Axios Pro Exclusive Content

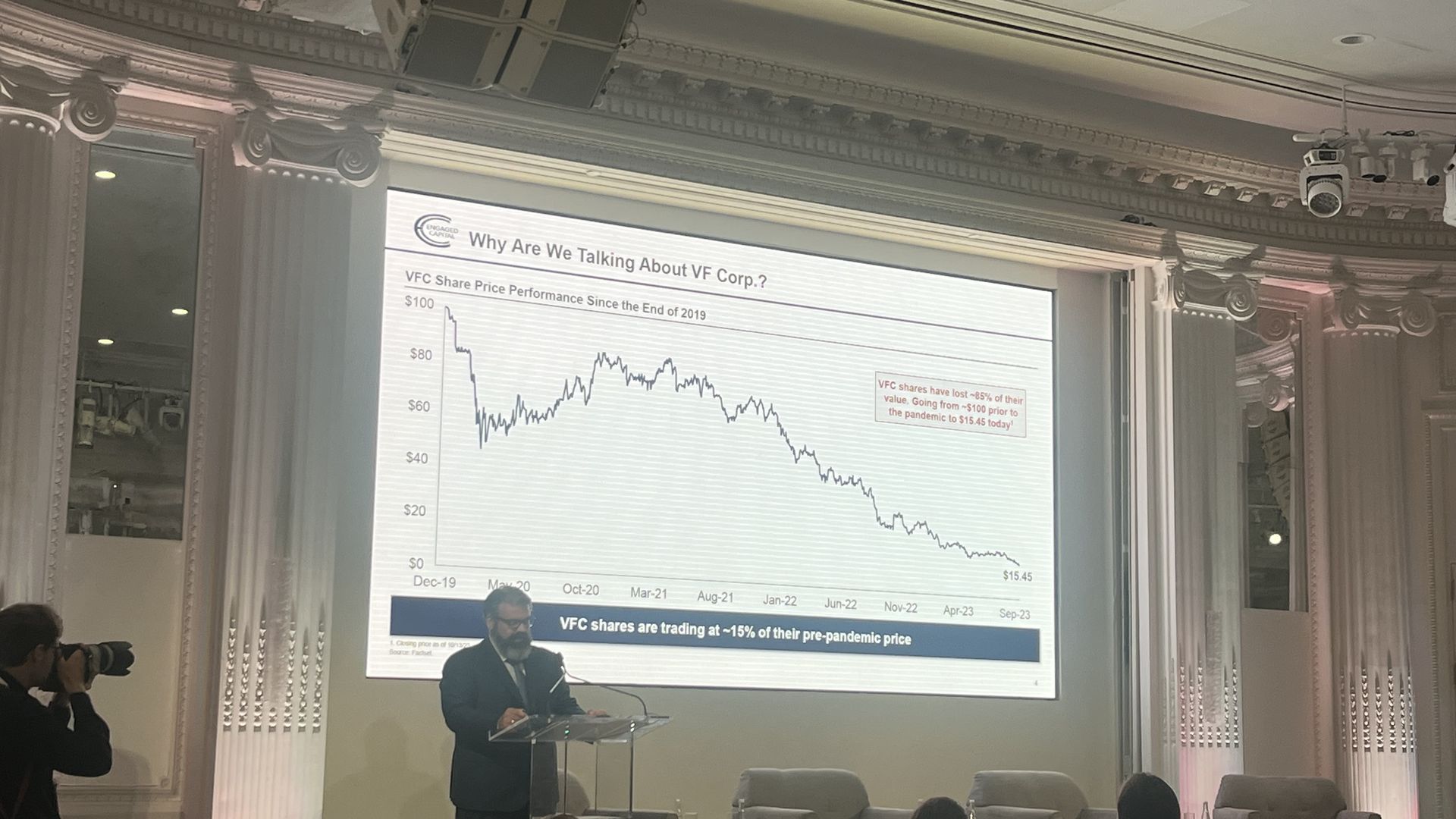

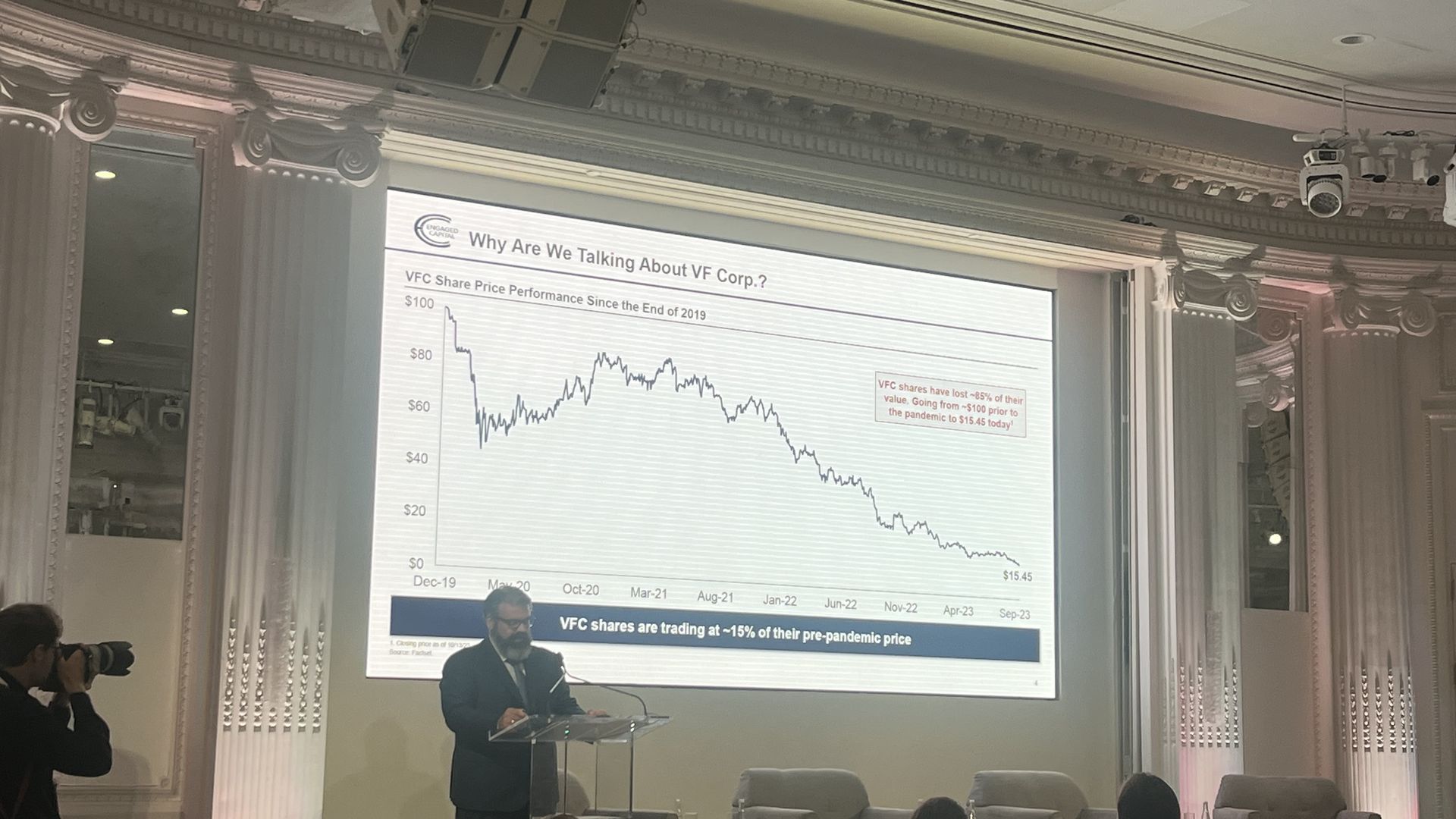

VF Corp. under attack from activist hedge fund Engaged Capital

Oct 17, 2023

Chris Hetrick, speaking at the 13D Active-Passive Investor Summit. Photo: Michael Flaherty/Axios

Chris Hetrick, speaking at the 13D Active-Passive Investor Summit. Photo: Michael Flaherty/Axios