Why venture capital might avoid "fund size cuts" during coronavirus crisis

Add Axios as your preferred source to

see more of our stories on Google.

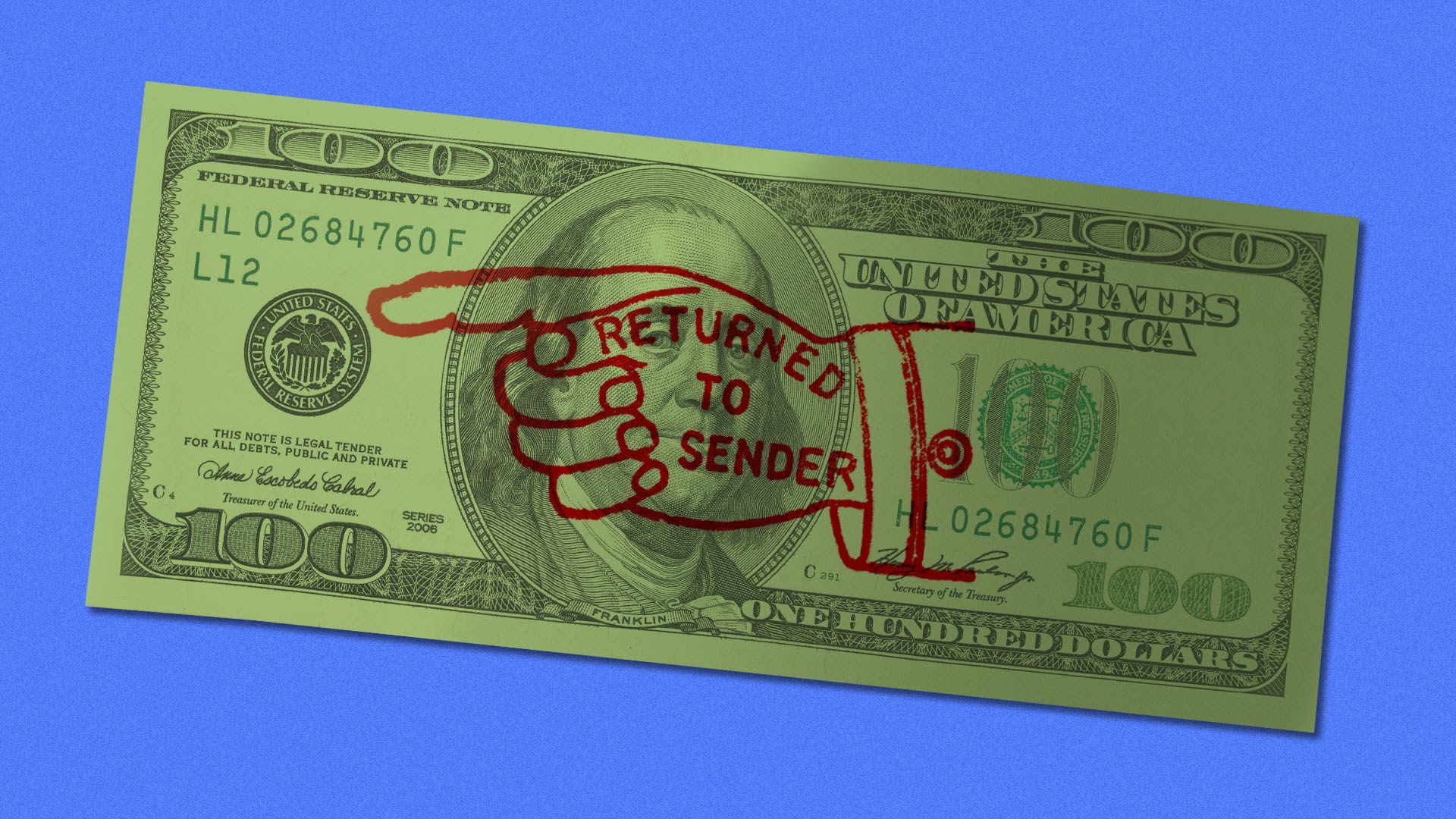

Illustration: Sarah Grillo/Axios

We're living through the third financial crisis of the modern venture capital era, following the dotcom crash and the housing bust.

The big picture: There wasn't a widespread push for "fund size cuts" in 2008, save for a few efforts tied to funds that had closed just before Lehman went under. While it's too soon to know for sure which path LPs will take this time around, odds are that it will look similar — with already-raised fund sizes remaining static.

Three reasons:

- Today's LP universe is more diversified than it was in 2001, when university endowments and private foundations ran the show (and many of the managers knew each other). It would be much harder in 2020 to coordinate consensus, particularly with massive money managers like sovereign wealth funds for whom venture is a tiny allocation.

- There aren't fundamental doubts about the legitimacy of tech startups. The 2001 experience wasn't just that firms had raised too much money in light of falling valuations, but also fears that the internet economy may be a mirage.

- Timing plays in general partners' favor. The dotcom crash was a slow burn that took nearly a year before limited partners agitated for fund size cuts. One big reason that we didn't see the same moves in 2008–2009 was that the recovery began in relatively short order. It likely will be harder to restart the U.S. economy than it was to shut it down, but most LPs I've spoken with believe that we'll at least be heading in a positive direction by Q3 (although several are worried about President Trump's itch to end lockdowns before the virus is contained).

But, but, but ... This isn't to say all will be copacetic between general and limited partners. Don't be surprised to see some pretty epic battles over clawbacks, particularly given how time-concentrated many VC funds have become.

The bottom line: U.S. venture capital funds raised $104 billion during 2018 and 2019. Don't expect retroactive shrinkage.

Go deeper: Venture capital has no guesses as to what 2020 has in store