Axios Pro Exclusive Content

Climate tech investors SOSV raises its fifth and largest fund

Apr 16, 2024

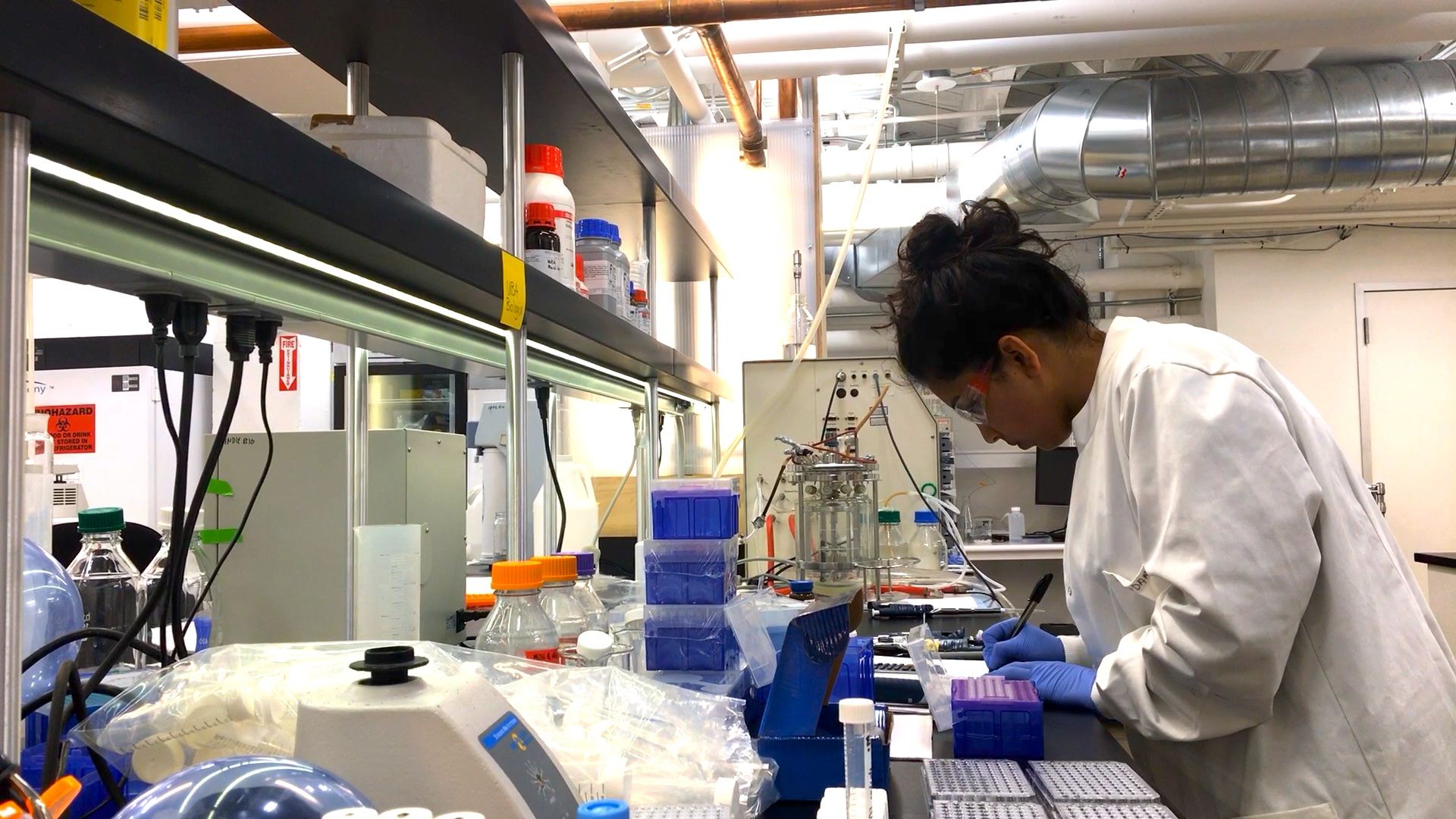

Lab space at IndieBio, part of SOSV, in San Francisco. Photo: Courtesy of SOSV

Lab space at IndieBio, part of SOSV, in San Francisco. Photo: Courtesy of SOSV