It may be time to get bullish about the U.S-China trade war

Add Axios as your preferred source to

see more of our stories on Google.

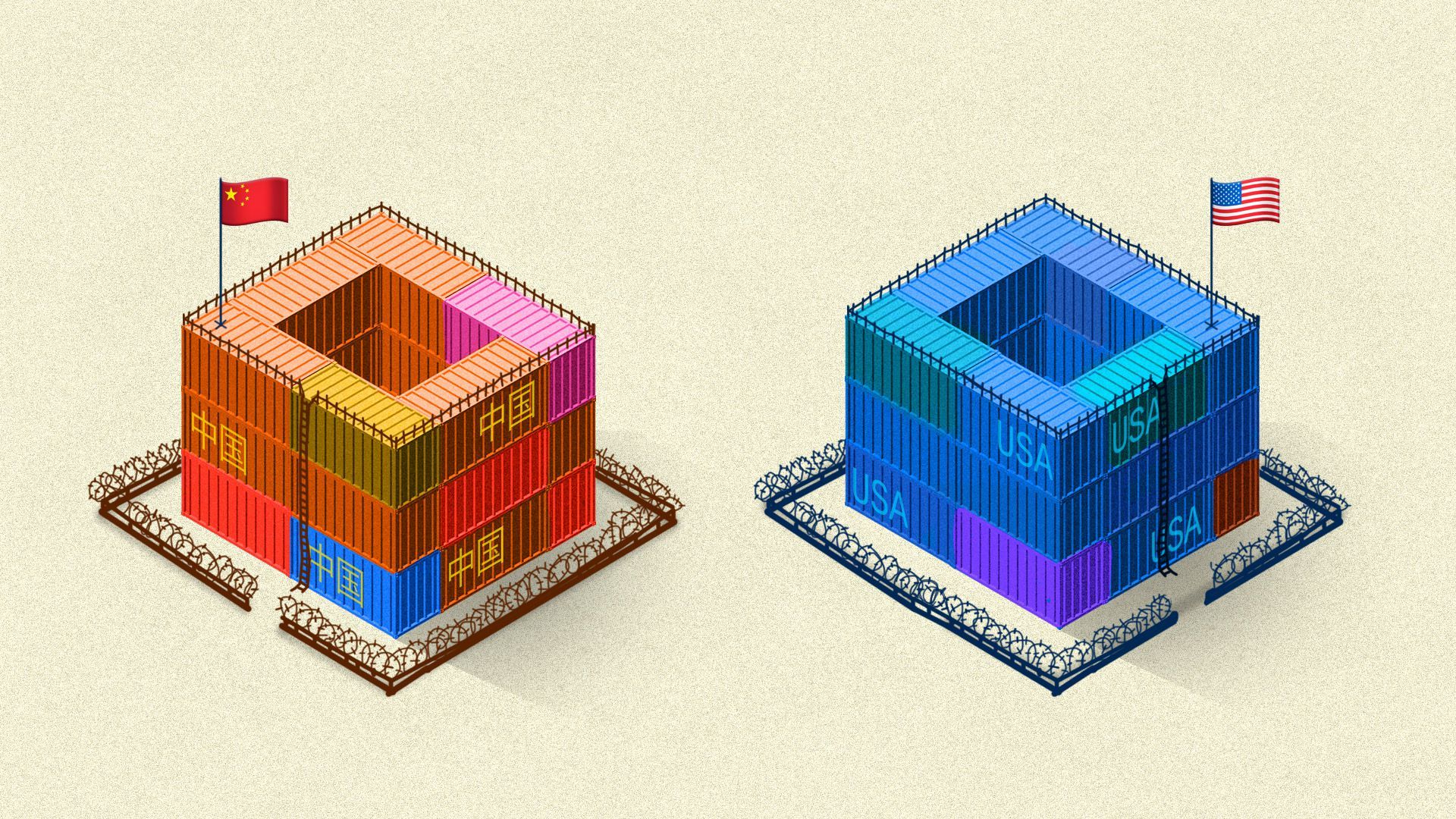

Illustration: Lazaro Gamio/Axios

All is calm on the trade war front, and investors are starting to believe that things may just get better.

What's happening: Goldman Sachs research analysts said in a note Sunday evening that they now believe "tariffs on imports from China have likely peaked" and are shifting their view, thanks to "recent developments and apparent progress in US-China negotiations."

Background: China ended its Fourth Plenum meetings without any negative trade war headlines last week, and "constructive" talks between top-level American and Chinese negotiators took place.

- "In the phone talks, the two sides had earnest and constructive discussions on properly addressing each other's core concerns, and reached principled consensus," China state news agency Xinhua reported.

- President Trump is reportedly now considering Iowa, Alaska, Hawaii and some locations in China as the location for the Phase 1 trade deal to be signed.

The big picture: There remains little hope of real structural change being implemented in China, but there's growing confidence that further escalation can be avoided.

What they're saying: Tim Stratford, chairman of American Chamber of Commerce in China, said he believed the “Phase 1” deal, which is expected to be signed this month, could prevent a further “downward spiral."

- However, with an election next year he believes Trump is likely more interested in helping his re-election chances than continuing to take a hard line.

- “It seems to fit the political goals of the president,” Stratford told the South China Morning Post. “But it’s not addressing the systemic trade issues that the business community would be concerned about on a long-term basis.”

What it means: That's good news for the stock market, where investors are more interested in the removal of tariffs than just about anything else.

- Since the announcement of the Phase 1 deal on Oct. 11, the S&P 500 has rallied by more than 4% and set three record high closes, including on Friday when the index rose 1% after a stronger-than-expected U.S. jobs report.

- The S&P has risen 22% in 2019, and analysts from Goldman Sachs said in a note last month that a 30% gain by year-end is realistic.

What's next: With the Fed having cut U.S. interest rates for the third time this year, all eyes are on the trade war.

- “Trump’s trade policy has definitely softened the U.S. economy and the Fed responds with three cuts and says it’s back in Trump’s court, therefore everyone is looking at what happens now with this trade deal,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, told CNBC.

Go deeper: Investors signal they hate Trump's "Phase 1" China trade deal