GE heads toward zero

Add Axios as your preferred source to

see more of our stories on Google.

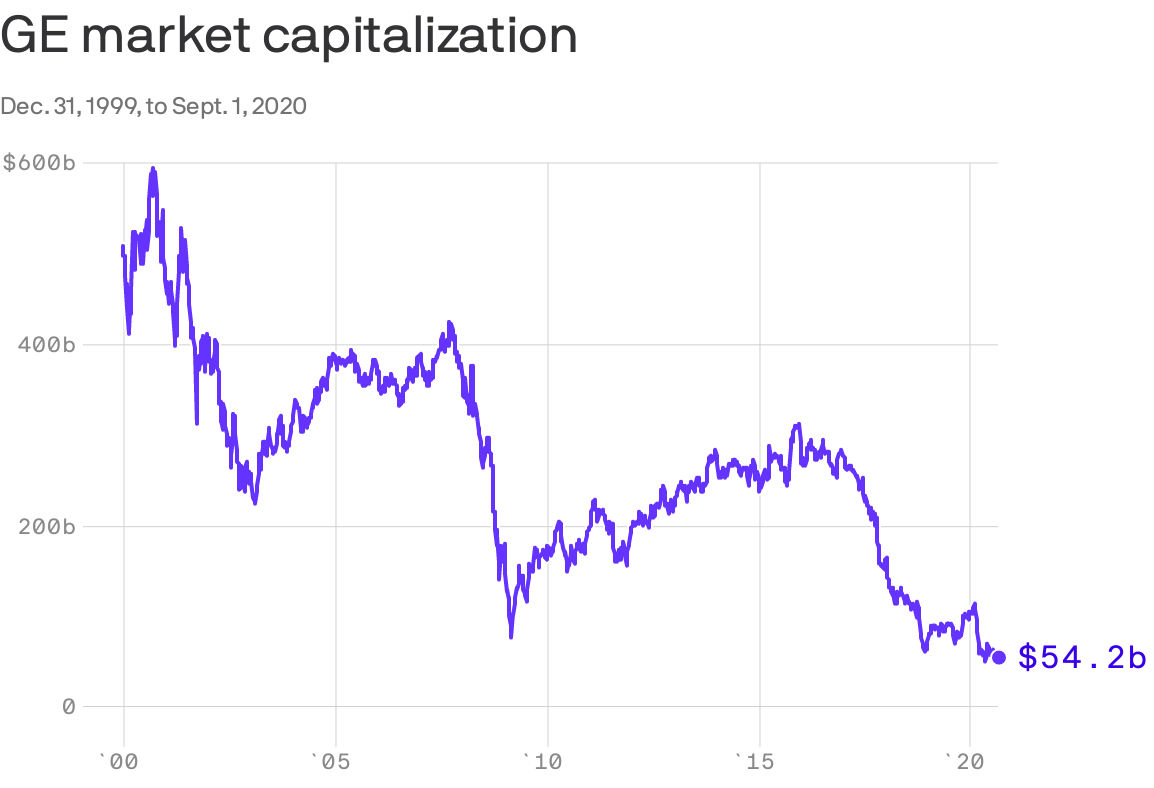

General Electric was the largest public company in the world in the early 2000s, a mighty conglomerate spanning everything from nuclear power plants to credit cards and daytime TV, but it's now worth less than companies you've may have never heard of, like Becton Dickinson or Crown Castle International.

- In fact, according to new research from JPMorgan analyst Stephen Tusa, GE stock — once the classic "widows and orphans" investment — might be worth nothing at all.

What went wrong: Under Jack Welch, GE's chairman from 1981 to 2001, GE became increasingly imperial and financialized. Welch's successor Jeff Immelt continued those traditions — until the global financial crisis destroyed GE Capital's balance sheet along with its coveted triple-A credit rating.

- Without GE Capital to smooth over the cracks, problems in GE's core businesses became harder to hide.

Immelt had two big ideas for how he was going to turn GE (or at least its share price) around.

- The first was to buy Alstom, a troubled French power company. The acquisition cost GE $10 billion. The subsequent write-down was about $22 billion.

- The second was share buybacks: Immelt spent more than $70 billion buying back shares during his tenure as CEO. That's more than GE's current market capitalization.

By the numbers: Tusa reckons that GE's core industrial business has an enterprise value of about $65 billion, based on the multiples its competitors trade at. Add on $6 billion for what's left of GE Capital, subtract $67 billion of liabilities, and you're left with about $4 billion in market cap.

- A small decrease in the trading multiple, or a small increase in the amount of money that GE has to put aside to cover a set of disastrous long-term care reinsurance policies, and GE becomes effectively insolvent.

- That's why JPMorgan no longer has a price target on GE.

The bottom line: At the heart of GE is its power unit. The jet engine business has been hit hard by the coronavirus pandemic, and the power-station unit overwhelmingly manufactures and services ways to turn carbon into electricity.

- If the world gets greener, as it must, that's bad news for GE.

Go deeper: Wall Street Journal reporters Thomas Gryta and Ted Mann take a deep dive into the Immelt years in their new book "Lights Out: Pride, Delusion, and the Fall of General Electric."