Jul 15, 2020 - Economy

Federal Reserve boosted big banks' bond trading profits in Q2

Add Axios as your preferred source to

see more of our stories on Google.

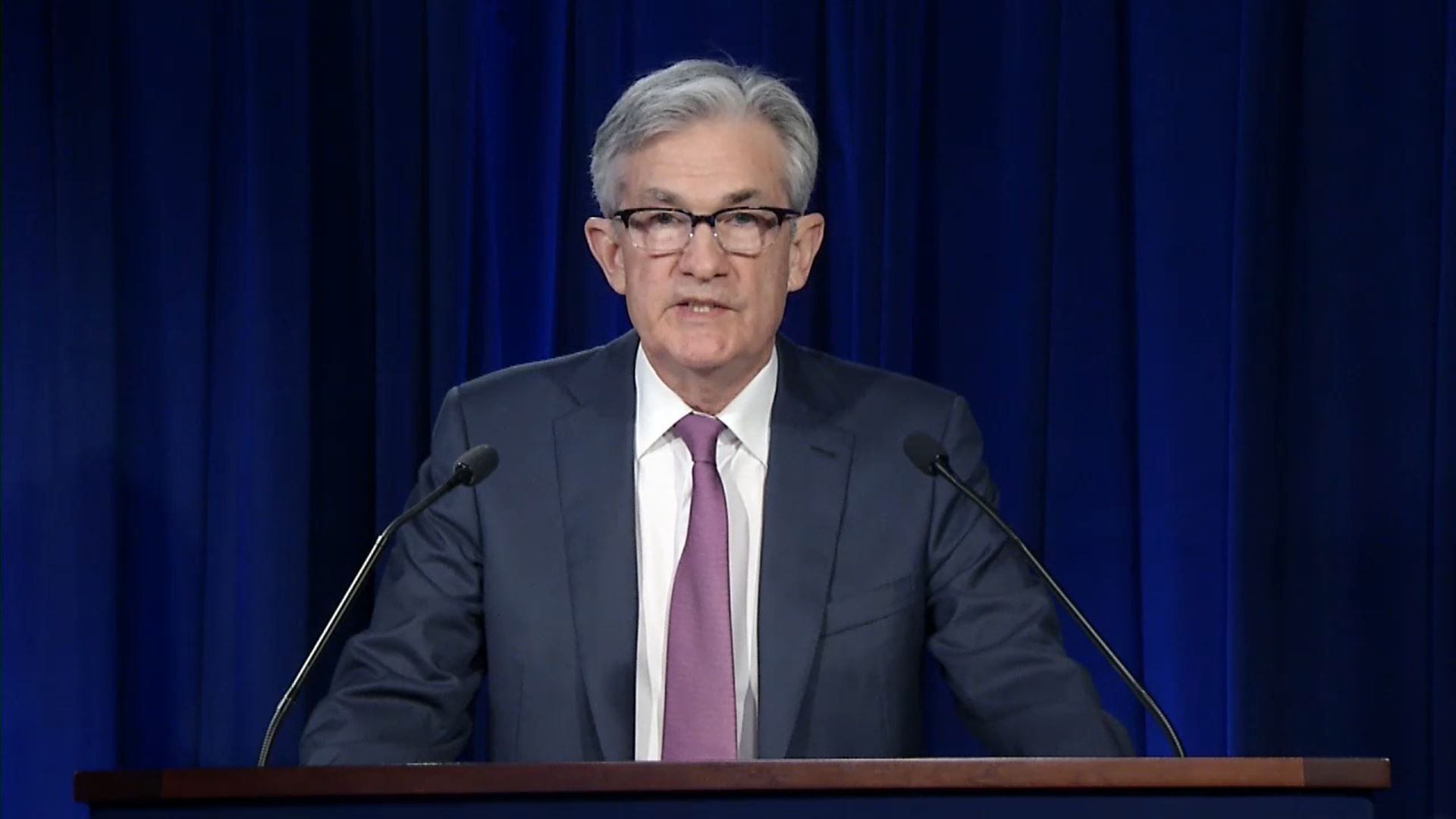

Fed chair Jerome Powell. Photo: Federal Reserve via Getty Images

Add Axios as your preferred source to

see more of our stories on Google.

