Fear and flatlining: The stock market's brutal 2018

Add Axios as your preferred source to

see more of our stories on Google.

After an epic 2017, the three major U.S. stock market indices are trending toward a negative year in 2018, with a return to volatility and puzzling sell-offs after strong — but not astronomical — earnings numbers in formerly stalwart U.S. stock sectors.

Between the lines: Maybe the valuations were a little too hot, or investors were spoiled by double digit returns.

- Perhaps it's people looking at the economy and forthcoming interest rate hikes and deciding to sell off now in case things turn south.

- Or maybe it's the fear of second-order effects from a potential cold war with China.

The other side: “This sort of price action is extremely normal,” Peter Lazaroff of Plancorp told MarketWatch. “What was strange was the outsized returns investors have earned in recent years with effectively no volatility.”

Driving the news:

- The FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) have collectively lost $1 trillion in market value from their 52-week highs.

- Four out of the 5 worst performing S&P 500 stocks today were retail companies (L Brands, Target, Ross Stores, and Kohl's), per FactSet.

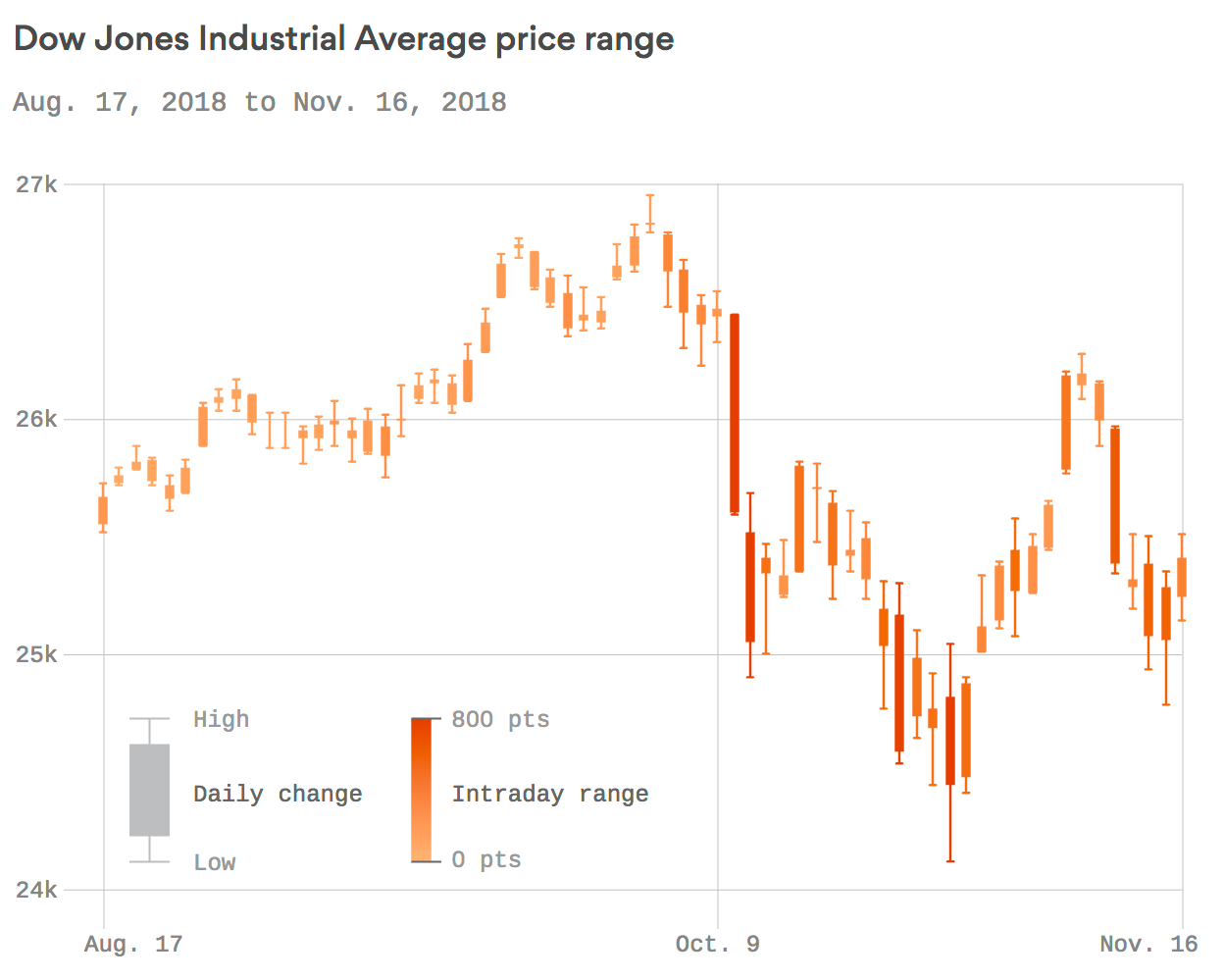

- In the last 3 months, the Volatility Index (VIX) — a fear indicator on Wall Street — has surged more than 50%, per FactSet. The gauge still remains low by historical standards, but it's producing big daily swings like the chart shown below.

The bottom line: Enjoy the holidays and get some rest. December and 2019 could be a wild ride.