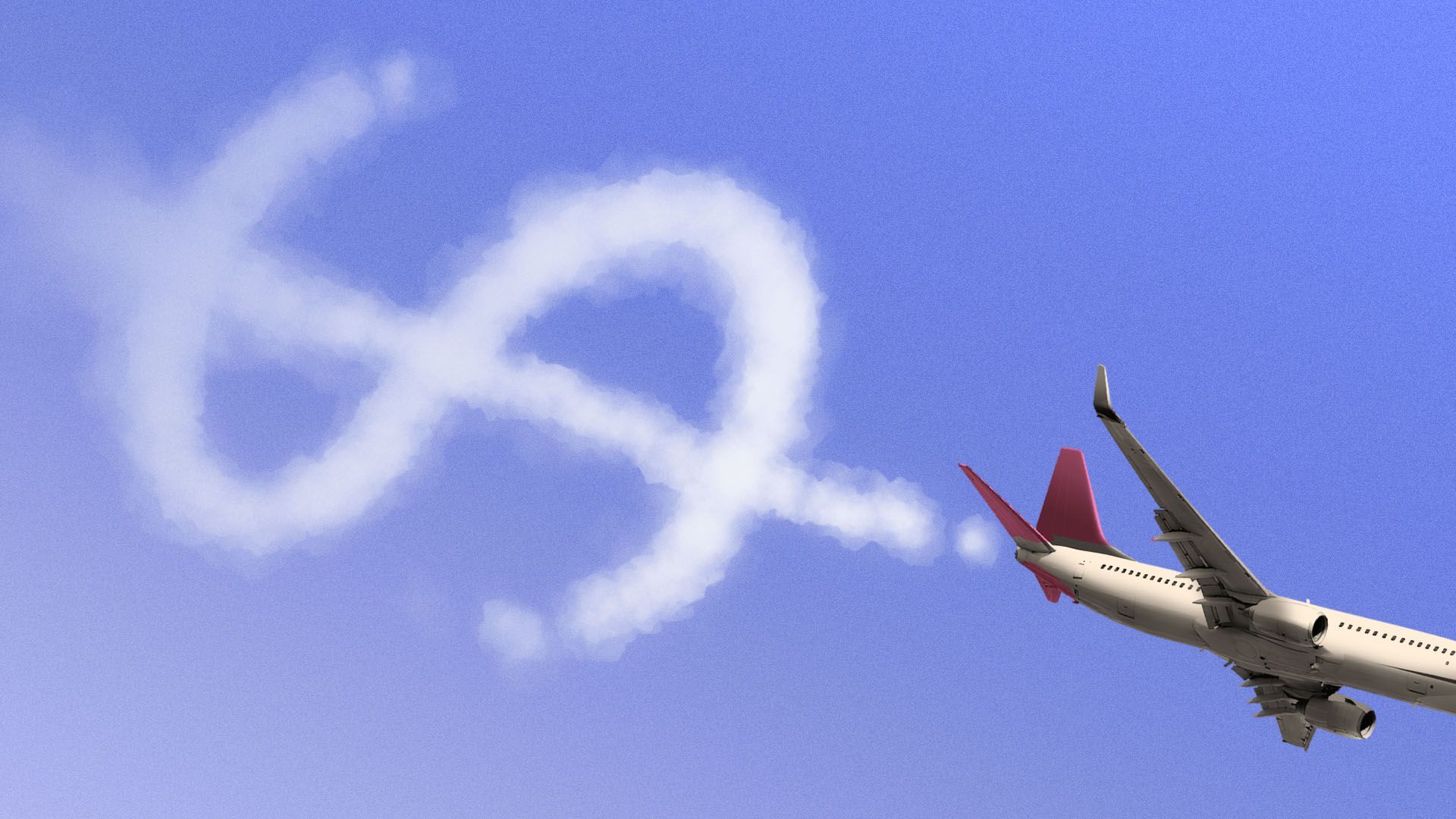

New turbulence for airlines

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Sarah Grillo/Axios

The peak leisure travel season — such as it is — is almost over, and without conferences or events to woo business travelers this fall, the airline industry's modest recovery could quickly lose altitude.

