Nov 1, 2019 - Economy

The Chicago PMI report was a mitigated disaster

Add Axios as your preferred source to

see more of our stories on Google.

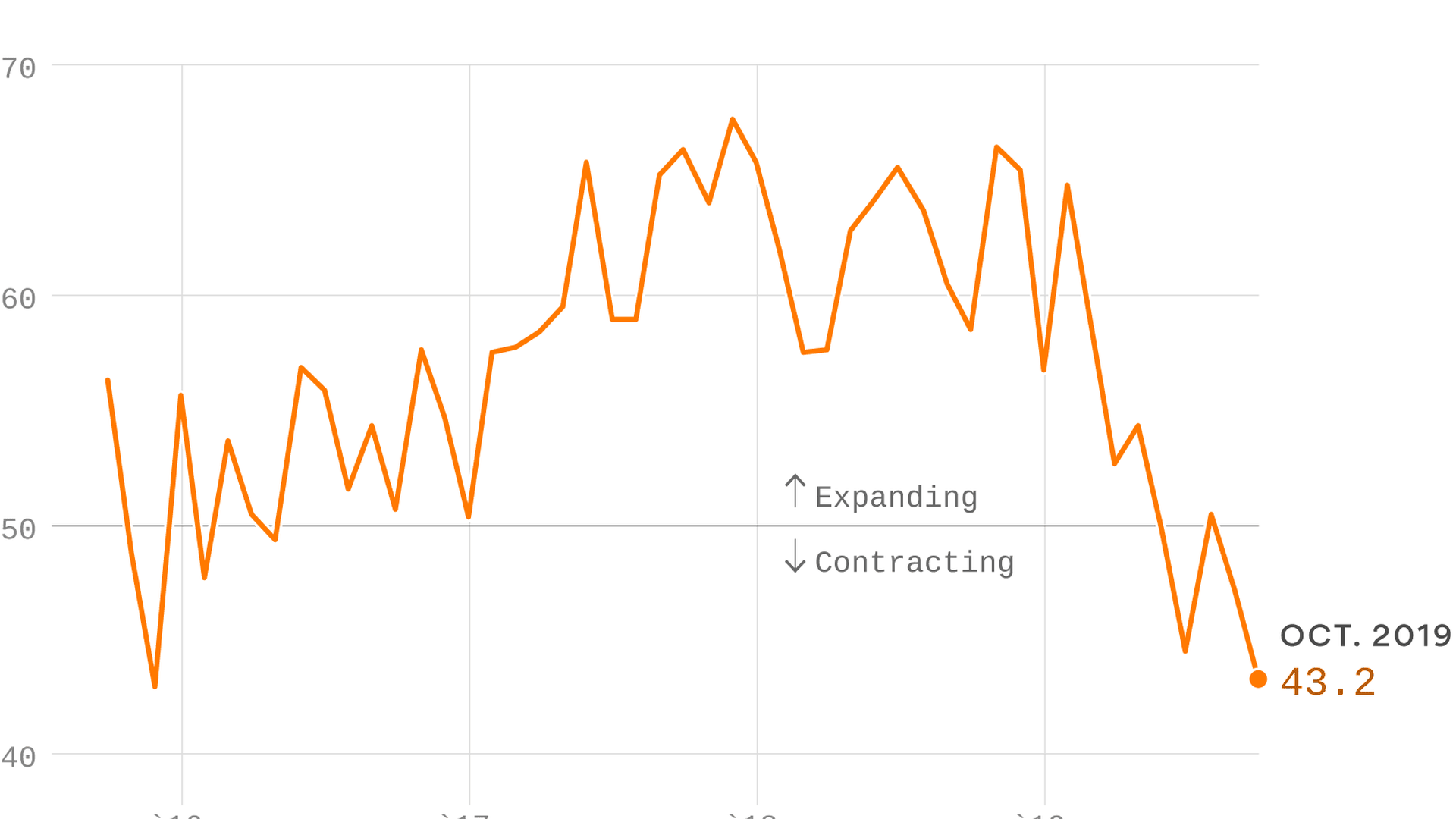

Data: Investing.com; Chart: Andrew Witherspoon/Axios

Ahead of Friday's ISM manufacturing report, the Chicago Business Barometer, a separate reading that tracks manufacturing companies based in the Midwest, produced its weakest reading in four years and the second lowest in a decade.

Threat level: The details of the report, also known as the Chicago PMI, were even worse.

- New orders declined to 37.0, the lowest since March 2009.

- Order backlogs fell almost 14 points to 33.1.

- Prices at the factory gate fell for the third consecutive month.

- The three strongest categories highlighted in a press release from the Institute for Supply Management — employment rose to 49.8, inventories moved up for a third month to 47.1, and production bounced to 46.8 — were all still below 50, the marker separating expansion from contraction.

Yes, but: The United Auto Workers strike at GM, which included nearly 50,000 workers and idled 34 plants across the country, likely contributed to the weakness.

- The numbers should improve now that the union has agreed to contracts with GM and Ford.

The intrigue: It also appears business owners who participated in the survey are feeling the sickness but are dubious of the medicine.

- In response to the question of how government-imposed tariffs would affect their firm’s business, 82.5% of respondents said it would have a negative impact (56.5% noted a little negative impact and 26% indicated a major negative effect).

- October’s special question asked: “What impact would the latest interest rate cuts by the Federal Reserve have on firm’s business?” The majority (51.1%) expect no impact, while 31.1% state a positive effect.