Goldman Sachs settles Malaysian bribery case for $2.9 billion

Add Axios as your preferred source to

see more of our stories on Google.

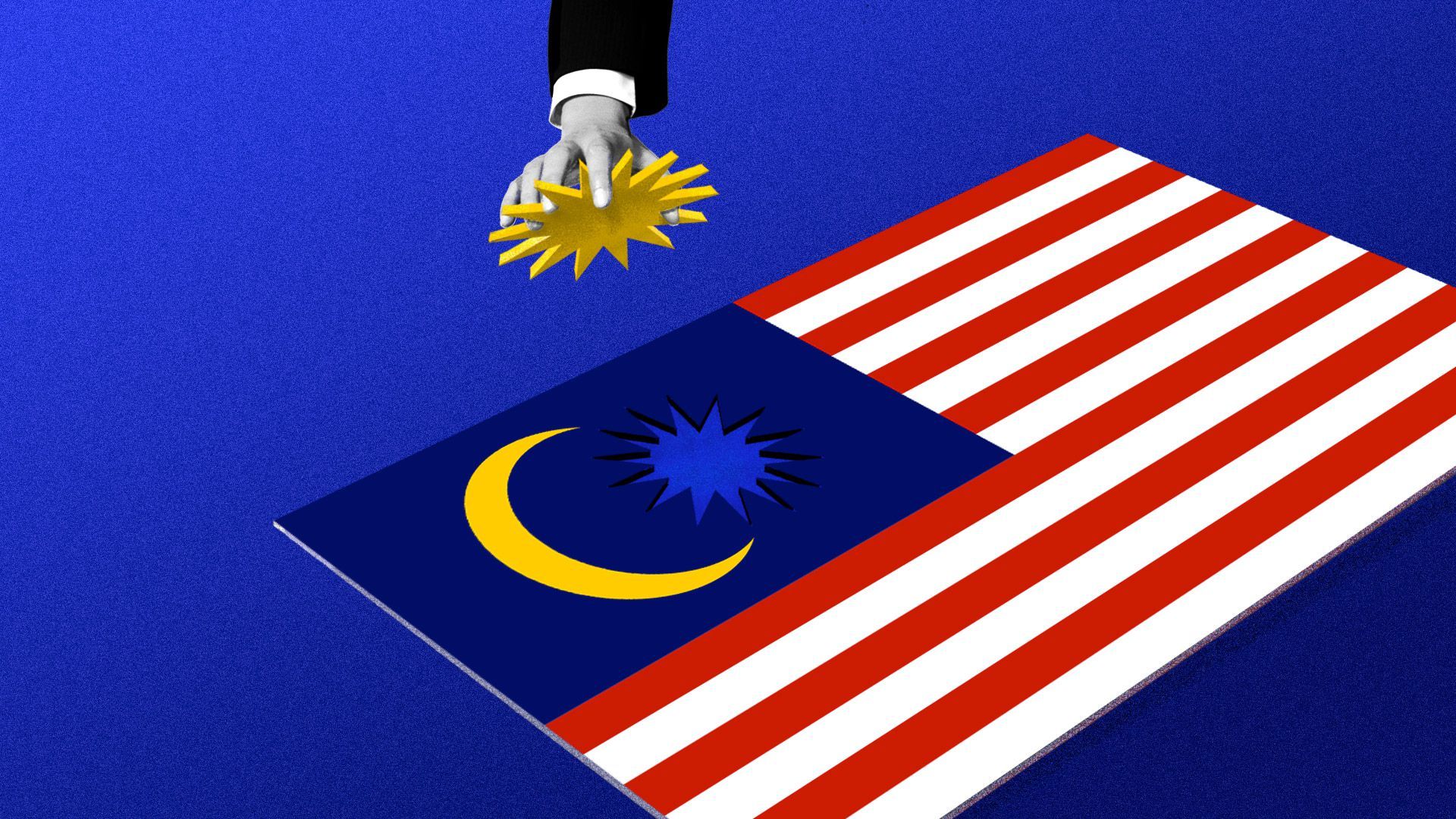

Illustration: Lazaro Gamio/Axios

Goldman Sachs has agreed to pay more than $2.9 billion to the U.S. government to settle charges surrounding its role in facilitating the $6.5 billion 1MDB fraud.

The big picture: The fine comes after Goldman previously agreed to pay Hong Kong regulators $350 million, and another $2.5 billion to the government of Malaysia, plus the restitution of $1.4 billion in assets.

- The investment bank's Malaysian subsidiary has also pleaded guilty to violating the Foreign Corrupt Practices Act, or FCPA.

The backdrop: Goldman played a central role in facilitating the 1MDB fraud, earning almost $600 million in fees on three bond deals from the deeply corrupt Malaysian fund. That's about 200 times more than the normal amount a sovereign issuer would pay. Each time, as soon as Goldman provided the money to 1MDB, corrupt financier — and Goldman client — Jho Low would steal it.

- Low is in hiding, but two former Goldman bankers, Tim Leissner and Roger Ng, have been arrested for their role in the fraud. Leissner has pleaded guilty and will be sentenced in January; Ng has pleaded not guilty and is awaiting trial in March.

- Goldman CEO David Solomon and his predecessor Lloyd Blankfein are both having some of their previous pay clawed back by the bank, The Wall Street Journal reports.

What they're saying: Acting assistant U.S. Attorney Brian Rabbit has charged Goldman with paying a whopping $1.6 billion in bribes, which he said is "the largest amount of bribes ever paid by a company in violation of the FCPA."