Why it matters: Investors have been snapping up airlines as bargain stocks lately — encouraged, in part, by reports of potential progress toward a coronavirus vaccine that could boost depressed air travel.

Investors seem to be betting that furloughs and other deep cost cuts — and perhaps another round of federal aid — will put airlines in decent shape for a financial recovery when travel picks up again.

- But a vaccine won't immediately end the pandemic.

- Betting on travel "re-opening" stocks — like cruise lines, hotels and airlines, which would presumably thrive if COVID-19 were subdued — remains a risky play and ultimately depends on when the traveling public feels it is safe to fly and spend money again.

What's happening: The re-opening trade has been popular since the start of August. Hotels like Marriott and Hyatt have each gained 12%. Airline stocks represented by the JETS ETF are up 9%, and MGM Resorts surged 30%.

- They have far outpaced the S&P 500's 3% gain during that time, and even the red-hot Nasdaq's 4%.

What they're saying: "Companies now sit at a lean and mean position that you rarely get to, except after a depression," Jim Paulsen, chief investment strategist at the Leuthold Group, tells Axios.

- "CEOs are hunkered down for the worst and have virtually no costs on the books. That's a recipe for profitability on the bottom line that’s not appreciated by Wall Street."

Yes, but: Short sellers — investors who bet that companies' stocks are overpriced and profit when they fall — are lining up to bet against the airlines, with $95 million of new short sales over the last week, according to data firm S3 Partners.

- Airline shorts are up $3.15 billion for the year.

- "It looks like shorts are thinking that the recent airline rally is a bit overdone and are looking for a near term pullback, at least until actual airline ridership upticks in a larger and broader manner," Ihor Dusaniwsky, S3's managing director of predictive analytics, tells Axios.

For the record: the airline industry was on its way to another year of record operating revenues in 2020 when COVID-19 shut everything down in mid-March.

- Passenger volumes collapsed more than 90% in late March and early April, amid stay-at-home orders and international border closings.

- Operating revenues plummeted an average of 86.5% in the second quarter, per Airlines for America.

By the numbers: According to the trade group's data:

- As of mid-August, domestic passenger volumes are still down 70% from a year ago; international travel is down 88%.

- The average domestic flight is 47% full, vs. 88% a year earlier.

- About 717,000 people passed through TSA checkpoints per day in mid-August, vs. 95,000 in mid-April and more than 2 million per day pre-COVID.

Quarantine restrictions have had a big effect on travel to some regions: Flights to New York and New Jersey have dropped the most, because of New York's clampdown on travelers from states with high infection rates. Travel to Hawaii, which has similar restrictions, is almost non-existent, with passenger counts down 94% year over year.

Almost all of those who are flying are leisure travelers — people visiting friends and family, or taking domestic vacations after being cooped up all spring.

- Business travel, which typically accounts for about 30 percent of flying passengers, has shown no signs of recovery, the airline group says.

- Cargo is a bright spot: airlines are flying more freight to help make up for lost passenger revenue.

Bank of America analysts are sounding a note of caution: "We are only a few weeks away from moving out of peak leisure travel season, and into a more business-heavy period. With corporate volumes not moving meaningfully off of trough levels, we believe there could be risk to domestic volumes as we move into September."

What to watch: The recovery will be bumpy, airline executives warn.

- "I think it's probably two to three years," Delta Air Lines CEO Ed Bastian told "Axios on HBO" in June.

- "I think there's two things going on. First, it's the success against the virus. We're hoping that over the course of the next 12 to 24 months, there will be a vaccine that's widely available."

- "The second part that we've got to talk about, though, is the economic impact" which he said will be "pretty significant."

- Plus, some corporate travel might be gone for good, as road warriors swap business trips for Zoom meetings.

The bottom line: Air travel took 3 years to recover from 9/11, and more than 7 years to bounce back from the global financial crisis, notes Airlines for America. We can expect a similarly slow recovery this time.