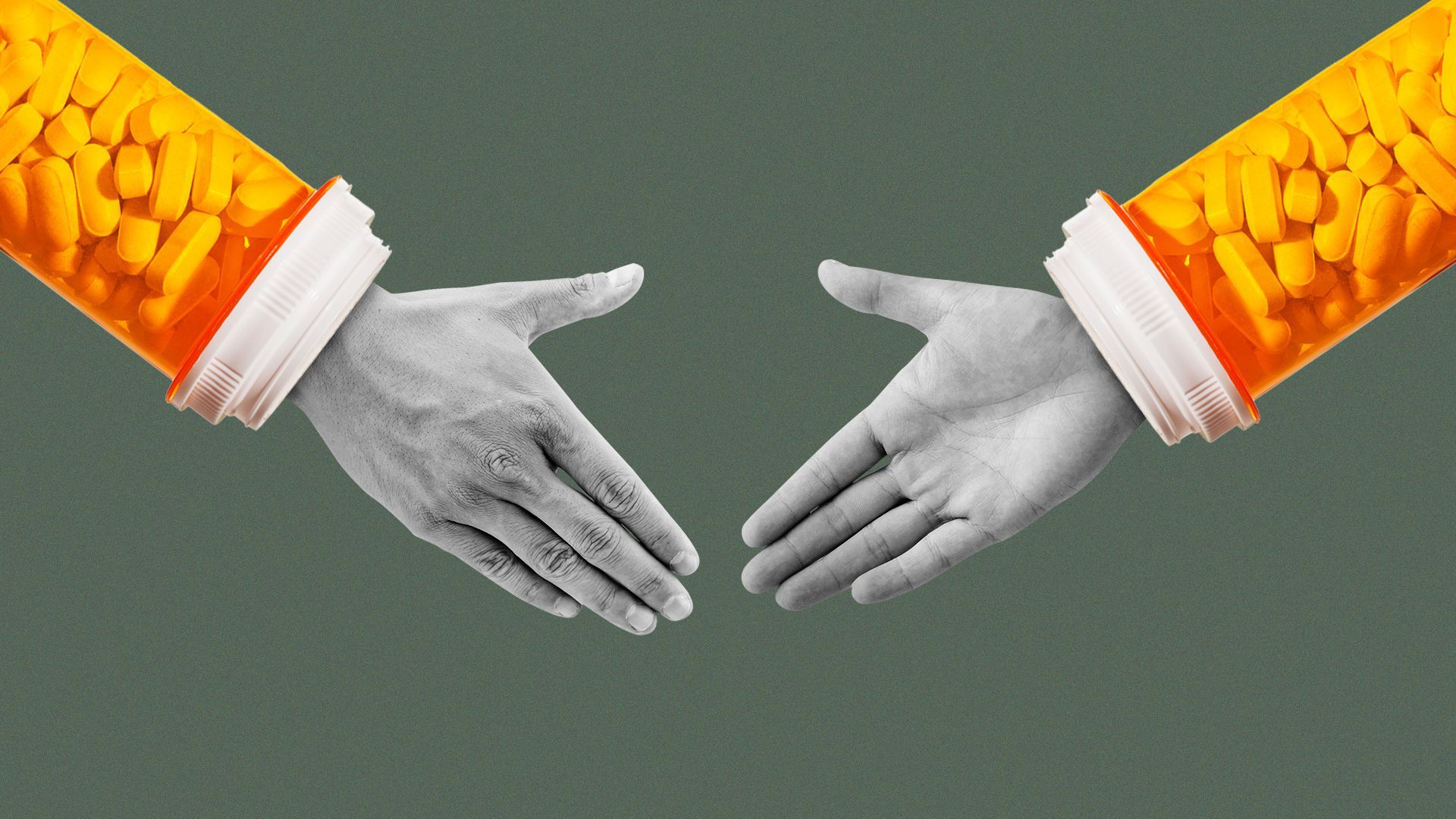

Pharma mergers are heating up

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Shoshana Gordon/Axios

The pharmaceutical industry is sitting on a lot of cash and is ready to make big deals.

The big picture: Drug companies completed smaller deals during the pandemic and instead built up their cash reserves. But the prospect of federal legislation that could allow Medicare to set some drug prices and looming patent expirations will motivate many companies to start spending their pandemic windfalls.

Driving the news: CSL, a drug manufacturer based in Australia, said Tuesday it is buying Vifor Pharma for $11.7 billion.

- Pfizer, sitting on tens of billions of dollars from global COVID-19 vaccine sales, said Monday it is acquiring Arena Pharmaceuticals for $6.7 billion.

State of play: These large deals are just the beginning, according to Wall Street analysts and company executives.

- 18 of the largest global drug companies will have a combined $538 billion in cash on hand by the end of 2022 and billions more in debt-financing power, according to investment bankers at SVB Leerink.

- Some companies, like Pfizer, BioNTech and Moderna, are "bolstered by a cash windfall from COVID vaccines and treatments," according to SVB Leerink.

- Pfizer plans "to be very active in dealmaking, and we certainly have the ability to do that," Pfizer executive Aamir Malik said on an investor call to discuss the Arena acquisition.

Between the lines: The massive reserves, which also were boosted due to the Republican tax overhaul, will likely lead to larger acquisitions or possible pharma mega-mergers that haven't been seen since 2019.

What to watch: The deal-heavy JPMorgan health care conference is next month, so more deals could be imminent, or big M&A plans will be formulated there.