People don't trust their governments to handle the coronavirus crisis

Add Axios as your preferred source to

see more of our stories on Google.

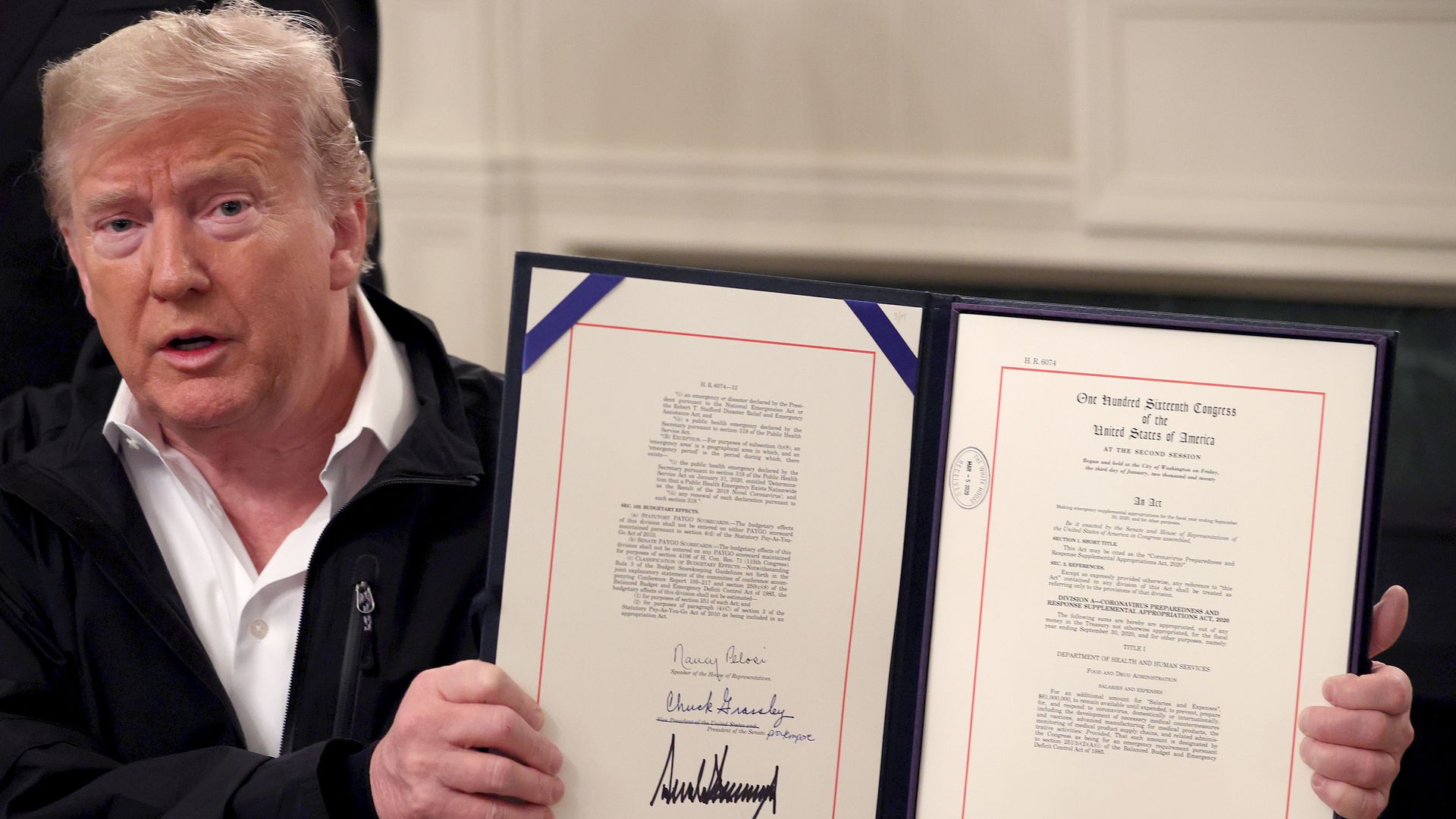

Photo: Win McNamee/Getty Images

The current collapse in global equities markets is mirroring a broader collapse in global public confidence.

The big picture: Both financial markets and public sentiment are reacting to uncertainty at three levels: the future trajectory of the coronavirus outbreak; the adequacy of the policy response; as well as the impact on the economy and financial institutions.

At the heart of all three is a growing gap in public trust in our various national governments.

- In part that's because folks have been told for so long that government is the problem, not the solution.

- In part it’s because critical public institutions mandated with the responsibility for defending public health have been defunded over time.

- It’s also because people understand that this crisis is bigger than any single national government can handle — yet the relevant institutions of international governance (i.e. the WHO) have been defunded as well.

Flashback: There are echoes of the Global Financial Crisis. After the Lehman Brothers collapse in September 2008, markets were in free-fall as business and consumer confidence collapsed and lines of credit dried up.

- What broke the fall was the G20 Summit in London the following March, when the world’s largest economies decided to act together.

- They agreed on a coordinated global fiscal and monetary stimulus, a ban on protectionist measures to keep trade flowing, and a regulatory response including the future stress-testing of globally significant financial institutions to handle future crises.

The U.S. could have taken the lead by reaching out to Beijing at the height of the crisis — and Washington could still do so — to establish a Joint Coronavirus Taskforce.

- This could provide the political capital to break through any geopolitical nonsense currently impeding serious work on effective prevention strategies and vaccine development.

- Second, G20 health and finance ministers, including the WHO leadership, could meet weekly by video-link around a fixed agenda of work.

- Third, a virtual G20 summit could be held to agree on global economic measures to reduce the risk of global recession and any associated threats to financial institutions.

The bottom line: Unless and until both public opinion and financial markets see major global governments working together with a credible, substantive policy response, then what we’ve seen so far will only be the beginning.

Kevin Rudd was the 26th Prime Minister of Australia and is President of the Asia Society Policy Institute and Chair of the International Peace Institute in New York. He also chaired the International Commission on Multilateralism which produced a report on Global Pandemics and Global Public Health.