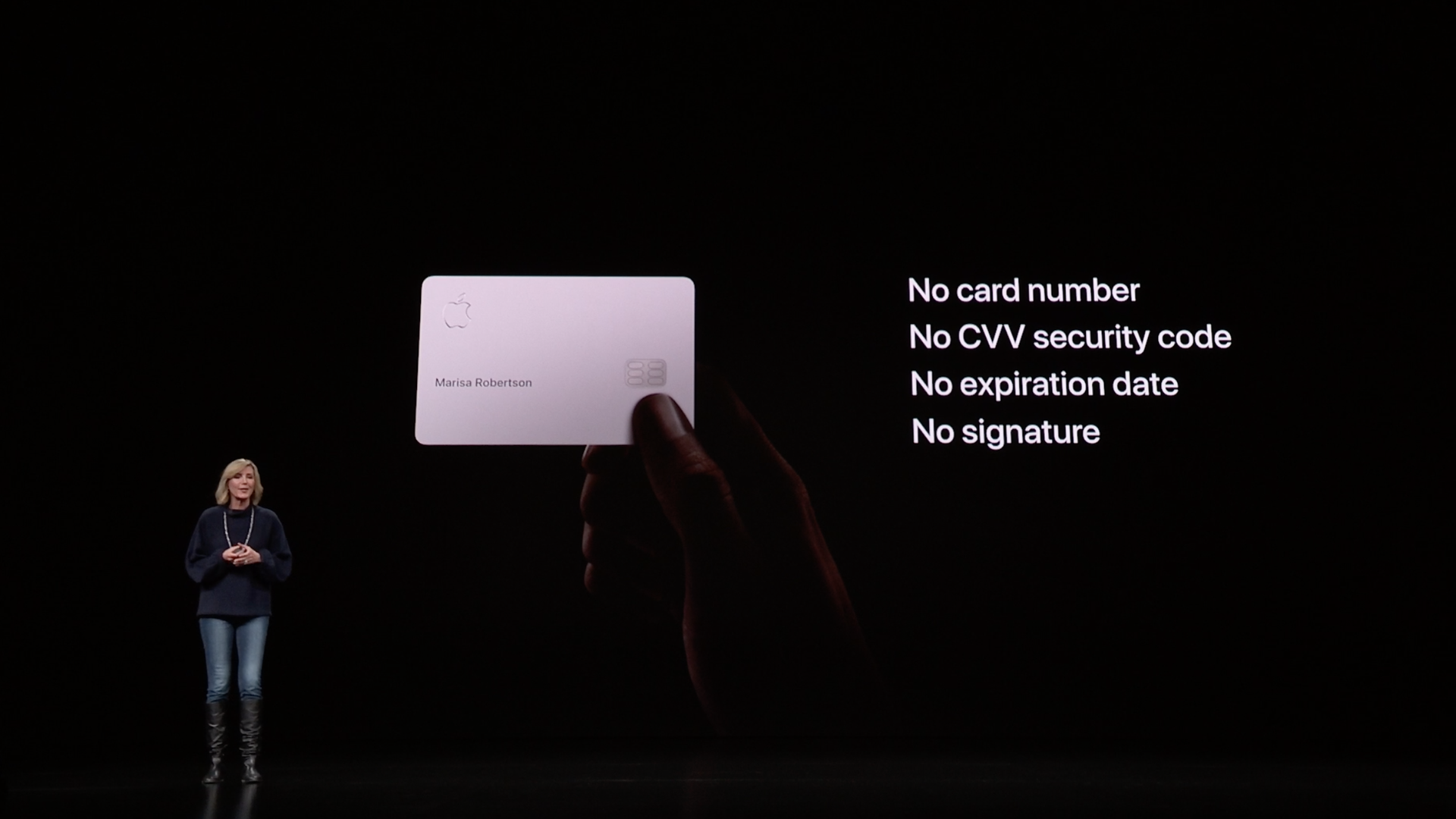

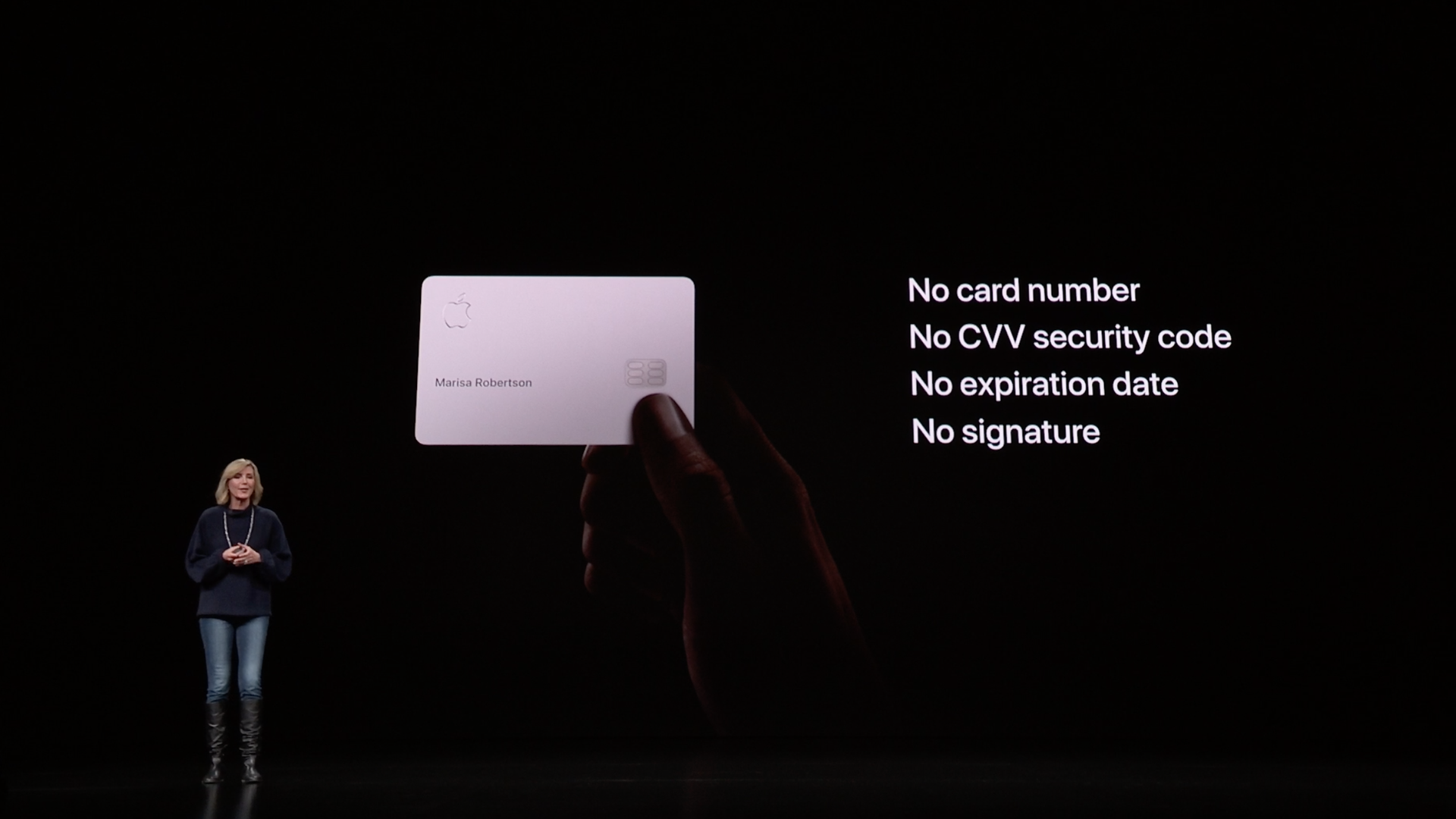

Mar 26, 2019 - Technology

Apple's minimalist titanium credit card

Add Axios as your preferred source to

see more of our stories on Google.

Apple VP Jennifer Bailey introduces the Apple Card at Apple's Monday event. Screenshot from Apple video

Add Axios as your preferred source to

see more of our stories on Google.

Apple VP Jennifer Bailey introduces the Apple Card at Apple's Monday event. Screenshot from Apple video