America's pandemic coin crunch returns

Add Axios as your preferred source to

see more of our stories on Google.

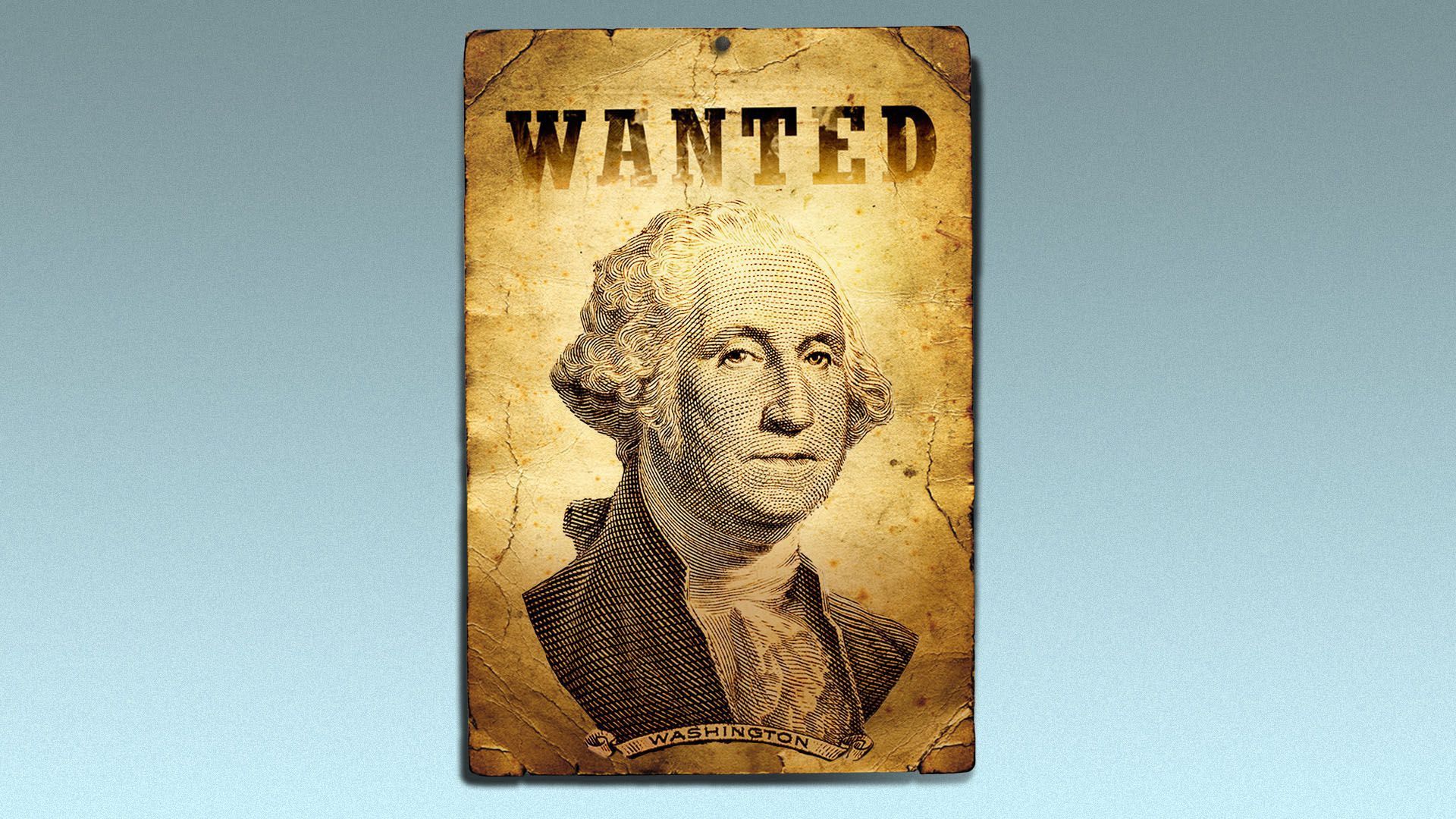

Illustration: Sarah Grillo/Axios

An early pandemic problem that plagued businesses is back: not enough change to go around.

Why it matters: The pandemic broke America's coin flow. It has repercussions for millions that rely on it for daily transactions.

Driving the news: The Federal Reserve last week began limiting how many quarters and dimes a bank can order. That impacts the number of coins that banks can offer customers (like stores).

- Of note: The limits are modest compared with those set at the height of the bottleneck last summer, which were eased earlier this year.

What's going on: Banks are ramping up coin orders. But how much the Fed has to offer is "below normal levels." Coin deposits have been falling for months.

- Why do banks want more coins? The latest stimulus checks and the economic reopening could jolt customer needs. Plus, there's a regular uptick in demand this time of year, per a Fed spokesperson.

Flashback: When people locked down en masse, change stopped flowing as more opted for digital payments. That habit may be sticking.

- Normally, for every 10 coins the Fed pushes out to banks, as many as eight end up back there — and the cycle continues.

- But only half that number were coming back during the pandemic, says Hannah Walker, who heads up political affairs at the Food Industry Association.

Where it stands: "What we don't know is have spending habits changed such that maybe there are coin orders in excess of what they need to be?" says Chris Hill, CFO of Bankers’ Bank of the West.

- Walker and Hill are part of the U.S. Coin Task Force — a group spurred by the pandemic. (Yes, they are meeting again.)

What to watch: Pushes to get spare change moving.

- It's happening in Wisconsin: North Shore Bank on Monday started offering free coin-to-cash exchanges, so it can "put those coins back into circulation," says Craig Witz, vice president of branch banking.