The oil market's plunge won't bring down electric vehicles

Add Axios as your preferred source to

see more of our stories on Google.

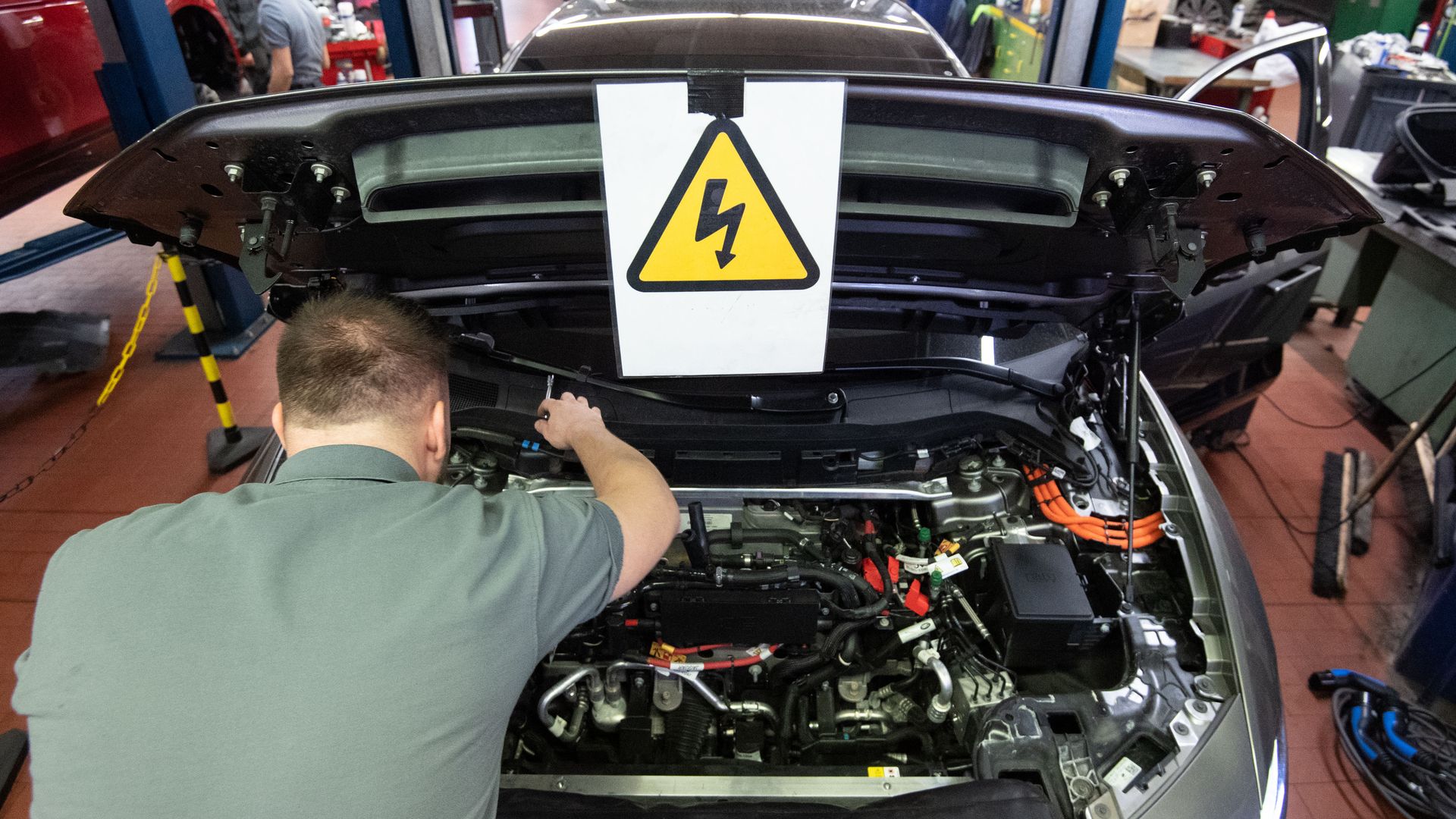

A mechanic maintains an electric vehicle in Germany. Photo: Marijan Murat/picture alliance via Getty Images

Cheaper gasoline thanks to the oil price collapse isn't expected to badly undercut electric vehicles, but the overall economic dislocation from coronavirus is a hurdle, analysts say.

Why it matters: EV sales have grown in recent years, but they're still basically a niche market and tiny percentage of overall vehicle purchases, so any new headwinds are worth watching.

What they're saying: "For many years the theory is that low oil and gas is not good for EV demand from a high level," Wedbush Securities analyst Dan Ives tells me. But he adds...

- "I believe on the margin some customers will stay away from EV in light of cheap gas, but overall the environmental movement and next generation technology and design behind Tesla neutralizes most of this dynamic."

The big picture: He's not alone. Morgan Stanley analysts gamed out the effects of gasoline prices at $2.37-per-gallon — where it was a few days ago — compared to $3.50-per-gallon.Yes, that lengthens the "payback period" from switching to an EV from a traditional car on fuel savings alone to roughly seven years rather than four.

But, but, but: They say that while lower oil prices put a "dent in economic paybacks," their note adds...

- "[W]e strongly believe the next burst in BEV adoption will not come from individual consumers waiting for their Model Y or Cybertruck… bur rather megafleets (think e-commerce final mile delivery vans and ride sharing fleets in dense urban cores) moving rapidly (either voluntarily or with regulatory encouragement) into all-electric fleets."

And a piece yesterday in Barron's quotes UBS analysts who say that in China, the world's largest EV market, "we believe continuous efficiency gain and cost cut along the EV supply chain is much more predictable than oil price fluctuations."

- The UBS note adds that in Europe, industry compliance with carbon emissions rules will drive sales.

Go deeper: What the oil market's collapse means for the climate