OPEC-Russia oil price war escalates as Saudi Aramco announces supply increase

Add Axios as your preferred source to

see more of our stories on Google.

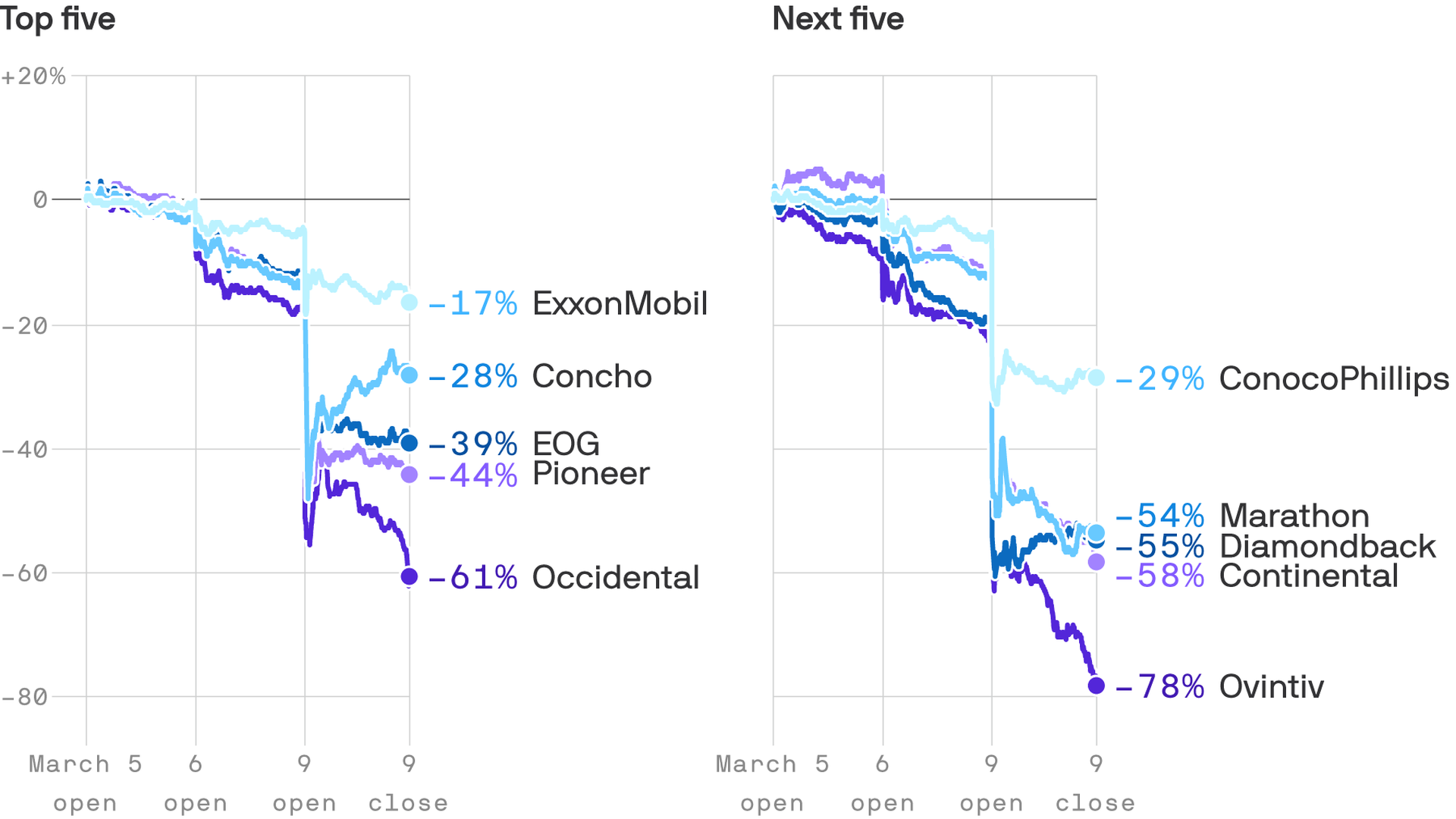

Data: Money.net; Chart: Andrew Witherspoon/Axios

The new oil price war escalated Tuesday as Saudi state oil giant Aramco announced, per reports in Reuters and elsewhere, that it plans to supply the market with 12.3 million barrels per day starting next month.

Why it matters: The increase underscores how the lunge for market share with the collapse of the OPEC+ agreement is going to create financial pain and problems for producers and governments worldwide.

- "Moscow responded within minutes in what looked like a war of words, with Alexander Novak, the country’s energy minister, saying Russia had the ability to boost production by 500,000 barrels a day," Bloomberg reports.

Driving the news: U.S. shale producers are quickly feeling the effects of Russia's decision to abandon joint supply curbs with OPEC, with their stocks dropping sharply across the industry.

- Companies are already starting to announce cutbacks. Yesterday Diamondback Energy said it was paring back operations, dropping rigs and lowering its planned 2020 spending.

Where it stands: The shale patch has oil majors, big independent companies and smaller operators, with a mix of debt levels and hedging strategies.

