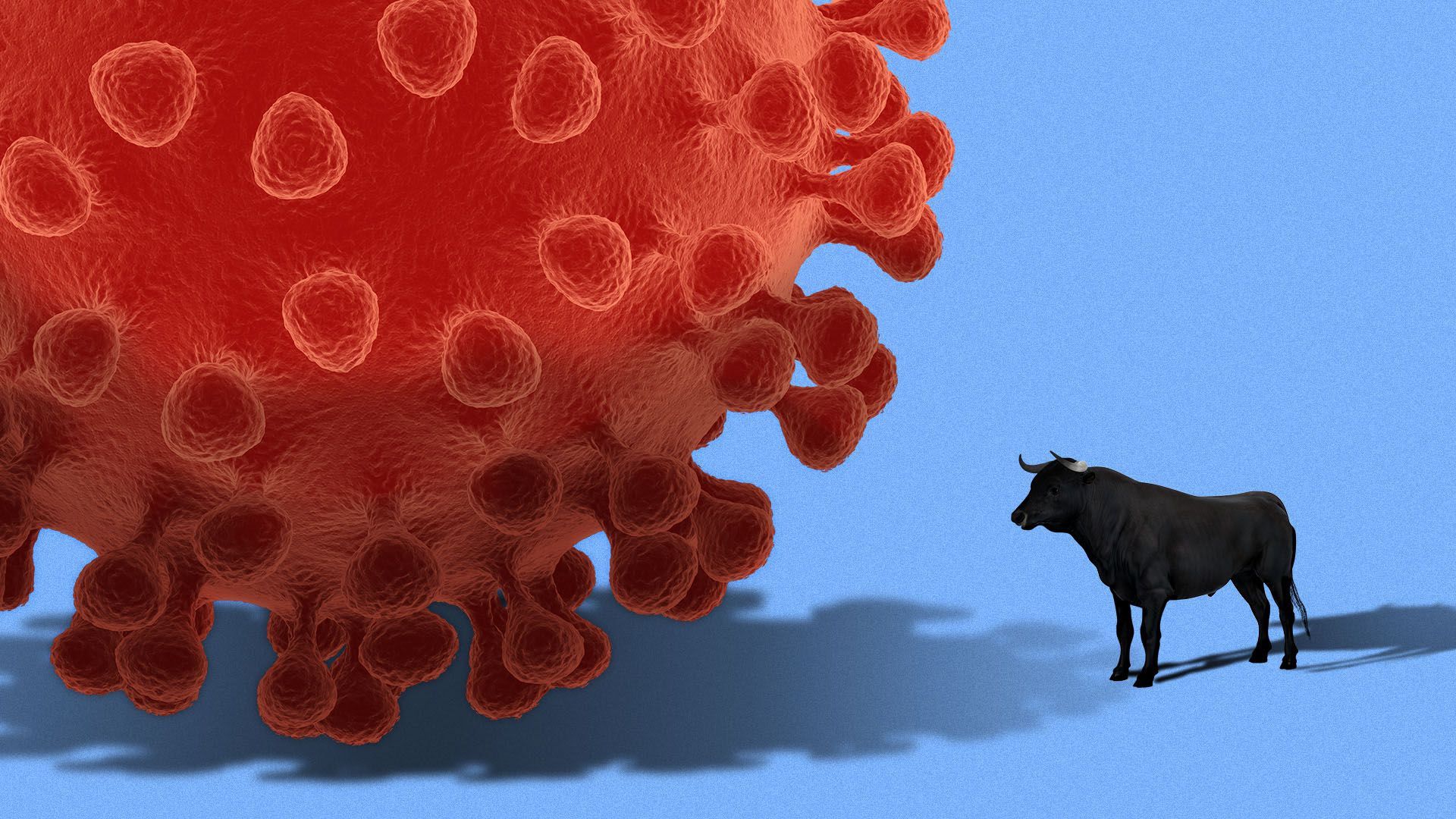

How coronavirus turmoil differs from a financial crisis

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Sarah Grillo/Axios.

We're not in a financial crisis, which means we don't need the full arsenal of weaponry a financial crisis requires.

Why it matters: Humanity needs to fight a virus, not a credit crunch. Our success or failure on the epidemiological front lines will ultimately determine the medium-term path of the U.S. and global economies.

- Markets are not part of the problem. Insofar as they're reacting to the coronavirus, they simply reflect investors' fears and expectations about the economic damage that the virus will cause. Goosing the stock market does nothing to address the much bigger underlying issue.

The big picture: With stocks whipsawing wildly and yields on Treasury bonds hitting new all-time lows, it's easy for policymakers to find themselves fighting the last war — to react to the current emergency in much the same way as they did to the financial crisis.

- Those responses will help, at the margin. If economic activity slows down as a result of the coronavirus, then lower interest rates will make it easier for individuals and businesses to borrow money to cover short-term losses.

- Fiscal stimulus, similarly, will always cause some kind of extra economic activity, and will therefore help to counteract a virus-related slowdown. But as former White House economic adviser Jason Furman told New York Magazine's Josh Barro, "This is definitely not TARP. I think this is a nice to have."

Our thought bubble: Political capital is finite, and fighting the virus directly has to be the top priority of any government. If and when the virus can be brought under control, then there's a good chance of a V-shaped recovery in which markets will take care of themselves.

- China provides a good example. The macroeconomic response will come, but first the government had to get to the point at which the rate of new infections was going down rather than up.

IMF chief Kristalina Georgieva has laid out the priorities facing any government fighting coronavirus. First is to "protect people’s wellbeing, take care of the sick, and slow the spread of the virus." Second is fiscal policy, targeted at the hardest-hit sectors and households.

- Monetary policy comes last — but so far it's the only area where the U.S. has taken decisive action, with the Fed's emergency rate cut this week.

The bottom line: Broken markets were a large part of the cause of the financial crisis, and fixing those broken markets was a large part of the necessary policy response. Neither of those things is true this time around.