Aug 30, 2021 - Economy

What economists expect from the August jobs report

Add Axios as your preferred source to

see more of our stories on Google.

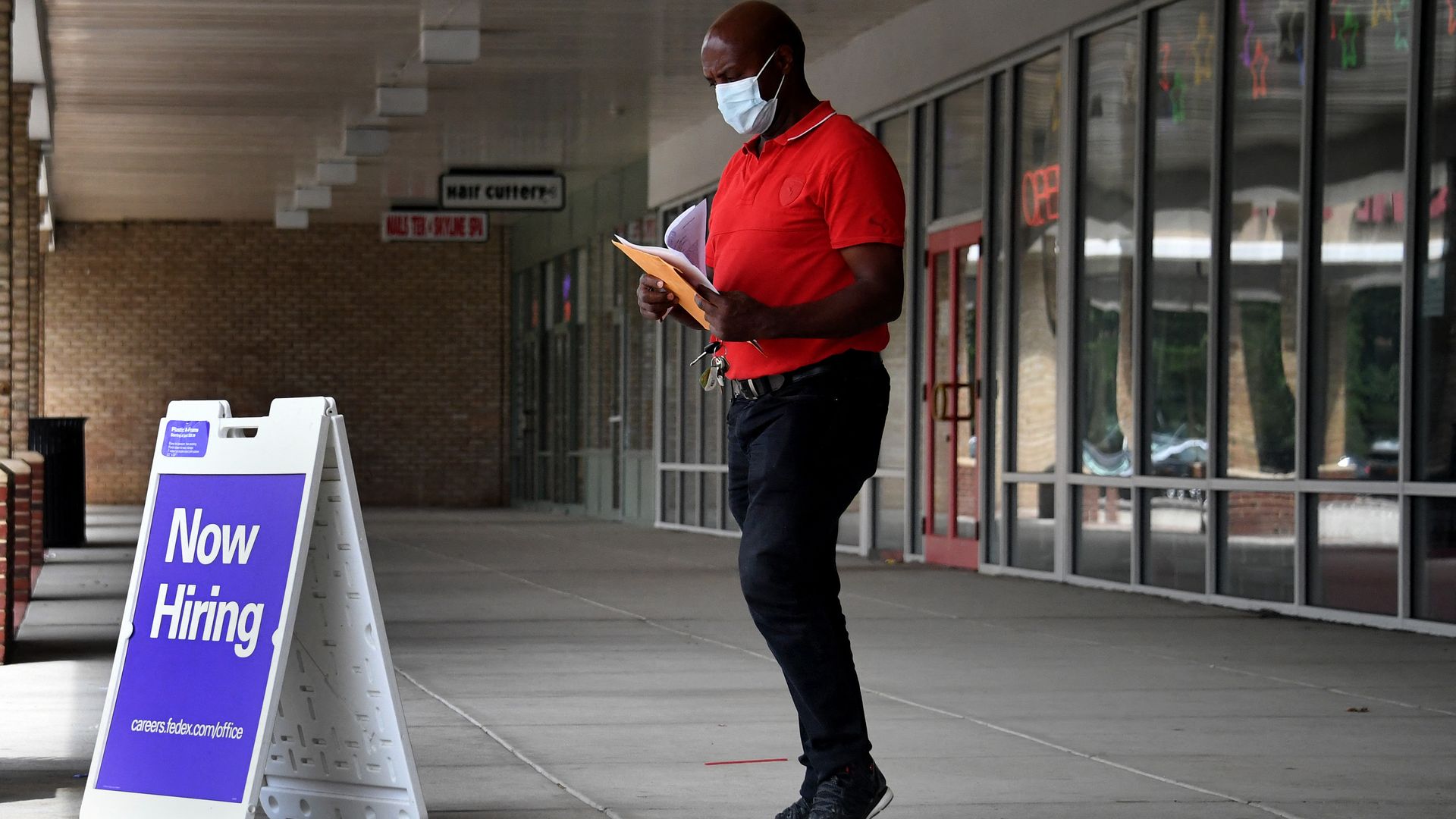

A man walks by a "Now Hiring" sign outside a store in Arlington, Va. Photo: Olivier Douliery/AFP via Getty Images