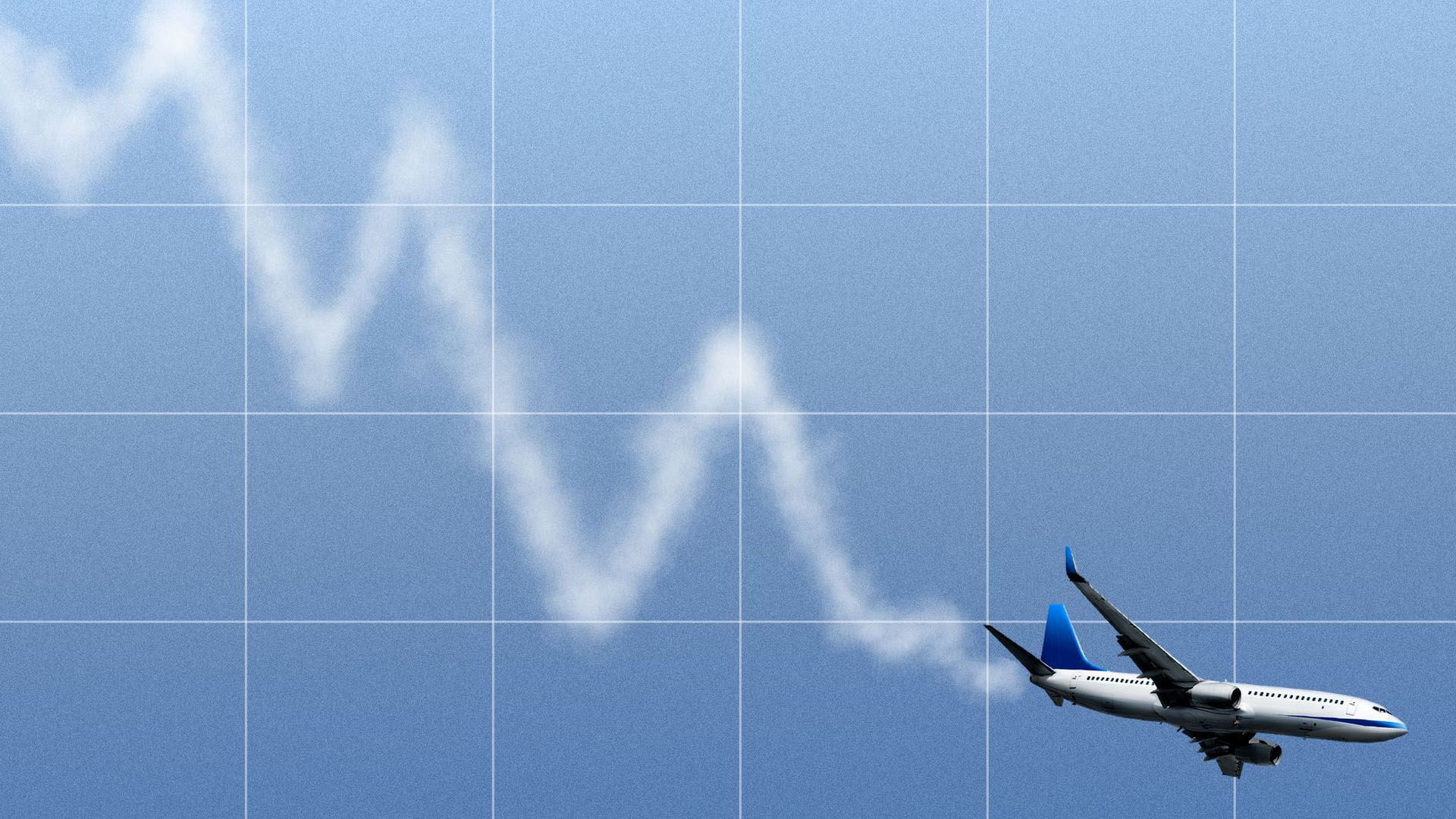

Travel spending softens

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Sarah Grillo/Axios

Credit card transaction data suggest the recent surge in COVID-19 infections is starting to impact parts of the economy.

Why it matters: The economy’s been on a robust upward trajectory, generating almost a million jobs in July alone.

- The big unknown is how much the spread of the Delta variant could derail that recovery.

What they’re saying: Looking at Chase debit and credit card transaction data, JPMorgan economist Jesse Edgerton observed spending in travel and entertainment softened in early July as infections accelerated.

- "Most notably, airline spending has fallen almost 20% from a recent peak in mid-July, a larger decline than during the severe winter COVID wave, when spending was at much lower levels," he wrote on Friday.

- Bank of America saw a similar pattern in its own debit and credit card data.

- "The slowing in air travel is not just a story for this week: the 2-year growth rate of air travel peaked four weeks ago and has taken a turn lower, potentially reflecting the risks from the Delta variant," the bank wrote on Thursday.

Zoom out: This is just one category of spending. In fact, Bank of America card spending levels for the week ending July 31 were 10% above 2019 levels.

What to watch: The details of the July retail sales report bear watching when they’re released on Aug. 17 for further clues about which categories are getting hit by the rise in infections.