- Not everyone will weather the storm, as less financially stable players are at risk.

- "[T]here will be many bankruptcies in our industries and tens of thousands of layoffs over the next 12 months," Pioneer Natural Resources CEO Scott Sheffield tells the Washington Post.

- He adds, however, that his firm will make needed adjustments to its balance sheet and is preparing for two years of low prices.

But, but, but: While it's a bleak picture, Brookings Institution energy expert Samantha Gross notes that "the U.S. industry is in better shape than it was during the 2015 price collapse."

- "Low prices then brought production efficiencies and consolidation among producers. The producers that remain are stronger financially and better able to weather a low-price period," she writes in this explainer on the global effects of the novel coronavirus.

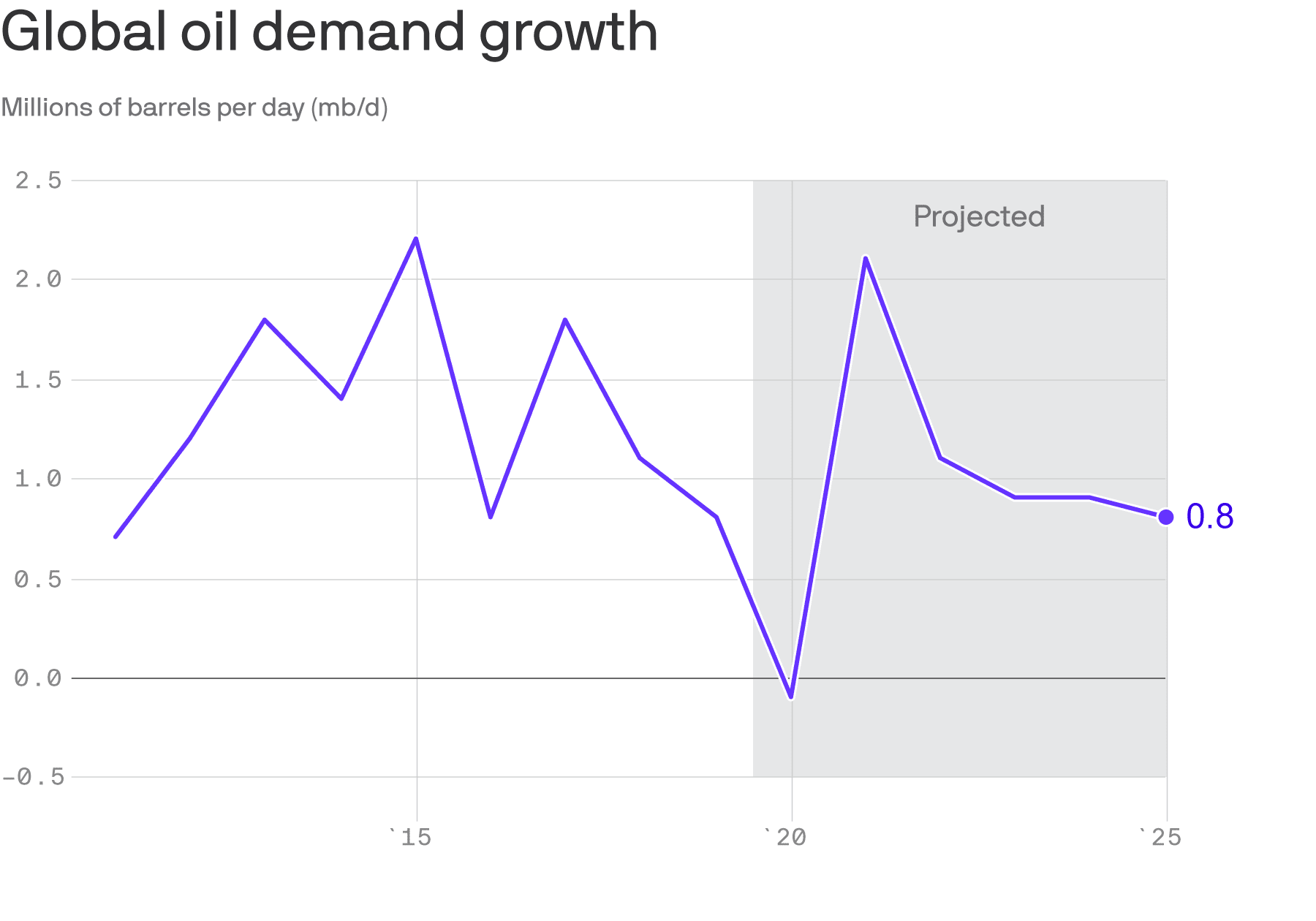

The big picture: One reason why oil producers are in for a rough ride is that even aside from this year's demand shock from the coronavirus, the International Energy Agency's five-year look-ahead sees the growth rate of global oil demand slowing down.

- While demand is still slated to grow, there's going to continue to be plenty of new production capacity, the report notes.

- They project global demand growing by a cumulative total of 5.7 million barrels per day in the 2019–2025 period.

- But global supply capacity additions will be even higher.