Record investment pours into carbon-tech company

Add Axios as your preferred source to

see more of our stories on Google.

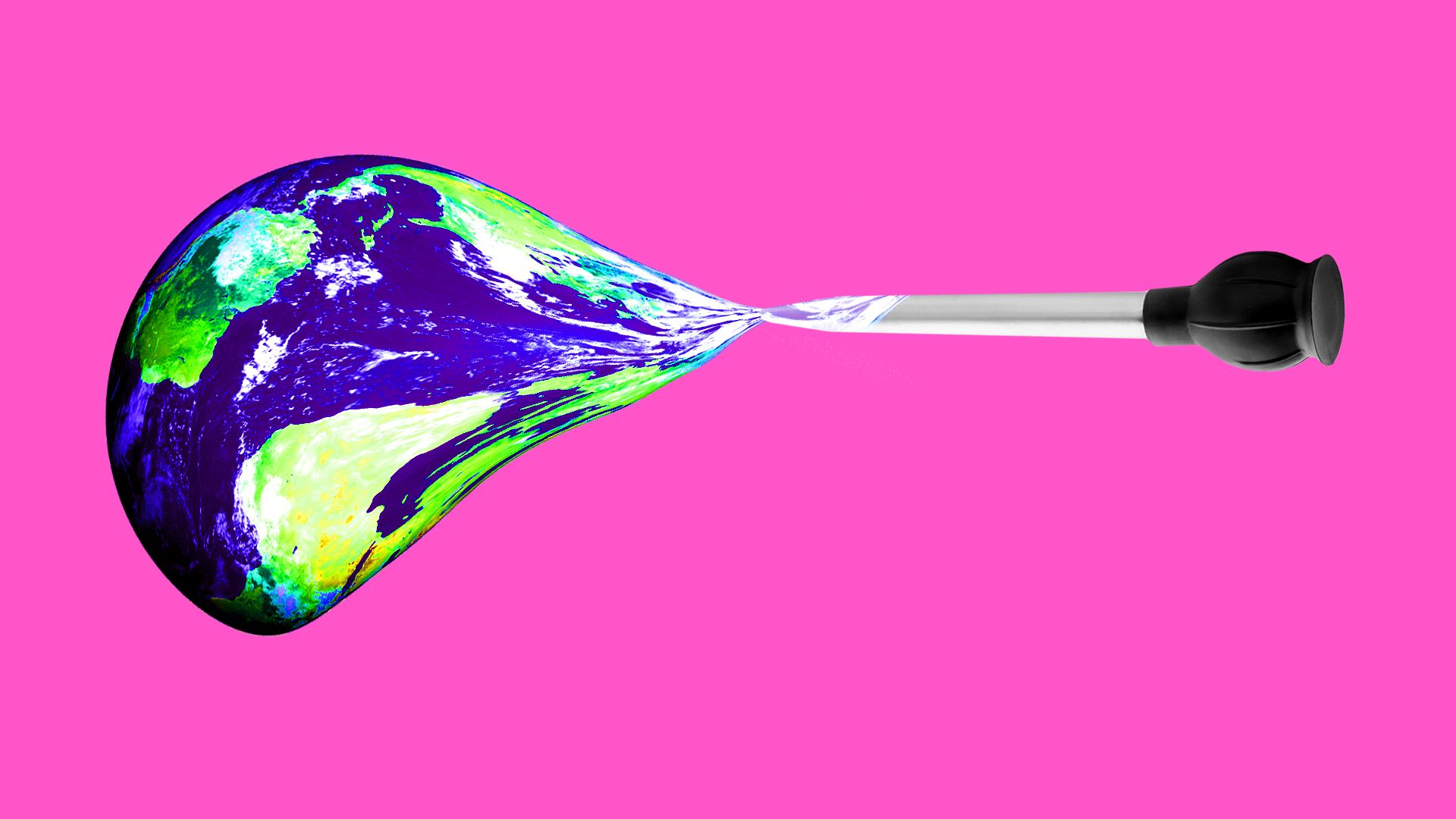

Illustration: Rebecca Zisser/Axios

Carbon Engineering brought in a record $68 million worth of private equity, which will enable the Canada-based company to commercialize zany-sounding technology capturing carbon dioxide emissions from the sky.

Why it matters: This type of technology does far faster what trees can and naturally: suck carbon dioxide out of the atmosphere. Because there's already so much buildup, scientists say we’ve reached a point in which some CO2 needs to be removed to limit Earth’s temperature rise and avoid the worst impacts of a warmer world.

What they’re saying: Carbon Engineering says its machine — part of which includes a giant fan — will be able to capture CO2 at less than $100 a ton. Its CEO says that's the cheapest price any company of its kind has achieved (only a small handful of such companies exist).

“There has been a lot of discussion around how [this technology] costs too much. What you’re seeing here is clear evidence that is not the case. This is financially sensible and ready to go to market.”— Steve Oldham, CEO, Carbon Engineering

Where it stands:

- Carbon Engineering's investors include billionaire Bill Gates, venture arms of oil companies Chevron and Occidental Petroleum, several equity firms and private family foundations.

- This $68 million, which the company says is the biggest such publicly disclosed announcement, is more than half of the total funding it has received since its founding a decade ago, a spokesperson said.

One level deeper:

- For at least the near term, the technology needs policies incentivizing it, Oldham said, and in America there are 2 big ones: a recently expanded federal tax credit for captured CO2 and California’s new law requiring 100% of its electricity come from carbon-free sources by 2045.

- The captured CO2 can then be stored underground (often, ironically, after extracting oil) or turned into transportation fuel with another of the company's technologies.

What we're watching: The company will announce later this year the sites of 2 commercial plants, with at least 1 in North America, per Oldham. One of its investors, Jim McDermott of Rusheen Capital Management, says the cost curve will drop, much like what happened with solar energy as more plants are built.

Go deeper: