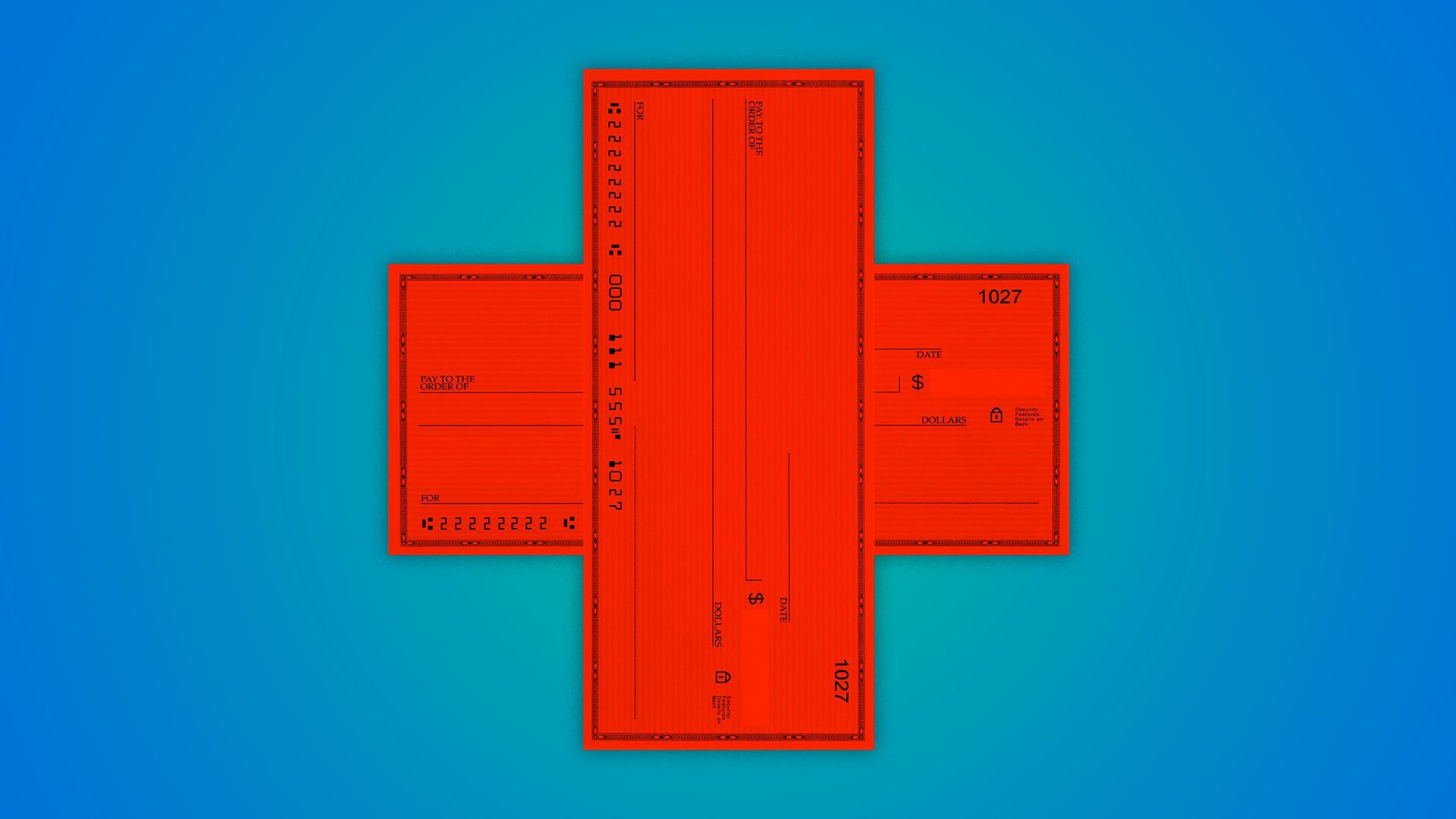

Digital health hit five-year funding low last year

Illustration: Aïda Amer/Axios

Digital health M&A activity dropped 57% year over year to $25.9 billion last year, according to a report from CB Insights recapping 2022.

Why it's the BFD: The fourth quarter in 2022 represented the lowest quarterly funding in the last five years, indicating the bloom is falling off the digital health rose.

Yes, but: Per PitchBook data, private equity and VC-led digital health activity is ticking up this month, with $2.06 billion invested in the space in January, a roughly 30% increase from December 2022.

By the numbers: Mental health tech funding dropped 53% to $2.6 billion in 289 deals last year, from $5.5 billion and 354 deals in 2021

- Clinical trial tech funding was cut in half to $1.4 billion in 64 deals last year, from $2.8 billion spanning 68 deals the year prior.

- Funding for telehealth hit a five-year low at $7.5 billion.

- Digital health had 14 global IPOs in 2022 — down from 81 in 2021 — and just four SPAC exits last year, down from 18 in 2021.

- There were zero new unicorns in digital health last year, after 108 startups reached the status last year.

Zoom in: In mental health tech, which had a funding frenzy coming off the COVID pandemic, women’s health-focused Maven clocked the largest fundraise with a $90 million Series E.

- Online therapy provider Valera was second, raising a $45 million Series B.

- Digital behavioral health has had mixed results, with some startups ending operations amid funding pressures and difficulty scaling.

- Surging SEO and customer acquisition costs have many mental health tech players burning cash quickly, says one health tech banker.

Zoom out: Global funding and deals both hit five-year bottoms, with $3.4 billion in 366 deals.

Of note: “Median deal size trends down across investor types, except angel deals,” the report says.

- The median angel deal size increased for the third consecutive year to $4 million in the last quarter of 2022.

- With public markets unable to provide liquidity, late-stage digital health investment has lagged, and investors are increasingly flocking to earlier rounds.