Robinhood's too-good-to-be-true checking account

Add Axios as your preferred source to

see more of our stories on Google.

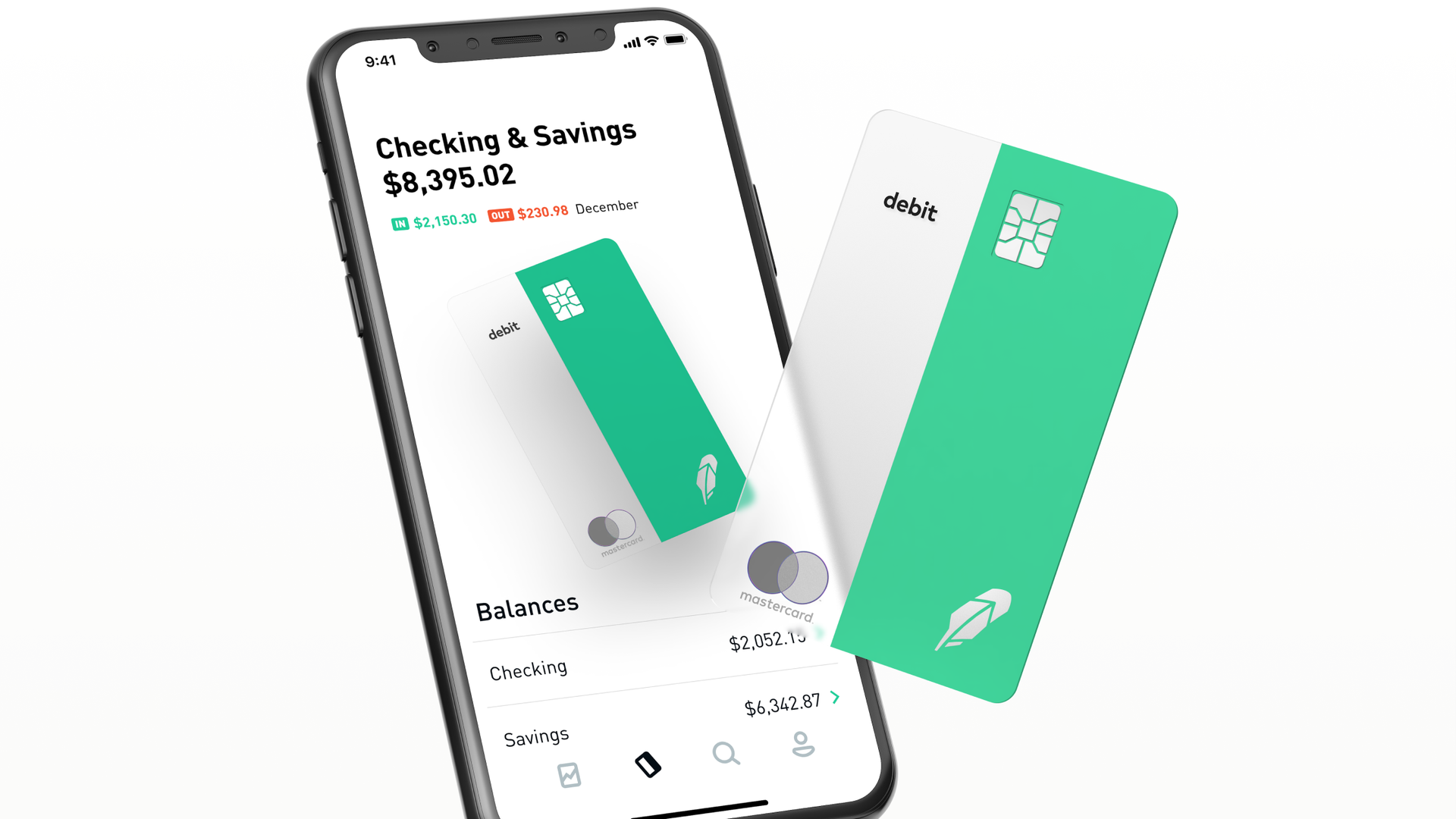

Illustration via Robinhood

On Thursday, online brokerage firm Robinhood announced a new checking account paying 3% interest. It seemed too good to be true. It was.

The big picture: Checking accounts are extraordinarily powerful things. They're one of the key mechanisms by which banks create money and help to keep the economy growing. They're also the key mechanism behind bank runs that can cause an economy to crash. That's why depositary institutions are the most regulated companies in the world.

- Deposits are a very low-cost unsecured loan from depositors to a bank. They're a stable and cheap source of funding, and non-banks tend to be very jealous of banks' deposit bases. As a result, the non-banks (including Robinhood) constantly try to invent products that look like bank deposits but aren't. When those products blow up (see the Reserve Fund breaking the buck in 2008), the consequences can be catastrophic.

How it works: If you want to offer a real checking account, you need to submit to regulation not only by a bank regulator, but also by the FDIC, which provides the all-important deposit insurance. Those regulators insist that you have a minimum level of capital, and they ensure that your business model is sustainable. Getting a bank charter for a mobile-native app is extremely difficult: Only Varo Money is even close, and it has spent years getting to this point.

- Banks are the riskiest part of the financial system. Lenders can go bust no problem; their borrowers won't mind. Brokerages are basically safety deposit boxes for your securities. But if a bank fails, it takes your money with it.

Robinhood was trying to game the system. It was a brokerage trying to be a bank. It wanted to get the advantages of being a bank, like deposit insurance and maturity transformation, without the concomitant regulatory oversight. It even contracted with a genuine bank, Sutton Bank of Ohio, to provide things like routing numbers and Mastercard-branded debit cards. But Sutton Bank wouldn't get the money. That would stay at Robinhood.

- Robinhood was less than clear about what it wanted to do with its depositors' money, but it seemingly felt happy investing it in bonds for its own account, just like MF Global. Lack of transparency seems to be an endemic problem at the company, which was last valued at $5.6 billion.

The bottom line: Robinhood took down the checking.robinhood.com site on Friday evening and put up a blog post talking instead about a "cash management program" to be announced at an unspecified point in the future. The "do first, ask forgiveness later" approach, it turns out, doesn't work very well in financial services.

Go deeper: