Jim Cramer jolts fossil fuel divestment debate

Add Axios as your preferred source to

see more of our stories on Google.

Photo: Steven Ferdman/Patrick McMullan via Getty Images

CNBC money pundit Jim Cramer is an unlikely new avatar for climate activists with his take on Big Oil's future.

What he's saying: Cramer made waves Friday with his response to ExxonMobil's and Chevron's glum earnings reports. "I’m done with fossil fuels. They’re done," he said, later adding, "We are in the death knell phase" and citing divestments by "a lot of different funds."

- Cramer said fossil fuels' market prognosis is now untethered from their fundamentals.

- He cited "new kinds of money managers who frankly just want to appease younger people who believe that you can’t ever make a fossil fuel company sustainable."

Where it stands: It excited divestment advocates like Naomi Klein, Bill McKibben, and Bernie Sanders, who all seized on the comments from an analyst outside the activist ranks.

- "Why are Wall Street investors getting scared of fossil fuel stocks?" Bernie Sanders tweeted. "Because the climate justice movement is making it clear that political pressure for divestment will not stop. It will only grow stronger."

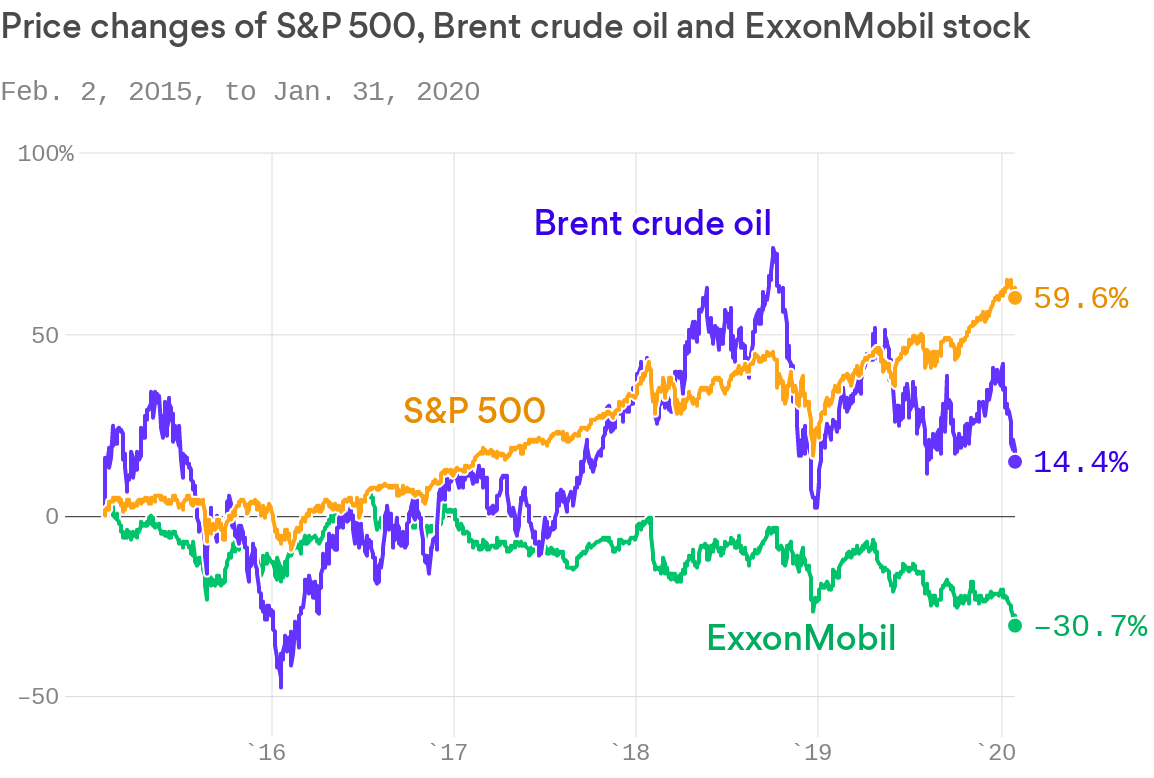

The big picture: Friday's results sent the stocks of Exxon — already at a decade-low after several tough years — and Chevron downward. It's just the latest sign of the sector's waning market performance.

- Bloomberg columnist Liam Denning notes that energy's weighting in the S&P 500 index last week fell below 4% for the first time in at least four decades.

- Exxon fell out of the S&P's top 10 for the first time last summer — a sign of its declining market value, especially relative to other huge corporations.

While climate activists quickly signal-boosted Cramer's comments, it's hardly clear that investors are truly spooked over climate concerns and pressure.

- A more conventional analysis is that industry woes stem largely from the glut of both oil and especially natural gas in recent years. Chevron wrote down $10 billion in assets in Q4, largely related to gas holdings.

- "Rising demand, exceeded only by the amount of supply growth depressing prices and shares, is an odd situation to characterize as the 'death knell phase,'" tweeted Jason Bordoff, head of a Columbia University's energy think tank.

Quick take: Axios' Dion Rabouin said poor financial performance — not the environment — is what's really behind the trend of fossil fuel divestments. Check out the chart above.

- "The oil companies are underperforming, so they're much easier to drop. And because the Dow and S&P 500 haven't dropped them, firms and asset managers can outperform the market and claim it's all an effort to be woke on the environment and sustainability," Dion notes.

Go deeper: Big Oil's big lobbying Q4