Life insurers screen for COVID-19

Add Axios as your preferred source to

see more of our stories on Google.

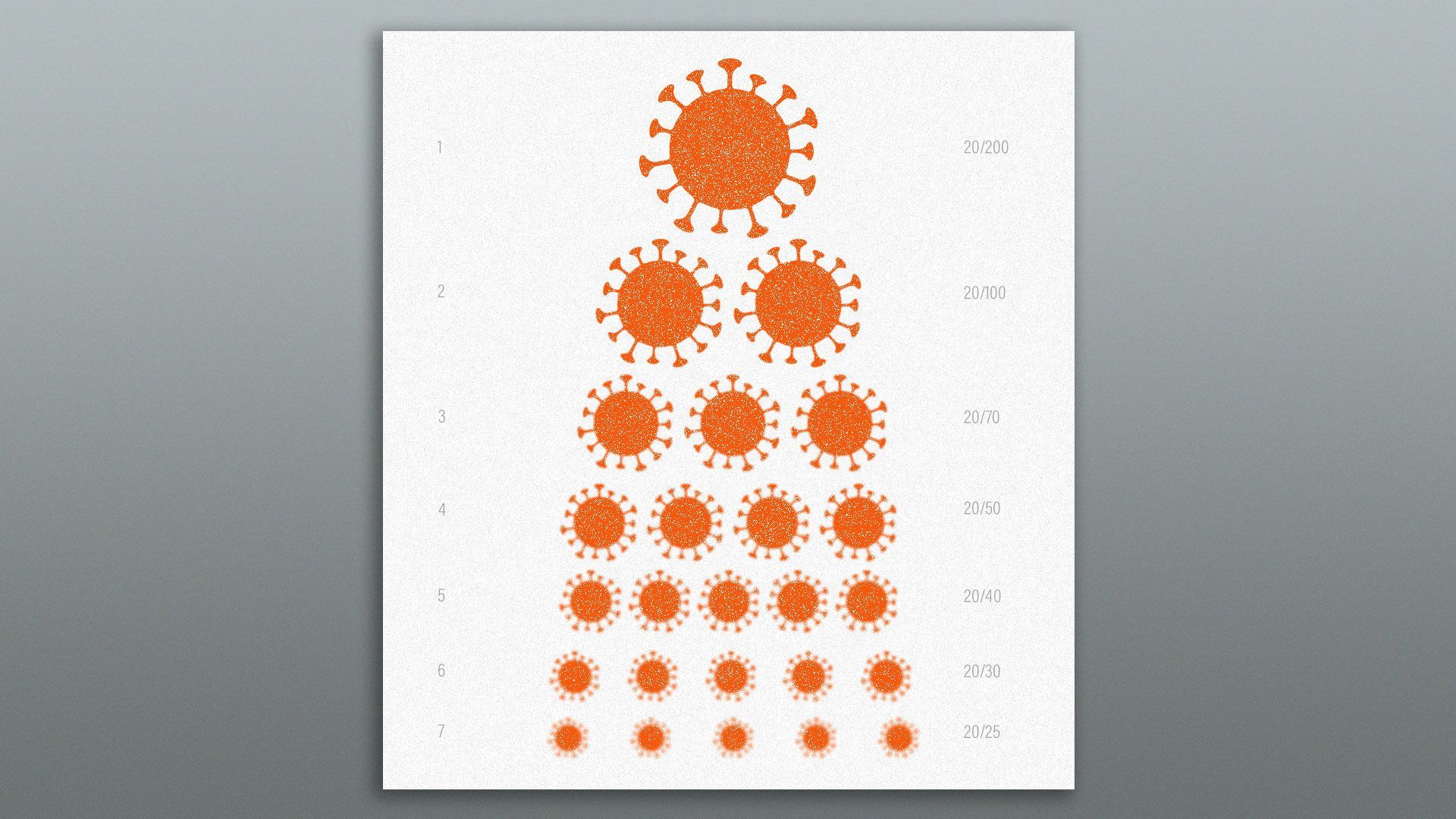

Illustration: Eniola Odetunde/Axios

Because of the pandemic, more people than ever are seeking out life insurance — just as insurers seek ways to identify people who have had COVID-19, and in some cases deny them coverage.

Why it matters: If the coronavirus makes it harder for people to get life insurance — or to collect on existing policies — it could diminish access to an essential financial safety net.

Driving the news: Alarmed at clampdowns by underwriters in Europe, the Consumer Federation of America (CFA) just sent a letter to the National Association of Insurance Commissioners urging that U.S. insurance firms establish clear and transparent rules on life insurance eligibility and COVID-19.

- In Europe, some insurers impose 30-day waiting periods on applicants who are former COVID patients and limit coverage by age, the CFA letter said, citing a Reuters article.

- "Some are even imposing waiting periods on people who have not been diagnosed with COVID, based on previous symptoms alone," the CFA said.

- "Our initial inquiries have not turned up such changes in America, but the possibility of similar actions by life insurers here in America is high."

What they want: The group says state insurance regulators "must issue a rule to protect consumers from arbitrary insurance practices."

- "The rule should require that underwriting rules relating to COVID be made public before they are used and establish reasonable standards for what would trigger a delay or denial of coverage."

Where it stands: U.S. insurers are gingerly tweaking their underwriting rules.

- In June, Bloomberg Law reports, insurers started filing requests with the Delaware Department of Insurance "to change their application forms to specifically ask applicants if they’d had COVID-19."

- A lot were permitted to do this: A regulatory body known as the Insurance Compact "has approved 32 such requests since March."

- “This is classic insurance reaction," Bob Hunter, director of insurance at the Consumer Federation of America and a former Texas insurance commissioner, told Bloomberg Law. "They did it after AIDS and SARS.”

According to the Insurance Compact's website, underwriters may ask life insurance applicants if they've been treated for COVID-19, but can't ask open-ended questions about symptoms and potential exposure.

Of note: The CFA says some people who have life insurance "may be considering dropping their coverage for a period to save some money to help the family get through the economic consequences of COVID."

- "These policyholders need to know the possible danger of such action."

The big picture: A recent McKinsey report painted a rosy 10-year outlook for the life insurance industry, noting that "the COVID-19 pandemic has only reemphasized the need for mortality protection."

- But S&P Global predicts 2021 will be tough: "Life insurers will continue to deal with investment portfolio stress, muted earnings, challenges to distribution, and elevated mortality claims."

The bottom line: "Some reasonable precautions by life insurers are understandable, but to burden COVID patients and their families a second time is unjust and unfair," the CFA said.