Aug 7, 2018

Scoop: TPG raises over $10 billion for new fund

Add Axios as your preferred source to

see more of our stories on Google.

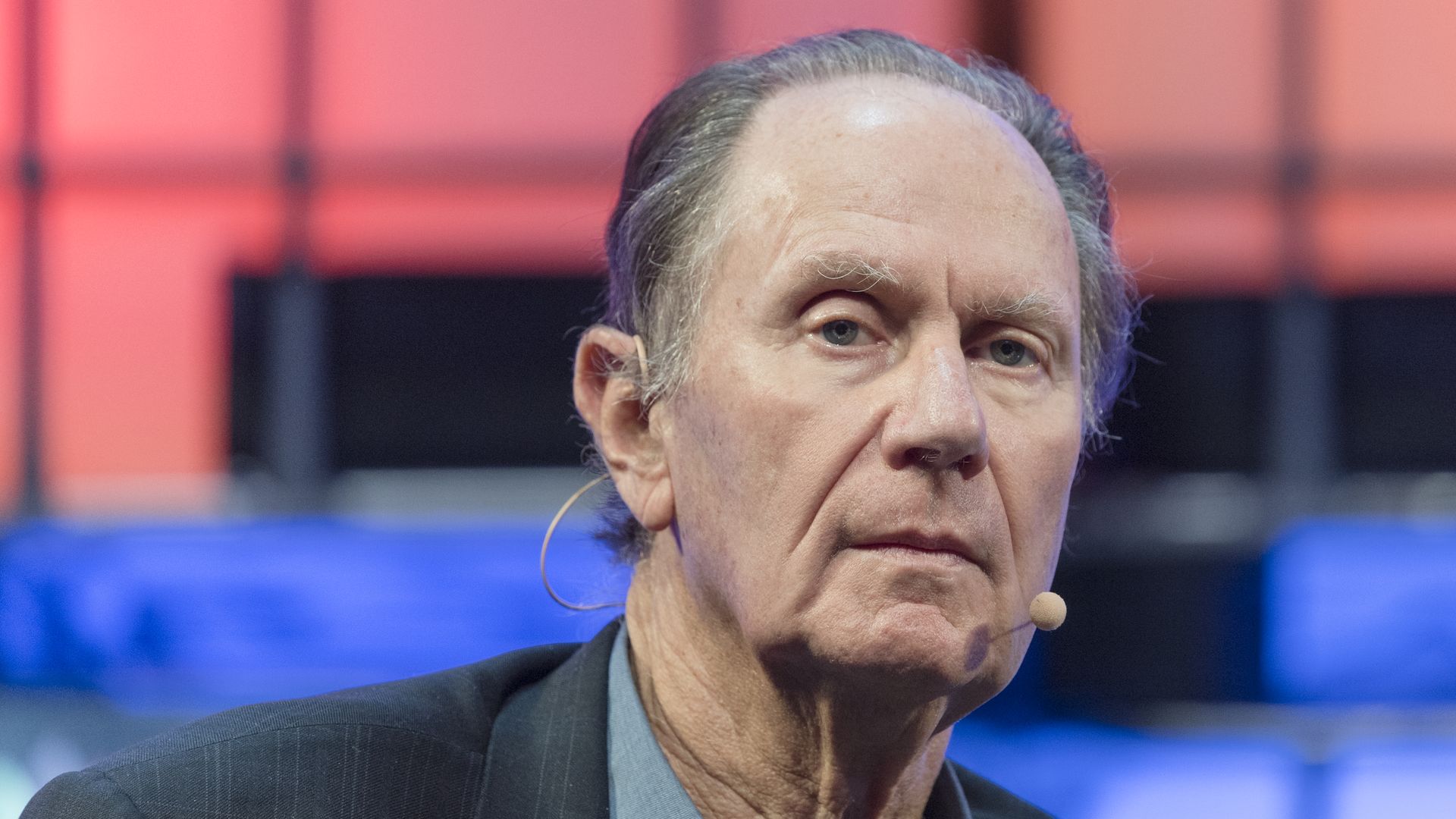

TPG co-founder David Bonderman. Photo by Horacio Villalobos, Corbis/Getty Images.

Add Axios as your preferred source to

see more of our stories on Google.

TPG co-founder David Bonderman. Photo by Horacio Villalobos, Corbis/Getty Images.