Antitrust pressure on Big Tech takes center stage in Congress

Add Axios as your preferred source to

see more of our stories on Google.

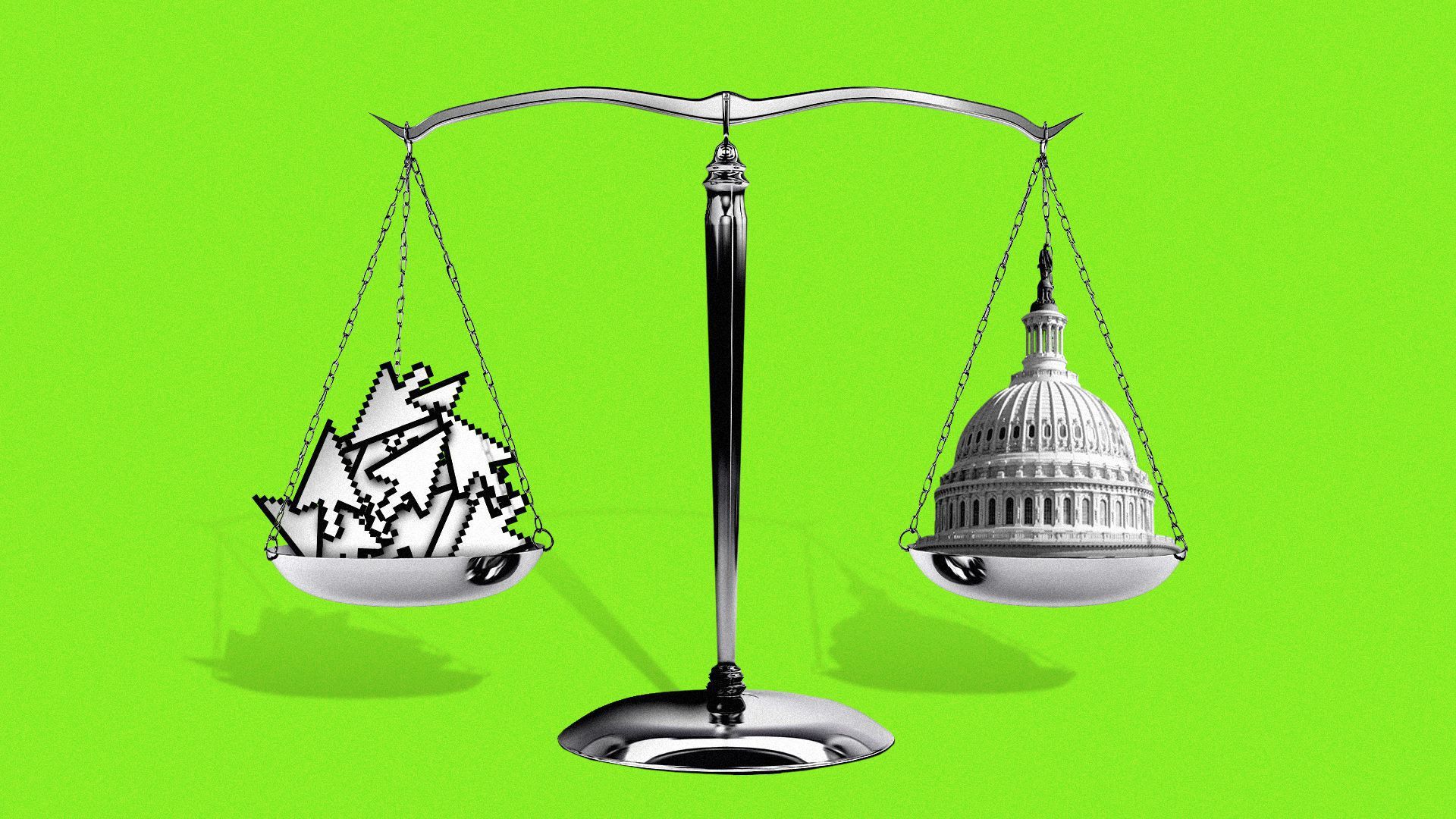

Illustration: Aïda Amer/Axios

The antitrust noose is continuing to tighten around Big Tech, with some bankers saying that the pressure is impacting deal-making.

Driving the news: Lina Khan, a law professor who famously argued for breaking up Amazon, tomorrow will get a Senate confirmation hearing to become an FTC commissioner.

- The House Judiciary Committee, controlled by Democrats, last week passed its tech antitrust report, setting the stage for legislation.

- Sen. Josh Hawley (R-Mo.) last week unveiled his own trust-busting proposal, while Republicans on the House Energy & Commerce Committee are circulating a staff memo outlining their ideas for tech accountability.

Selection bias: Most of the D.C. antitrust focus, including formal investigations by the FTC and DOJ, is on four companies: Apple, Amazon, Facebook and Google.

- No member of that quartet has put a blanket hold on M&A. But they've been noticeably sluggish, particularly given their heaving cash piles and near record-high stock prices.

- The last sizable purchase was five months ago, when Facebook agreed to pay $1 billion for Kustomer.

- "They're scared and are pretty much telling us that they'd rather not risk a long regulatory fight," says an M&A advisor who recently had a client's tires kicked by one of the Big 4.

Be smart: Other Big Tech companies are taking advantage of their time outside of the spotlight.

- The best example of this is Microsoft, as evidenced by its recent megadeal for Nuance, its reported pursuit of both Discord and Pinterest and its public jabs at Google.

- Microsoft has a larger market cap than any U.S. tech company outside of Apple, but D.C. seems to believe it's already taken enough antitrust lumps to last its lifetime.

- Or look at Twitter, which apparently felt secure enough to pitch Clubhouse on an acquisition. Or Salesforce buying Slack.

The bottom line: Until legislators and regulators resolve what they want to do about Big Tech, beyond throwing rhetorical barbs, some of the largest potential acquirers are being relegated to the sidelines.