Oct 10, 2017

Pfizer may sell off its consumer health unit

Add Axios as your preferred source to

see more of our stories on Google.

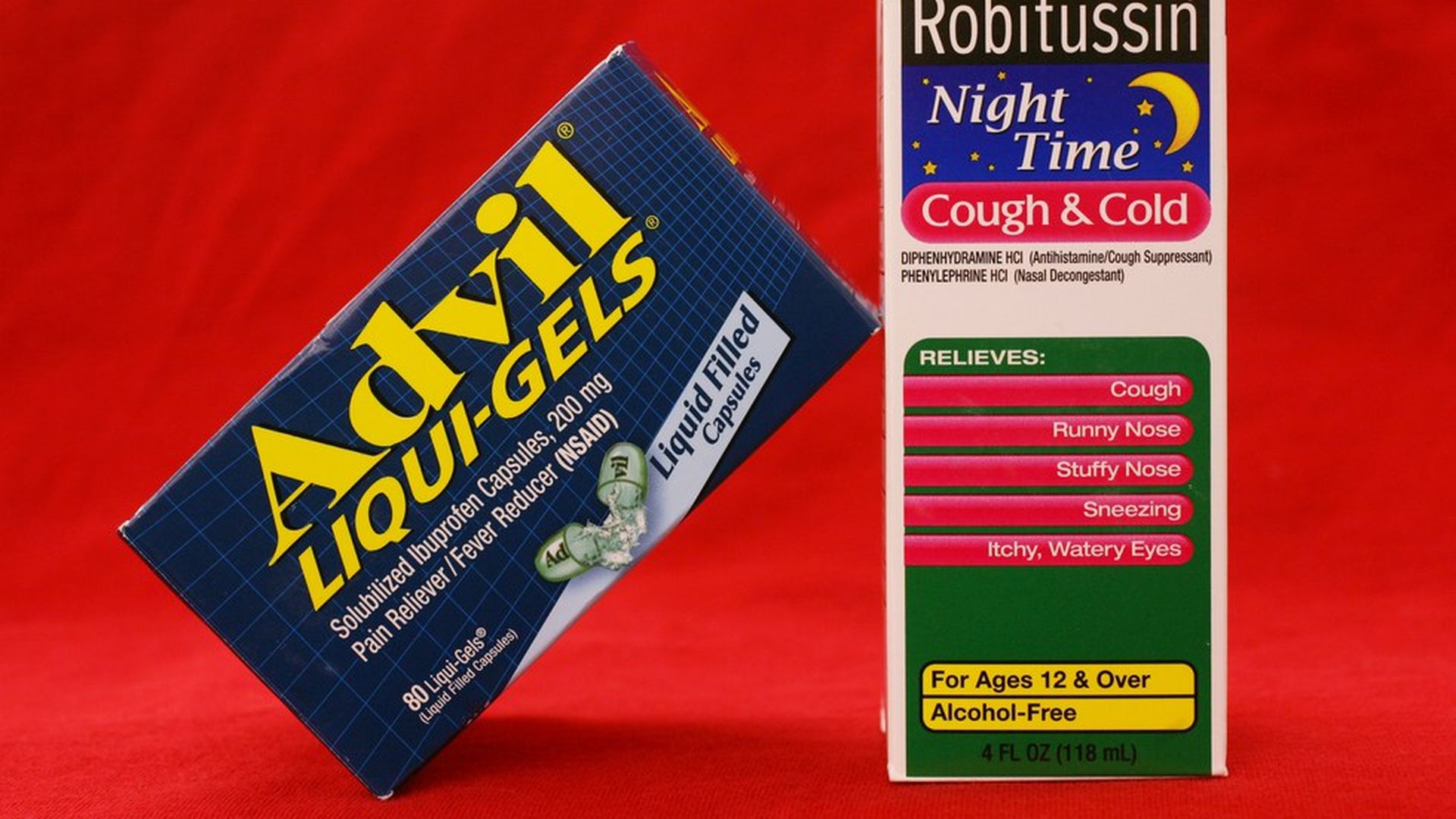

Pfizer is soliciting offers for its unit that sells over-the-counter products like Advil and Robitussin. Photo: Mark Lennihan / AP