Apr 15, 2020 - Economy

JCPenney weighing bankruptcy amid strategies to deal with coronavirus

Add Axios as your preferred source to

see more of our stories on Google.

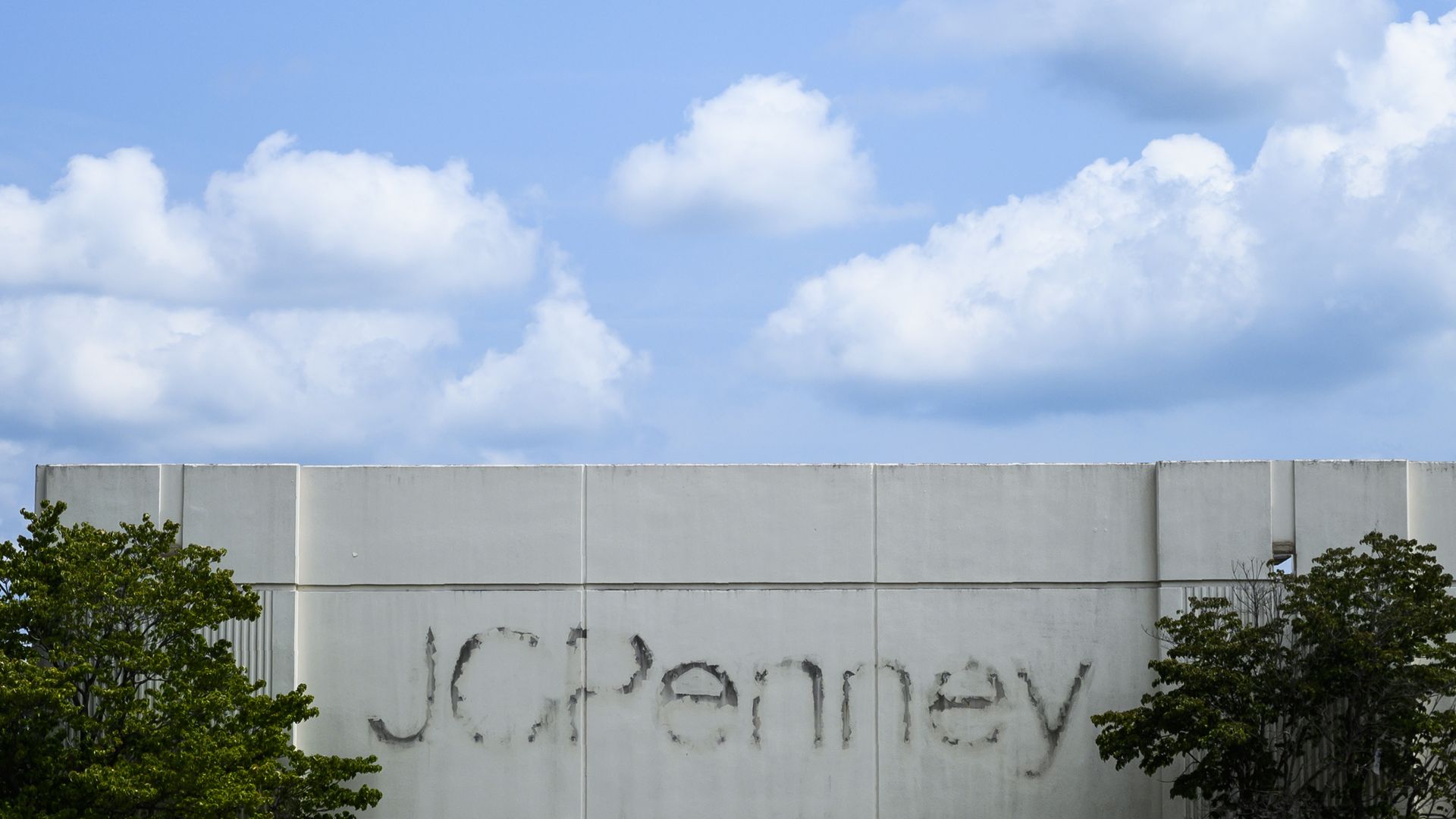

A JCPenney department store logo at an abandoned shopping mall in Roanoke Rapids, North Carolina in August 2019. Photo: Andrew Caballero-Reynolds/AFP via Getty Images