The economic recovery is reversing

Add Axios as your preferred source to

see more of our stories on Google.

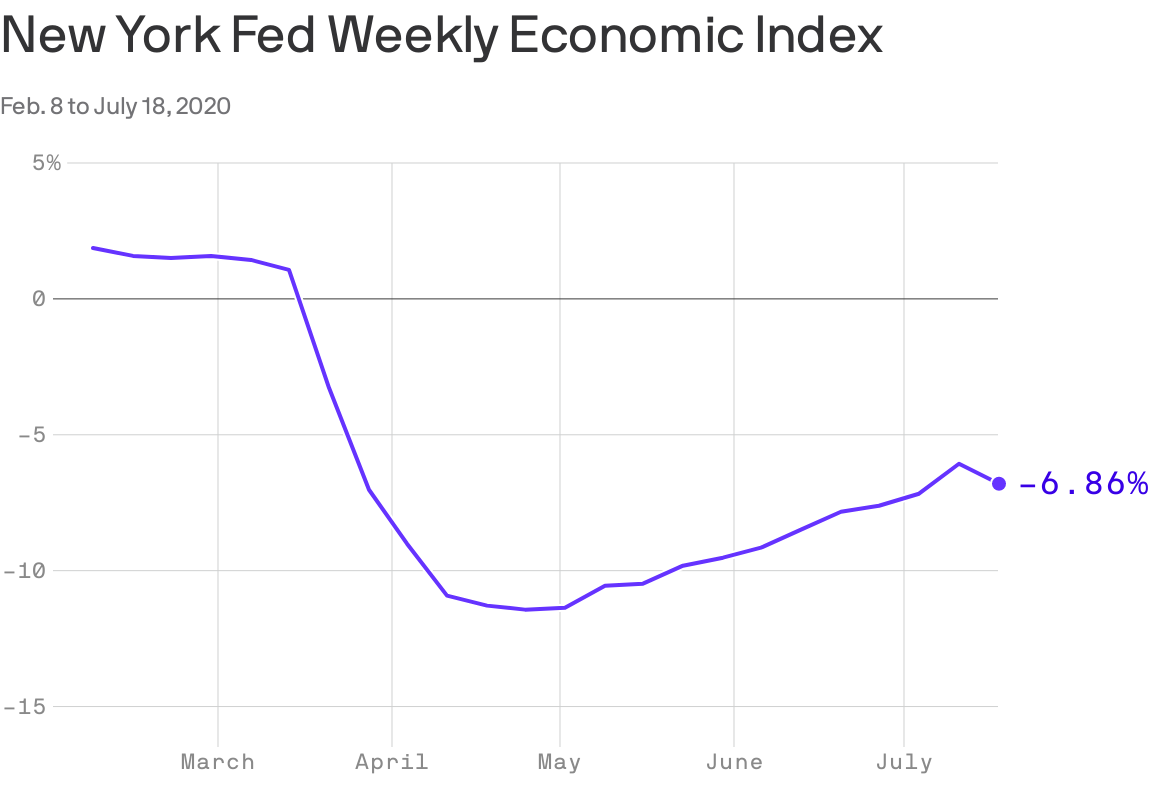

The New York Fed's Weekly Economic Index (WEI) is reversing course, showing real-time, high-frequency economic data is again turning negative after climbing back from April and May's coronavirus-driven swoon.

Why it matters: The index is one of many that show the economy is getting worse in a trend that could be picking up steam.

- The WEI represents the common component of 10 different daily and weekly series covering consumer behavior, the labor market and production.

- It is scaled to the four-quarter GDP growth rate and if it continues on its current trajectory would mean U.S. GDP is poised to sink by 7% in Q3 and decline year over year for the third straight quarter.

What's happening: In addition to the New York Fed's index, real-time data trackers from Goldman Sachs, Jefferies and Oxford Economics have all turned from stalling to falling.

- The St. Louis Fed's coincident employment index has turned lower, showing jobs growth has reversed.

- The number of employees returning to work at small- and medium-sized businesses declined by at least 5% from early June to mid-July, according to Homebase.

- TSA data showed the first weekly decline in people passing through checkpoints since April.

What's next: "Economic data over the next few weeks will likely underscore the depth of the recession and provide a warning that a full recovery is still far from being achieved," David Kelly, chief global strategist at JPMorgan Asset Management, says in a note to clients.

Where it stands: While many investors are counting on stimulus from Congress as well as a renewed balance sheet expansion from the Fed if economic data continue to deteriorate, Kelly says this is akin to "pumping air into a leaky tire."

- "Government spending will also likely drag on the economy as many state and local governments will be forced to cut payrolls to balance budgets in reaction to the deep recession and lack of sufficient federal government aid."

- He anticipates real GDP will fall 7.5% year over year in the third quarter, with much slower future progress without the widespread distribution of a vaccine.

The bottom line: "To state the obvious, economic uncertainty is extraordinarily high right now, even eclipsing levels at the worst of the financial crisis," Kelly says.

- "It is the pandemic, rather than any lack of stimulus, that is holding the economy back."

- "[I]n a pandemic economy, stimulus alone cannot trigger a full recovery."