Playboy and the corporate future of NFTs

Add Axios as your preferred source to

see more of our stories on Google.

Photo: Frazer Harrison/Getty Images

Playboy — yes, that Playboy — has become the stock market's hottest play for NFTs with its shares jumping more than 150% since returning to public markets via SPAC on Feb. 11, even after a 20% correction over the last two days.

What's happening: Having shed its roots as a magazine dads kept hidden under their beds and rebranded as a sexual health and lifestyle brand, Playboy, now PLBY Group, is catching fire as investors look to cash in on the company's brand recognition and its future on the blockchain.

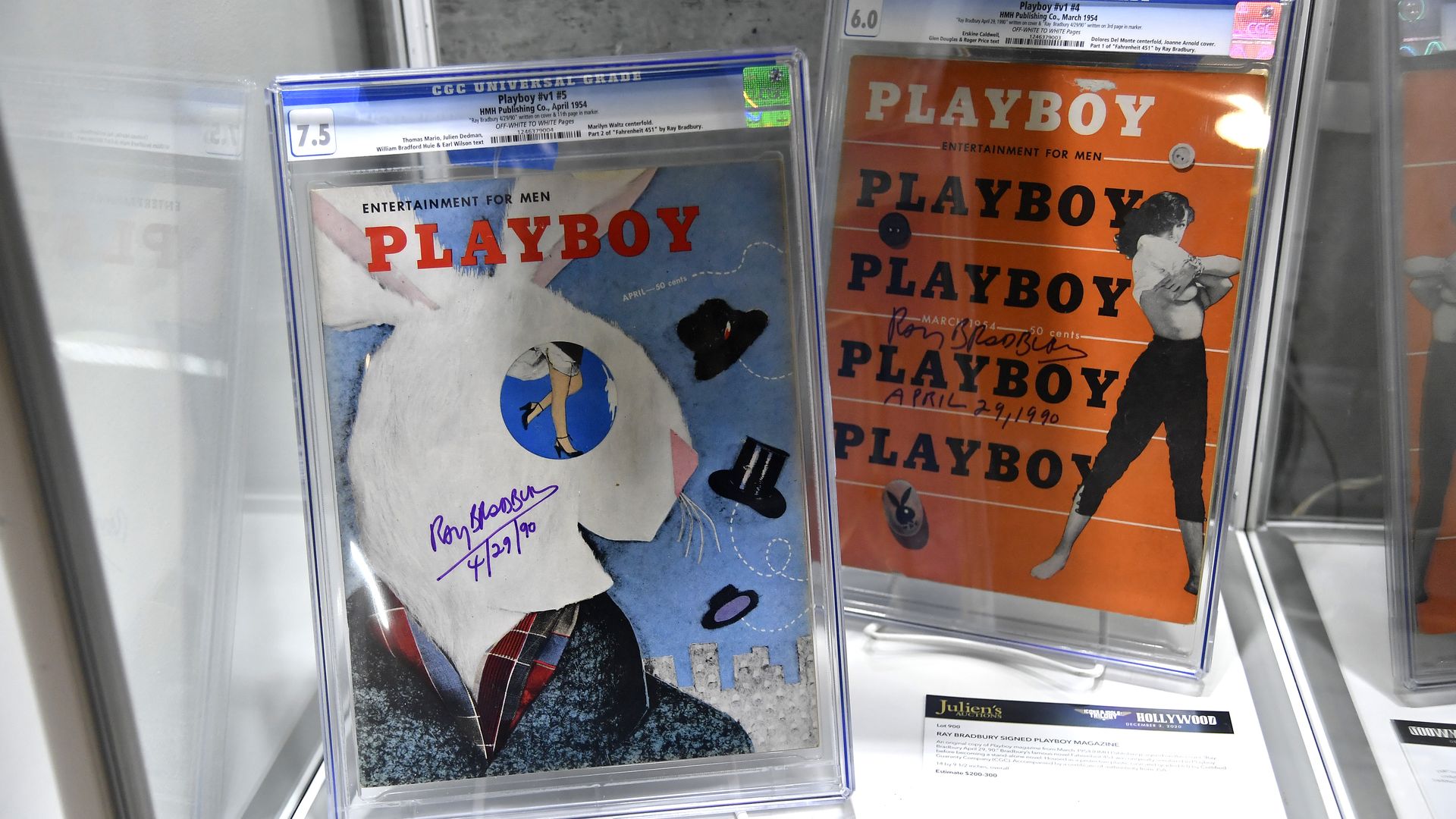

The intrigue: Playboy is working with companies like Nifty Gateway to offer fractional ownership in the company's original artwork — think the original Marilyn Monroe Playboy cover or the Kim Kardashian centerfold — as well as artwork the company has accumulated over the years and sell their digital rights as NFTs.

- The company also is shifting what it means to own an NFT — after dividing digital ownership rights into fractional shares, Playboy will retain an ownership piece that will pay the company long after the original sale.

What we're hearing: "NFTs for us are a really interesting opportunity to monetize not only new work that we would commission but really those 10 million pieces that we have in our archives plus our 5,000-piece art collection," PLBY Group CEO Ben Kohn tells me on the latest episode of "Voices of Wall Street."

- "We have a Matisse in our board conference room that John Lennon actually put a cigarette out in one night when he was in the Playboy mansion on a bender."

What to watch: Kohn's pitch is not about Playboy's ability to capitalize on the moment but on the company's ability to deploy NFTs as a long-term revenue stream that can create a brand new collector base and keep earning money from those collectors literally forever.

- "We can dictate what terms we want moving forward. ...Not only can you receive 80% of the initial sale, every subsequent sale thereafter you receive 10% of."

- "So the same thing works whether we do it with Nifty, SuperRare [digital market on Ethereum] or even on our own platform, we can create a down-market revenue stream that lasts in perpetuity."

The bottom line: Playboy's model of divvying up and selling digital rights while also retaining a partial ownership stake and holding onto physical copies and copyrights could open up new revenue streams for dozens of other companies with similarly recognizable brands.

- "The ability to monetize that over time, both through original pieces, creating new pieces, creating collages off of it, it becomes really, really interesting," Kohn says.

- "We believe for us, long term, there's a big business there."