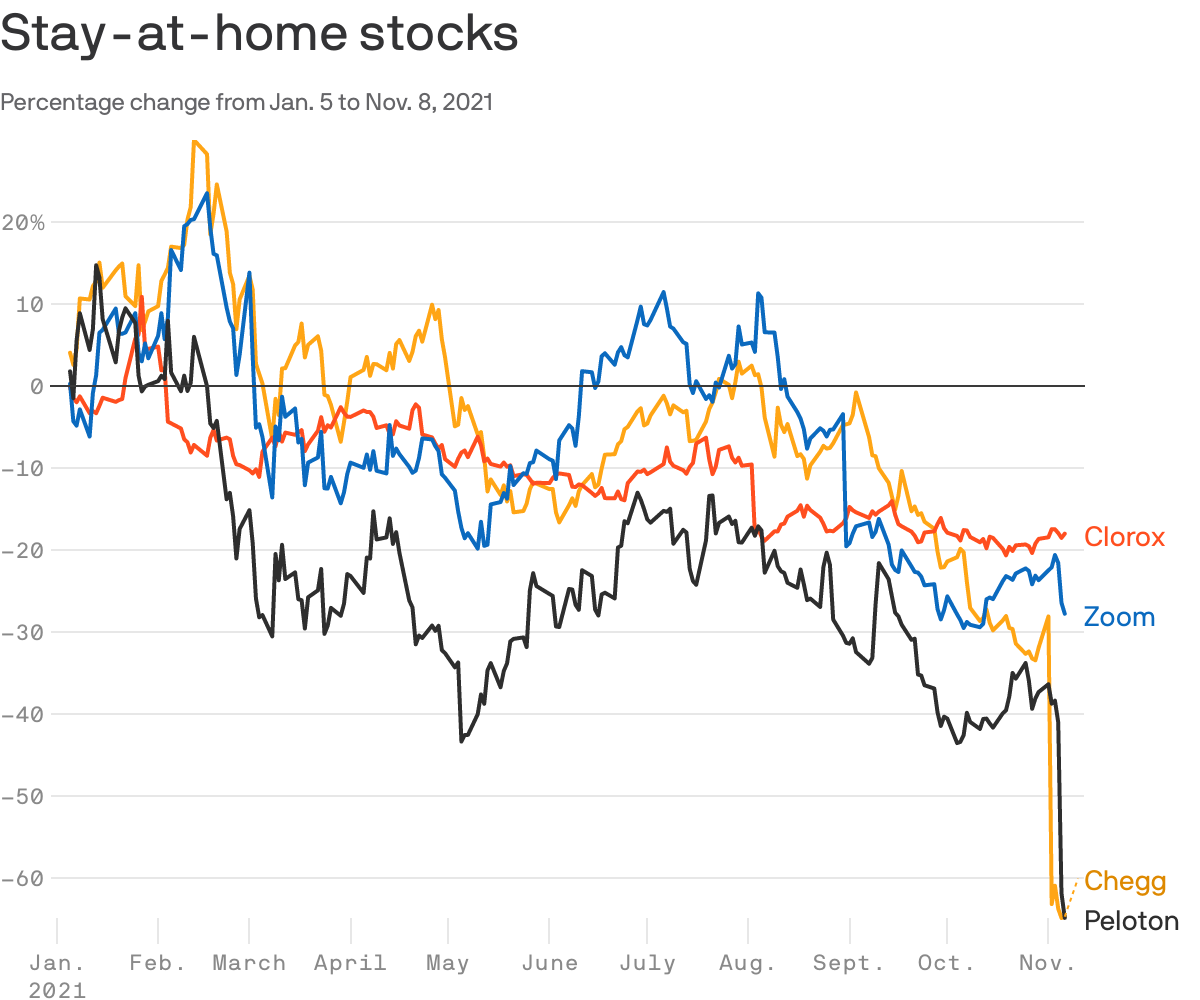

Stay-at-home stocks are imploding as the world reopens

Add Axios as your preferred source to

see more of our stories on Google.

Stocks are at all-time highs. Onetime pandemic-era winners are moving sharply in the other direction.

Why it matters: Stocks move for all types of reasons. But the declines reflect a shift that's sticking: At-home workouts and remote learning are out. Travel and gyms are in.

What's happening: "Folks are saying, 'Hey you know, I'm going back to the office two days a week, perhaps I should go back to my old gym routine,'" says Ross Klein, a fund manager at Changebridge Capital, which is invested in gym chain Planet Fitness.

What's new: As the world makes bigger reopening strides, stay-at-home companies are issuing fresh warnings that the good times are behind them. The former "losers" say recovery has arrived.

- Take Peloton, which said last week the average number of times users work out with their at-home equipment each month fell again — a sign people are returning to gyms (or opting not to work out at all).

- That same day, Planet Fitness reported the best quarterly member growth it's ever seen this time of year. Its stock hit a record high; Peloton's shed over a third of its value.

The bottom line: Investors are figuring out whether the lockdown winners will "have the sales in the future they had when people couldn't do anything else," says Cole Smead, a portfolio manager at Smead Capital Management.

- Online education platform Chegg is among the latest to signal the answer is no: It warned sales will take a hit as students return to classrooms.