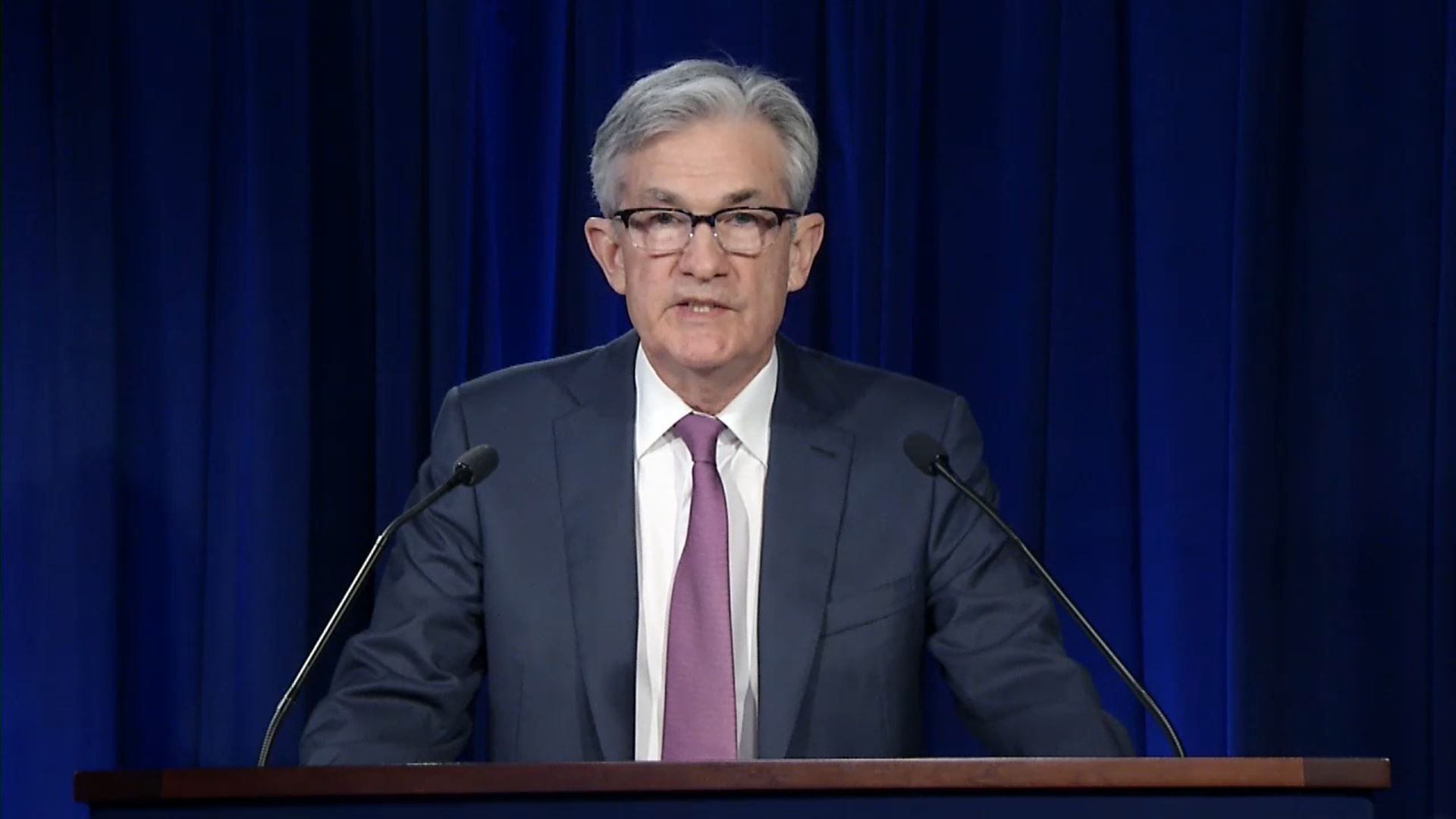

Fed chair Jerome Powell. Photo: Federal Reserve via Getty Images