Apr 2, 2020 - Economy

SoftBank pulls the plug on $3 billion WeWork bailout

Add Axios as your preferred source to

see more of our stories on Google.

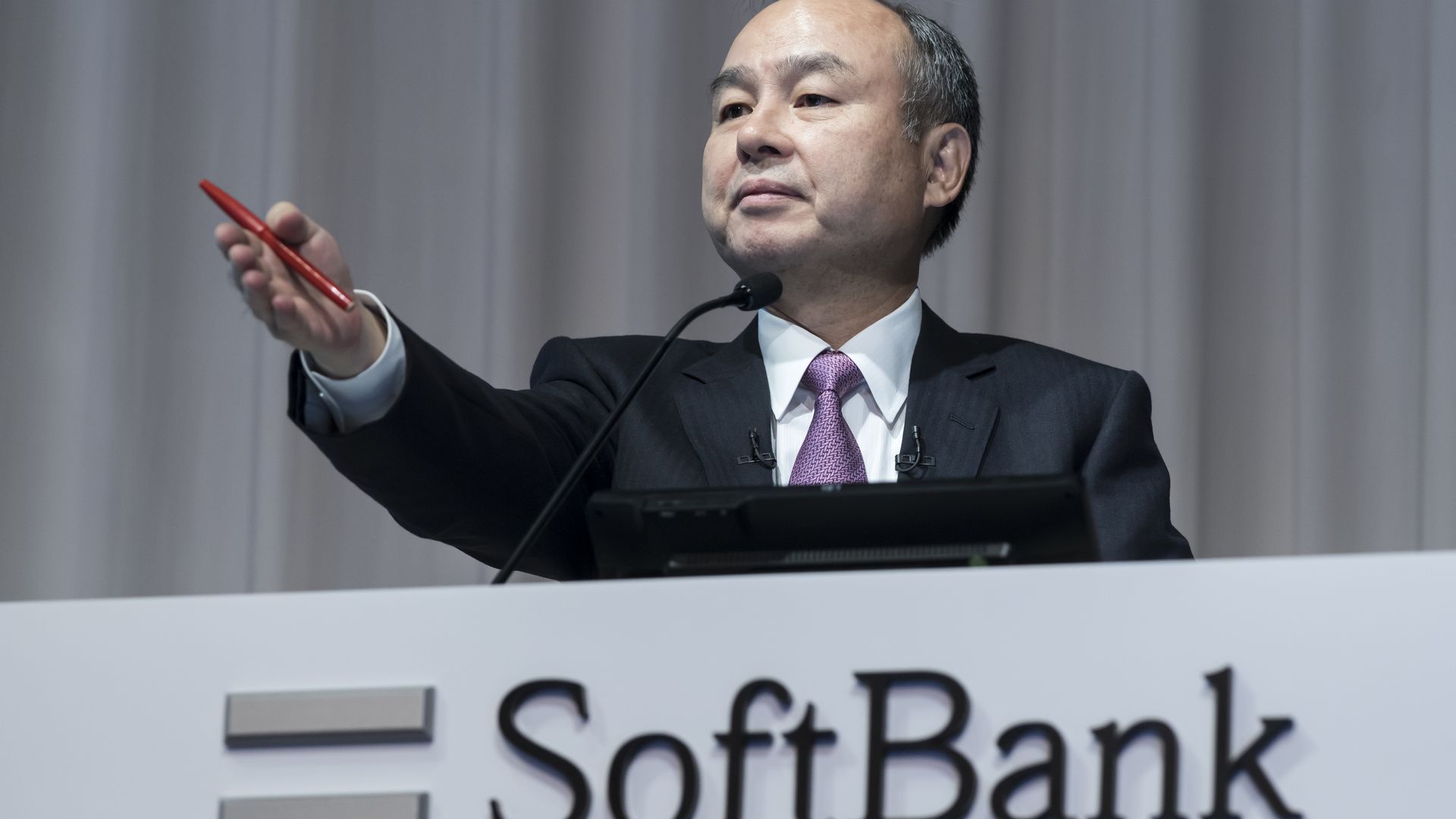

SoftBank Group CEO Masayoshi Son. Photo: Tomohiro Ohsumi/Getty Images

Add Axios as your preferred source to

see more of our stories on Google.

SoftBank Group CEO Masayoshi Son. Photo: Tomohiro Ohsumi/Getty Images