America's creaky payments infrastructure is showing cracks

Add Axios as your preferred source to

see more of our stories on Google.

Federal Reserve building. Photo: Samuel Corum/Bloomberg via Getty Images

Modern capitalism runs on a smooth global electronic payments system that works in an efficient and predictable manner. That system is beginning to show cracks.

Driving the news: The majority of the U.S. payments infrastructure came to a shuddering halt on Wednesday when a "Federal Reserve operational error" caused a whole slew of services to stop working.

- ACH went down, which covers most transfers in and out of bank accounts, along with Check21, which covers checks; FedCash; and more.

- Fedwire — the self-described "premier electronic funds-transfer service that banks, businesses and government agencies rely on for mission-critical, same-day transactions" — also went down.

Between the lines: The Fed is unlikely to give much public explanation of what went wrong. CNBC's David Faber, however, reported that the Fed did try turning the system off and on again — and that didn't work.

Flashback: One layer up from the public payments infrastructure are private payments protocols, which are also brittle and prone to error.

- Last August, Citibank accidentally wired $894 million to a group of Revlon creditors. Adding insult to injury, a judge ruled this month that the creditors who didn't voluntarily return the money were allowed to keep it.

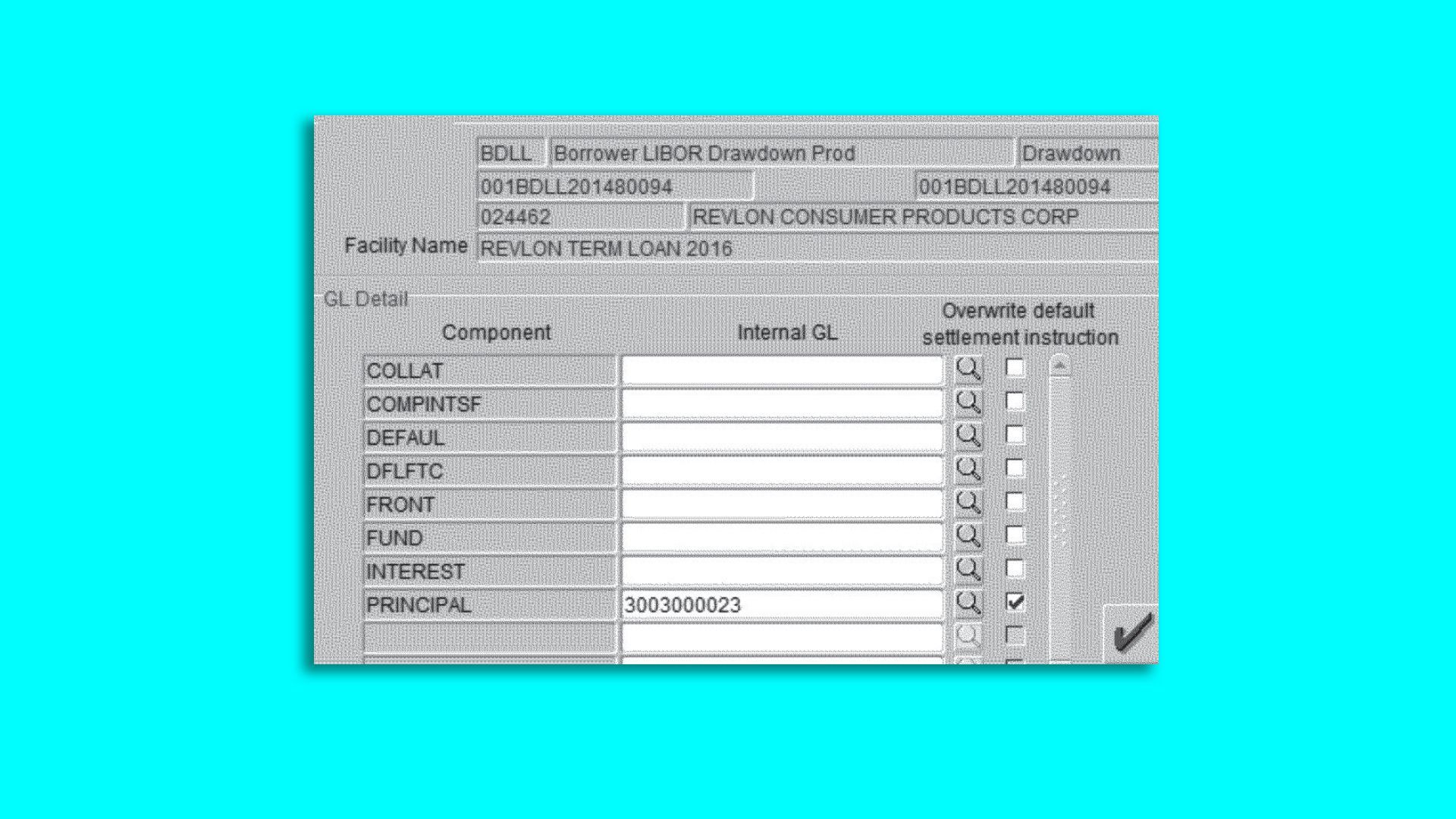

The judge's ruling sheds a lot of light on just how old and creaky Citibank's Flexcube payments infrastructure is.

- The software is incapable of sending principal and interest payments to just one creditor, as was intended in this case. Instead, it needs to be programmed to send principal and interest payments to all creditors, but with most of that principal diverted to an internal "wash account."

- The diversion to the internal account requires three different boxes to be ticked on this screen.

In reality, while the "principal" overwrite box was ticked, the "fund" and "front" boxes were not, which meant that the principal ended up leaving the bank.

The big picture: While the Federal Reserve has chided Citibank for its inadequate internal controls, no one has similar oversight over the Fed.

The bottom line: There's something wrong with America's payments infrastructure, which is still years away from the kind of real-time payments that are commonplace in countries from Sweden to India.

- Cryptocurrency is not the solution, however. As the Citibank and Fed stories demonstrate, mistakes will always happen. That means there has to be some kind of way to reverse transactions — something that remains impossible by design with most cryptocurrencies.