Maybe we can ignore inflation expectations

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Sarah Grillo/Axios

Just because we expect inflation to show up, doesn't mean it will. That's the message from an important new paper throwing cold water on a central tenet of monetary economics.

Why it matters: The Fed hikes interest rates when — and only when — it thinks inflation is otherwise going to be too high. That means it needs a formula to determine where it thinks inflation is going to be. But now a senior Fed economist is saying that the key ingredient in that formula "rests on extremely shaky foundations."

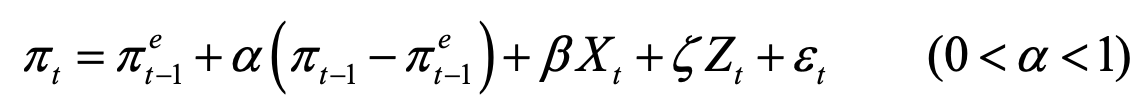

How it works: The Fed's main formula can be intimidating — it's at the bottom of this piece, for the econ nerds among you. But translated into English, it effectively says that actual future inflation is equal to expected inflation, adjusted by a few variables associated with things like unemployment and supply shocks.

- The catch: There's no empirical reason to believe that inflation expectations play a central role in driving observed inflation.

The big picture: If inflation expectations fed into actual inflation, it would be easy to construct a narrative as to why that might be the case. Businesses, for example, might raise their prices in order to stay ahead of expected cost increases in both materials and labor.

- Precisely because that narrative is so intuitive, however, it tends to be embraced even when inflation expectations have consistently outpaced observed inflation for decades.

Driving the news: An important new paper from Fed economist Jeremy Rudd systematically dismantles all the reasons inflation expectations play such a central role at the Fed.

- "Using inflation expectations to explain observed inflation dynamics is unnecessary and unsound," Rudd writes. "Invoking an expectations channel has no compelling theoretical or empirical basis."

Between the lines: As former Fed economist Claudia Sahm notes, Fed chair Jay Powell was talking about the central importance of inflation expectations as recently as last week. ("Our framework for monetary policy emphasizes the importance of having well-anchored inflation expectations," he said.)

The bottom line: It's unlikely that a single paper is going to change the board's mind on something so important. But Rudd's research does serve the purpose of encouraging the Fed to spend much more time looking at observed, rather than expected, inflation.

Bonus...The Fed's formula for forecasting inflation is a doozy...