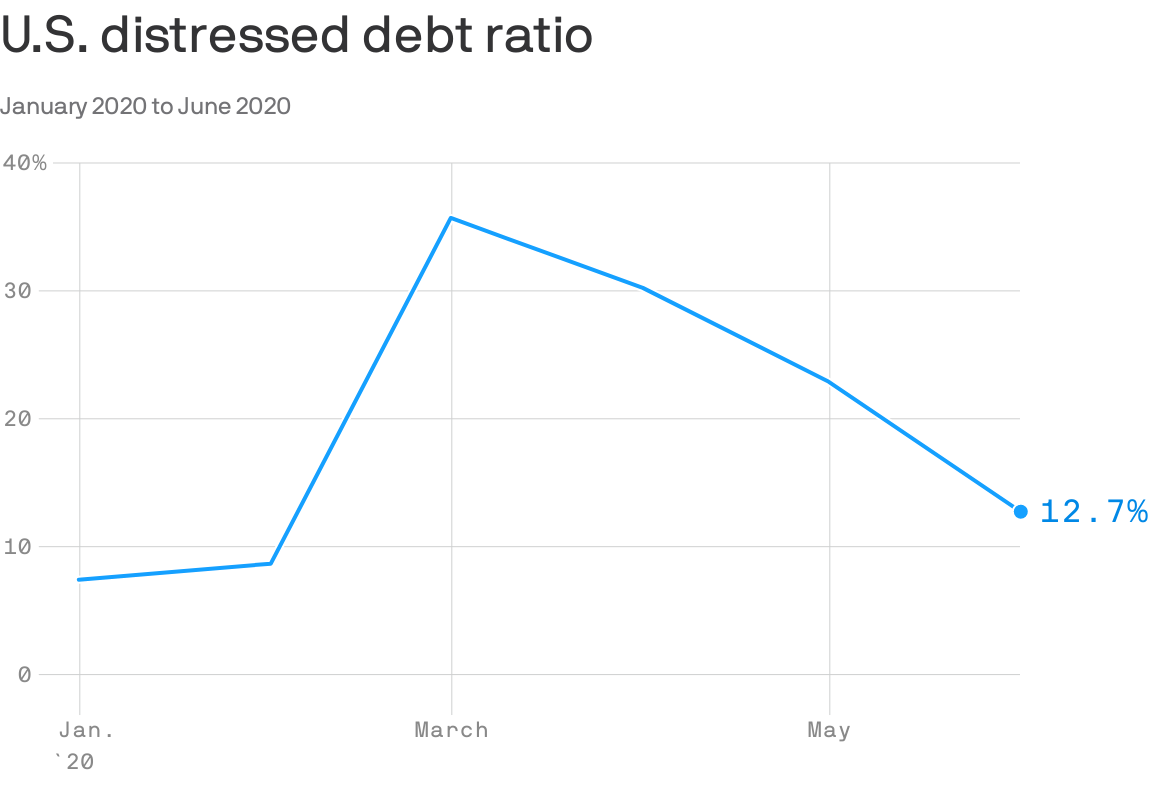

Distressed debt ratio falls again in June

Add Axios as your preferred source to

see more of our stories on Google.

The number of bonds trading at distressed levels has continued to fall since the Fed stepped in with its QE infinity program and promise to buy hundreds of billions of dollars in corporate debt.

Why it matters: The recovery has disproportionately benefited sectors where the Fed has shown it is willing to intervene, as companies with weak credit ratings have issued far less debt this year and still face elevated default risk.

What's happening: The U.S. distress ratio — the percentage of speculative grade issuers trading 1,000 basis points above comparable Treasury yields — declined to 12.7% as of June 19 from 22.8% as of May 6, S&P Global reports.

- S&P notes that investment-grade issuance has reached all-time highs this year, though issuance at the lower rating categories is still limited.

What they're saying: "The steep global recession and sudden and deep market dislocation have taken a heavy toll on speculative-grade issuers' revenues and access to funding sources," Sudeep Kesh, head of S&P Global Credit Markets Research, said in a note to clients.

- "Due to central banks' and governments' rapid and sizable support programs, credit markets have since reopened, but access remains limited for riskier issuers rated 'B-' and below."

- Oil and gas has the highest distress ratio of any sector at 40.2%, with $34.3 billion in distressed debt outstanding, or 29% of the total distressed debt, per S&P's data.