Apr 1, 2020 - Energy & Climate

Whiting Petroleum files for bankruptcy as coronavirus takes a bite out of the economy

Add Axios as your preferred source to

see more of our stories on Google.

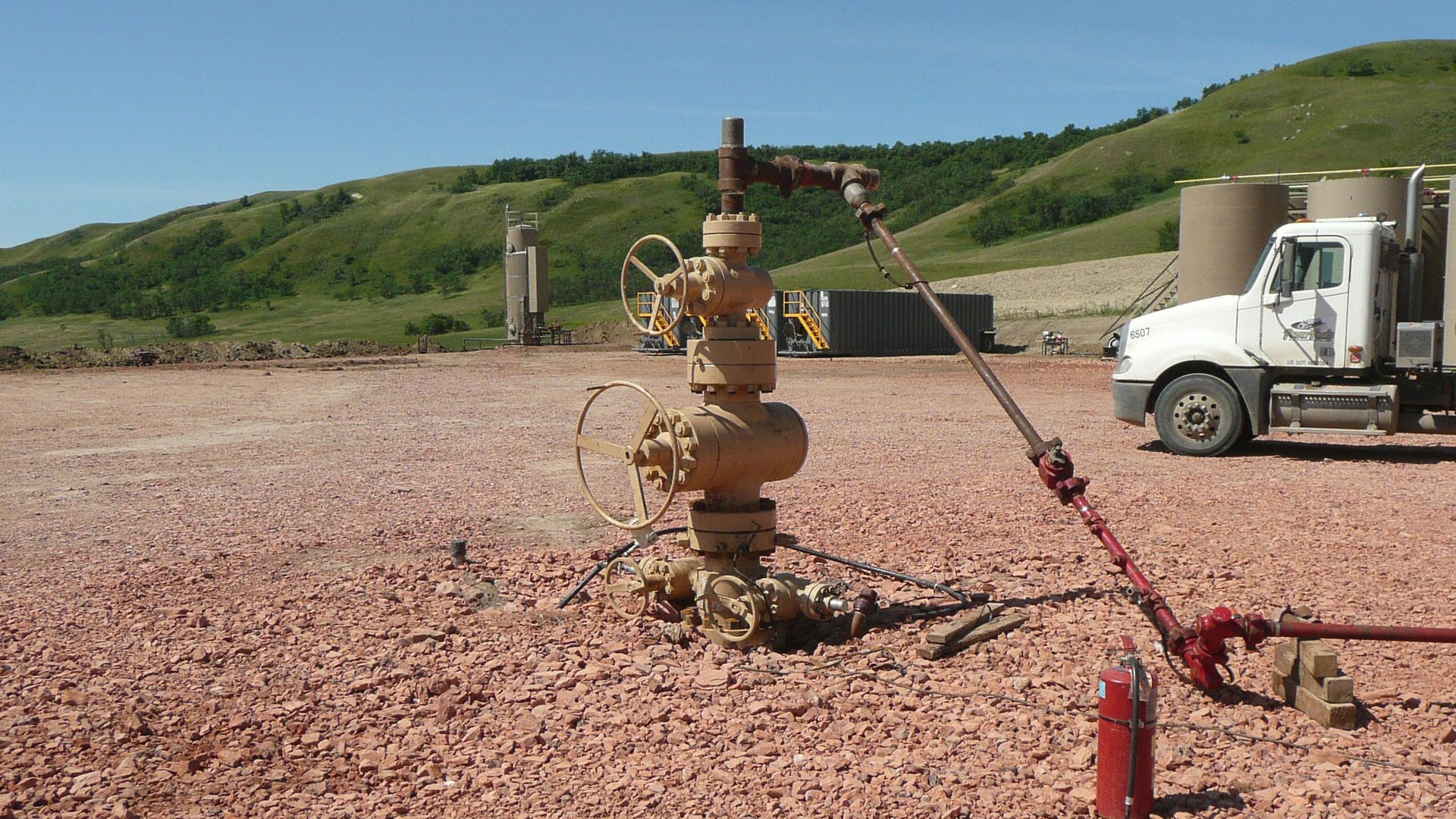

A drill of Whiting Petroleum. Photo: AFP / Stringer/Getty Images