Dec 18, 2018 - World

Expert VoicesTrump's new Africa strategy misjudges risks of Chinese debts

Add Axios as your preferred source to

see more of our stories on Google.

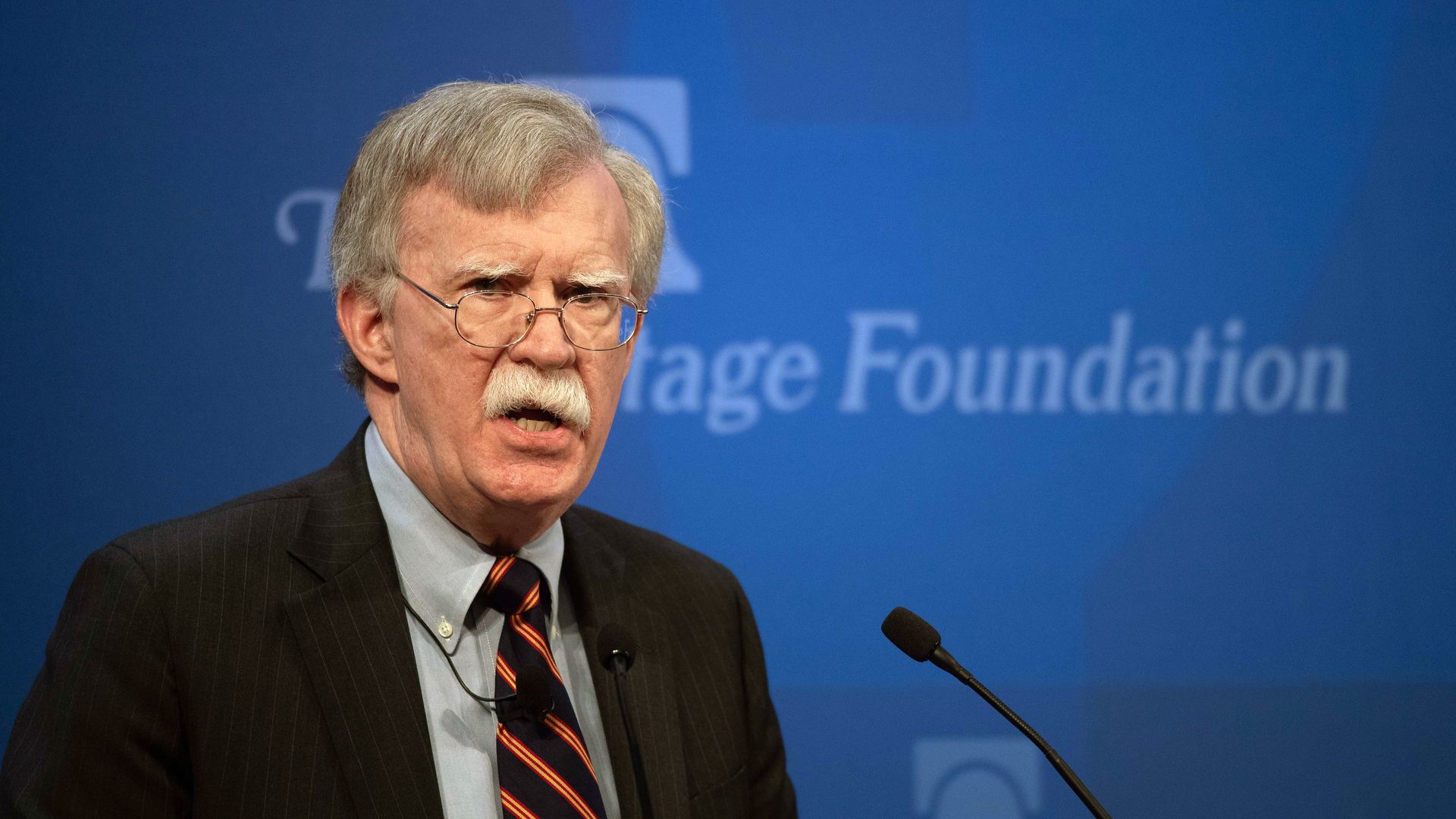

National security adviser John Bolton speaks about the administration's Africa policy at the Heritage Foundation in Washington, D.C., on Dec. 13. Photo: Nicholas Kamm/AFP via Getty Images